Bitcoin Hits Record $122K, Sparks Altcoin Surge Amid “Crypto Week” Buzz in Washington

Bitcoin pushed to a new all-time high of $122,000 on Monday, setting off a powerful rally across the crypto market. The surge is being fueled by strong ETF inflows, cascading short liquidations, and growing optimism around crypto policy discussions taking place in Washington.

A trading desk summed up the bullish outlook: “We could see Bitcoin test $130K–$150K by year-end if macro winds cooperate.”

Ethereum (ETH) soared past $3,000, underpinned by $383 million in ETF inflows recorded on Friday. Other major tokens followed suit:

- XRP (XRP) hovered near $2.95, up an impressive 30% for the week.

- Solana’s SOL reclaimed the $167 level.

- Dogecoin (DOGE) leapt more than 20%, fueled by retail enthusiasm and renewed memecoin chatter.

This broad rally echoes familiar patterns from past bull runs, where a surge in Bitcoin acts as a liquidity catalyst for the entire crypto market. Traders believe that if macroeconomic conditions remain stable and Bitcoin consolidates above $120,000, further gains in large-cap altcoins look increasingly likely in the weeks ahead.

The spotlight this week is on Washington, where lawmakers have kicked off “Crypto Week” in Congress—a series of hearings aimed at positioning the U.S. as the “crypto capital of the world.” Many traders are betting that positive legislative developments could add another tailwind for digital assets.

“Crypto prices got a major boost, with BTC climbing into the high $118K zone and triggering over $1 billion in short liquidations,” said Augustine Fan, Head of Insights at SignalPlus, in a Telegram message.

Fan added, “Sentiment looks set to stay frothy into summer unless we see a complete breakdown in tariff negotiations. The ball is in the President’s court regarding how forcefully he wants to play his current hand.”

Support around $109,000 on-chain, coupled with capital flowing from equities into digital assets, is adding confidence to the bullish case. Eugene Cheung, CCO at OSL, remarked, “The trend remains bullish. We could see Bitcoin test $130K–$150K by year-end if macro winds cooperate.”

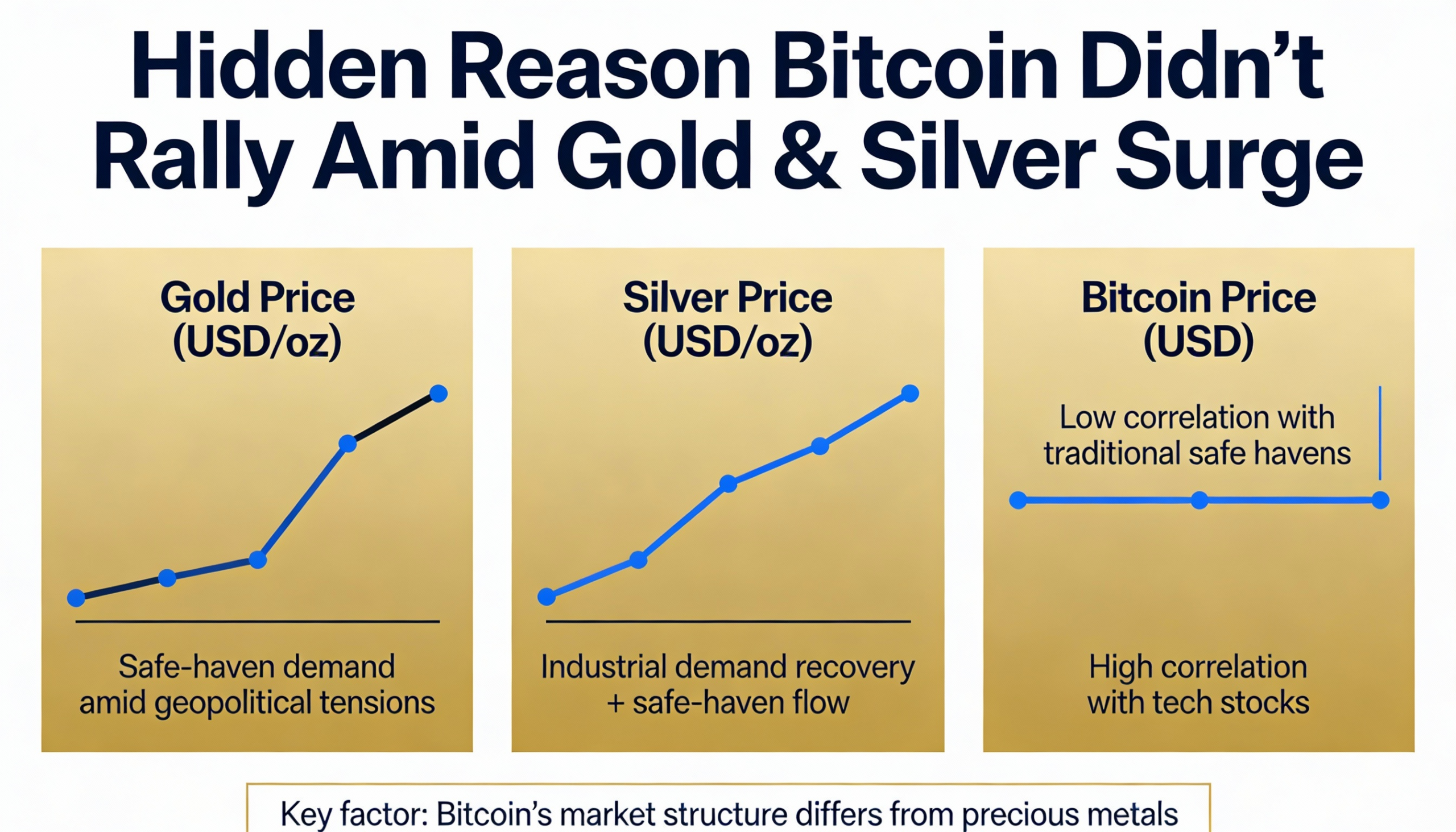

Meanwhile, traditional financial markets stumbled early Monday as geopolitical tensions rose. U.S. and European equity futures slipped after former President Trump announced a 30% tariff on goods imported from the European Union and Mexico, deepening trade frictions already affecting Brazil, Algeria, and Canada.

- S&P 500 futures dipped 0.4%.

- Europe’s Stoxx 600 futures declined 0.6% in Asian trading.

- Silver prices climbed to highs last seen in 2011, signaling heightened investor interest in hard assets amid global uncertainty.