Cryptocurrency prices had a robust rally through the final months of 2024, seemingly impervious to the rising global bond yields, but the impact of these increasing interest rates is starting to be felt in the market.

In recent months, Bitcoin and other major digital assets surged to multi-year or even record highs, despite the broader trend of rising government bond yields. However, the continuous climb in yields worldwide has begun to put pressure on these gains.

The U.S. 10-year Treasury yield, a key indicator of global financial conditions, reached 4.70% on Wednesday, nearing a multi-year high and marking an increase of over 100 basis points since the Federal Reserve initiated its rate cuts in September. In the U.K., the 30-year Gilt yield spiked to 5.35%, its highest level since 1998, and has surged by 105 basis points since the Fed’s first move to lower rates.

This rise in interest rates is not limited to the U.S. and the U.K., with countries like Germany, Italy, and Japan also experiencing significant hikes in bond yields. Japan’s 10-year JGB yield, though still relatively low at 1.18%, is at its highest level in almost 15 years.

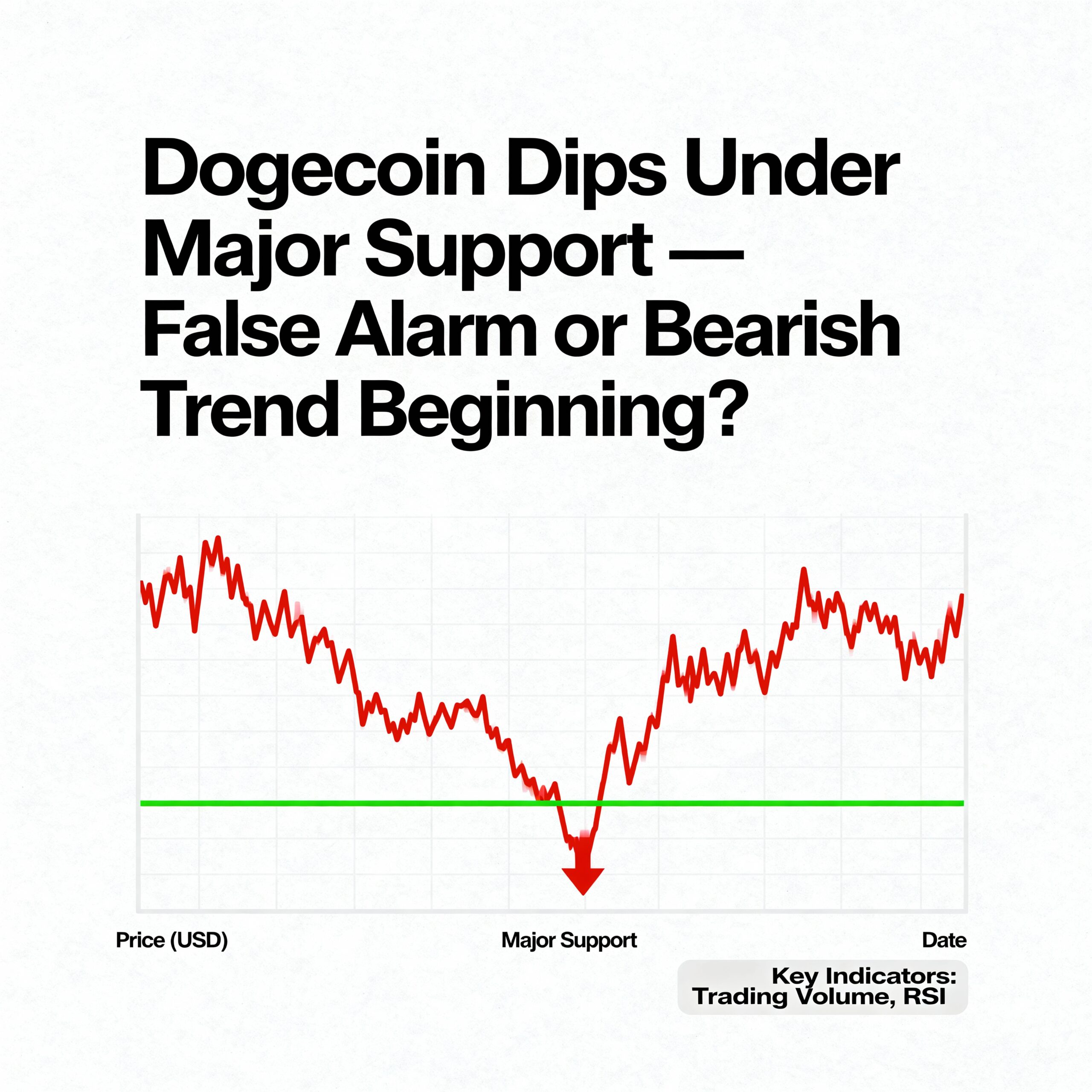

While these rising yields hadn’t significantly affected the price movement of cryptocurrencies until now, Bitcoin has recently fallen by more than 10% from its peak above $108,000 set just a few weeks ago, with several other major cryptocurrencies seeing even larger declines.

However, an outlier to this trend is China, where bond yields have been falling sharply due to ongoing deflationary pressures. According to an X post by The Kobeissi Letter, China is currently undergoing its longest deflationary phase since 1999, leading to a drop in its bond yields.