Aave Slides 18% Amid Governance Dispute, Outpacing Major Cryptos

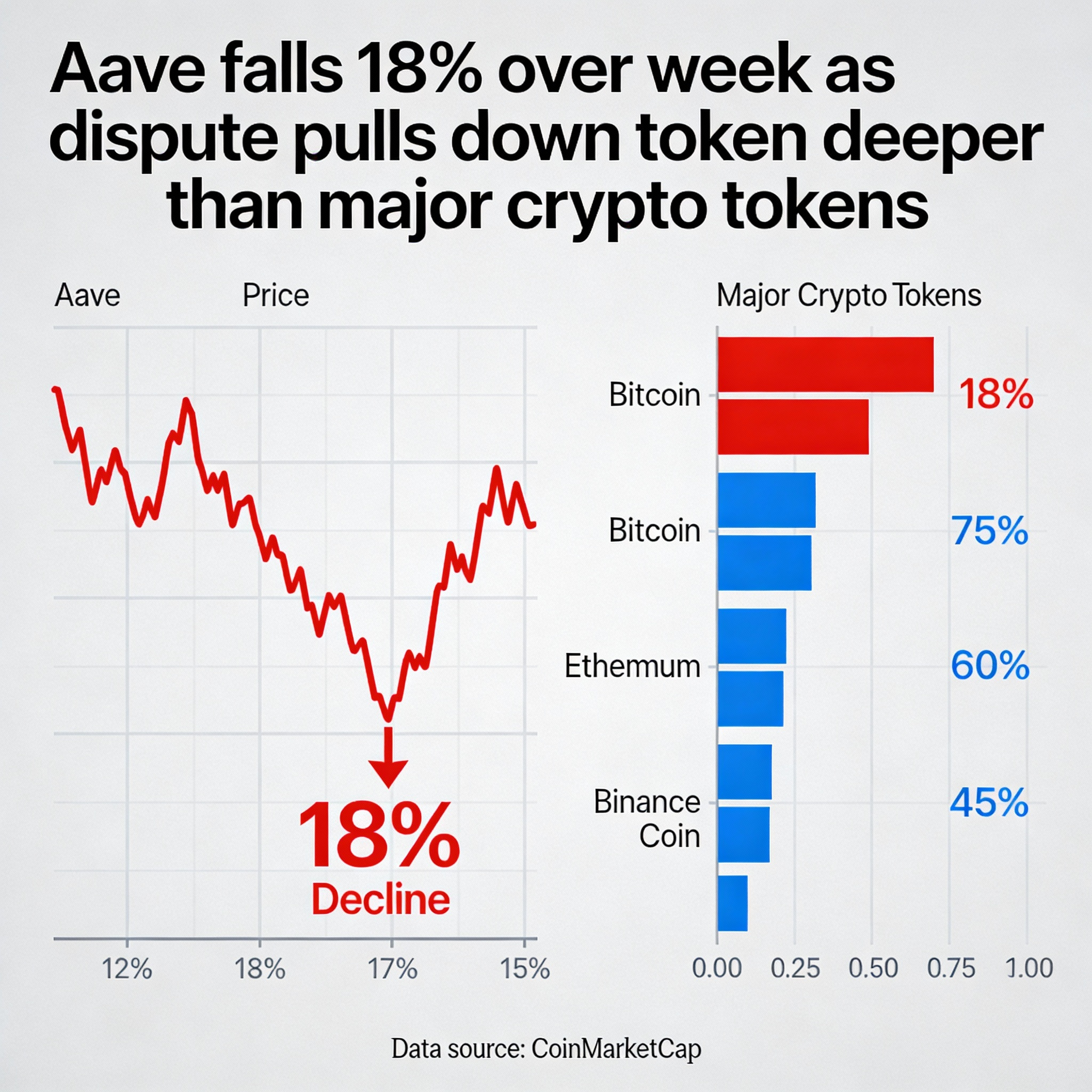

Aave’s internal governance conflict is taking a sharp toll on its token. Over the past week, AAVE has dropped around 18%, making it the worst performer among the top 100 cryptocurrencies, even as Bitcoin, Ether, and other large tokens trade largely flat.

The decline appears specific to Aave rather than reflecting broader market weakness. The token’s selloff follows a dispute over control of the protocol’s brand, domains, and public channels, which has played out across forums and social media. Traders are reacting to uncertainty over coordination, future governance decisions, and protocol oversight.

Onchain data from blockchain analytics firm Onchain Lens shows large holders acting decisively. One investor sold roughly 230,000 AAVE—worth nearly $35 million—within a short period on Monday, exchanging the tokens for Ether derivatives and Bitcoin and triggering an intraday drop of nearly 10%. The selling pressure had already been mounting since a governance proposal moved to a Snapshot vote.

Meanwhile, Aave founder Stani Kulechov appears to be buying the dip, acquiring around $12.6 million of AAVE at an average price of $176. Despite this show of confidence, the broader selloff has continued, leaving him with an unrealized loss of approximately $2.2 million.

The contrast with the wider crypto market is stark. Bitcoin remains near $90,000, and Ether, XRP, and other major tokens have avoided similar losses. This suggests that investors are selectively reducing exposure to protocols facing internal disputes rather than de-risking crypto broadly.

Governance disputes carry open-ended risk, with no clear timeline for resolution. In Aave’s case, control over the brand and front-end interfaces directly affects how the DAO exercises influence off-chain, making the outcome critical and uncertain.