Both Mubadala Investment Company and Al Warda Investments expanded their stakes in BlackRock’s iShares Bitcoin Trust during the fourth quarter, increasing exposure to bitcoin as prices declined.

Regulatory filings show that two of Abu Dhabi’s leading investment firms added to their bitcoin positions in Q4 2025, purchasing shares of BlackRock’s spot bitcoin ETF amid a roughly 23% drop in BTC over the period.

Mubadala, the sovereign wealth fund backed by the Abu Dhabi government, acquired nearly four million additional IBIT shares between October and December, lifting its total holdings to 12.7 million shares. The fund first disclosed a position in IBIT in late 2024 and has steadily built on that stake since.

Al Warda Investments, which manages diversified global assets on behalf of government-linked entities, reported holding 8.2 million IBIT shares at year-end, up from 7.96 million shares at the end of the third quarter.

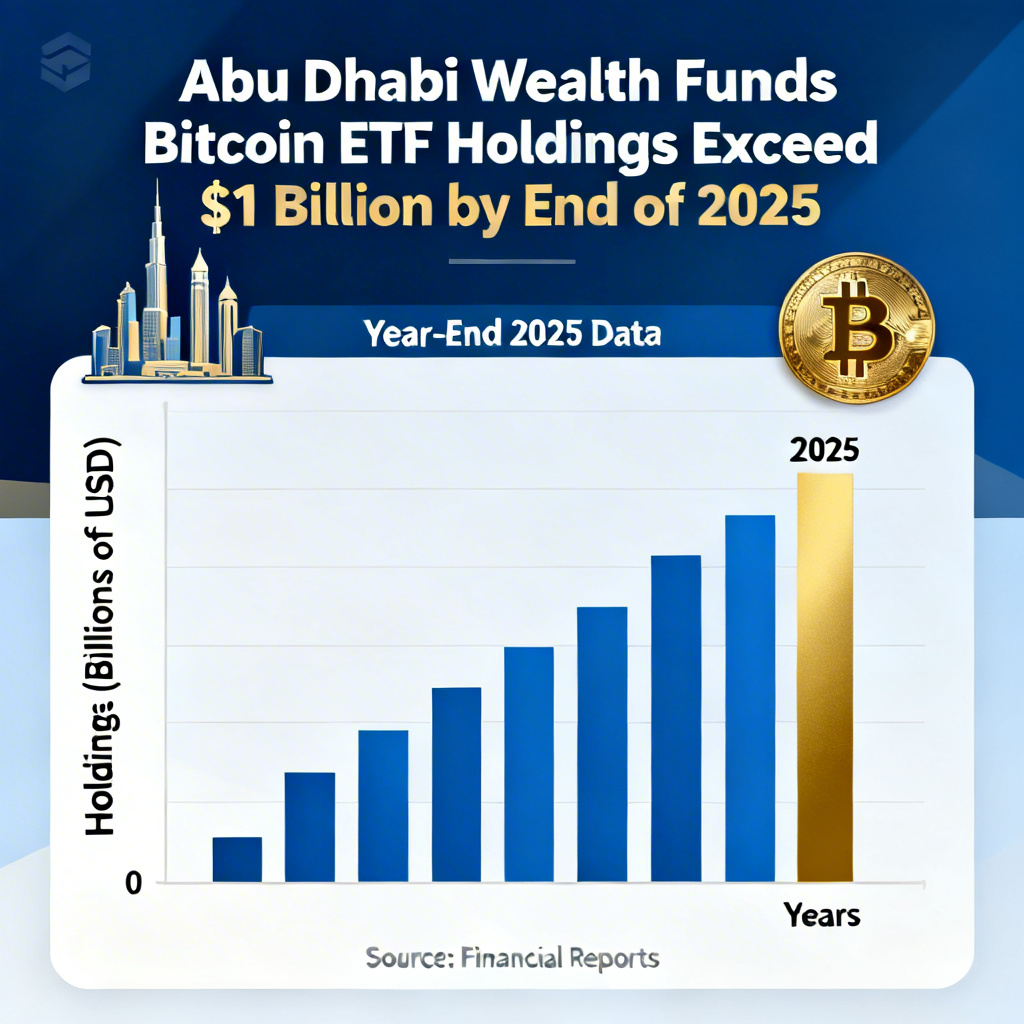

Combined, the two firms controlled more than $1 billion worth of bitcoin exposure through IBIT at the close of 2025. However, with bitcoin falling another 23% year-to-date in 2026, the estimated value of their joint holdings has slipped to just above $800 million as of Tuesday, assuming no additional purchases this year.

The positions were disclosed in 13F filings with the U.S. Securities and Exchange Commission, highlighting continued institutional appetite for spot bitcoin ETFs even during periods of market weakness. Since its launch in early 2024, IBIT has emerged as the leading U.S. vehicle for regulated bitcoin exposure.

Although the broader crypto market has faced pressure in early 2026 — including subdued volatility, softer retail activity and macroeconomic uncertainty — some long-term investors appear to be using price weakness to accumulate positions in liquid, regulated digital asset products.

Speaking on a recent panel, BlackRock’s head of digital assets, Robert Mitchnick, pushed back against the notion that hedge funds trading ETFs are fueling volatility and heavy selling. According to Mitchnick, the firm’s data suggests that IBIT investors largely maintain a long-term investment horizon.