Bitwise Predicts Bitcoin Breakout in 2026 as Institutional Interest Grows

Bitwise CIO Matt Hougan expects bitcoin (BTC$88,100.66) to reach new all-time highs in 2026, driven by lower volatility and weaker correlations with equities, which are reshaping institutional demand.

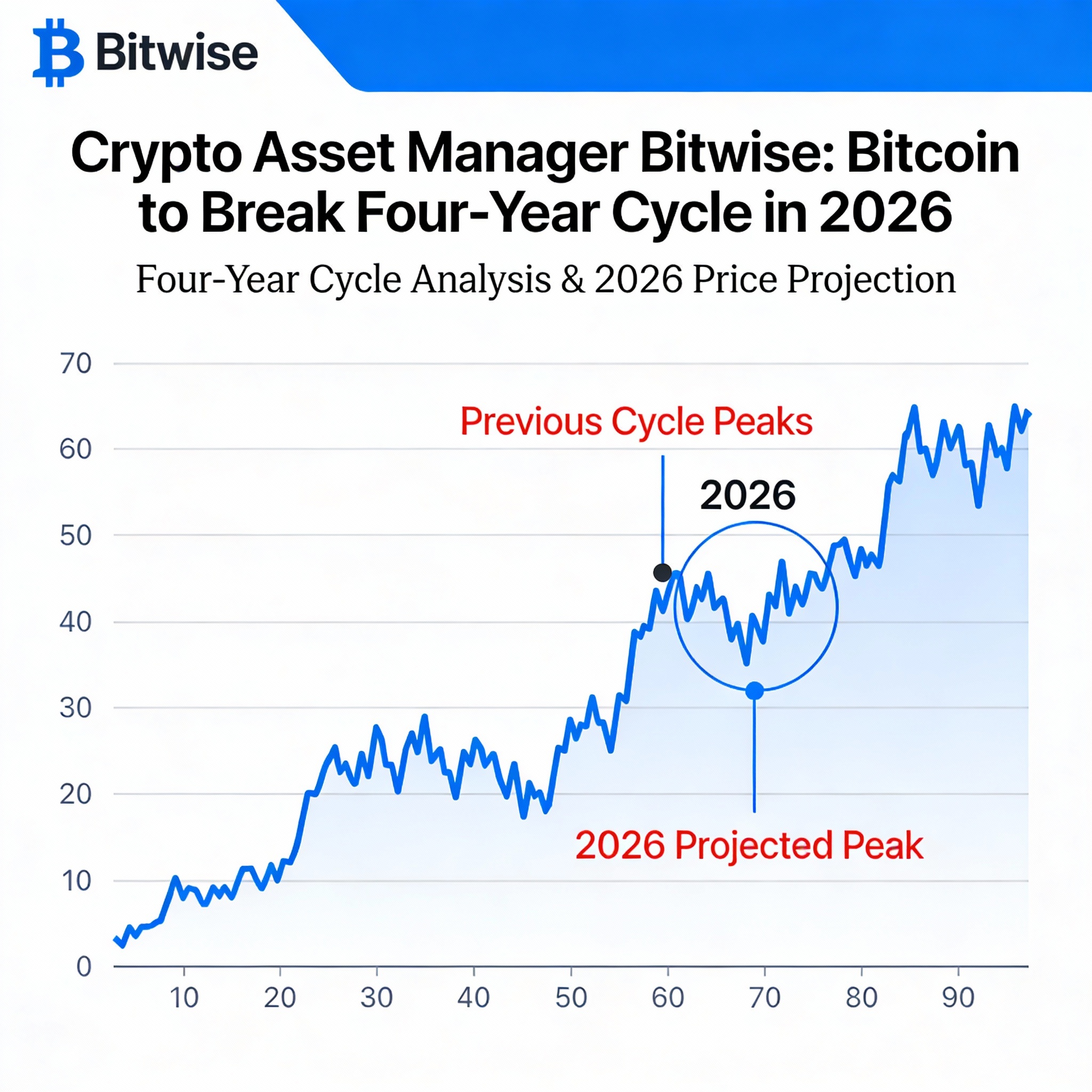

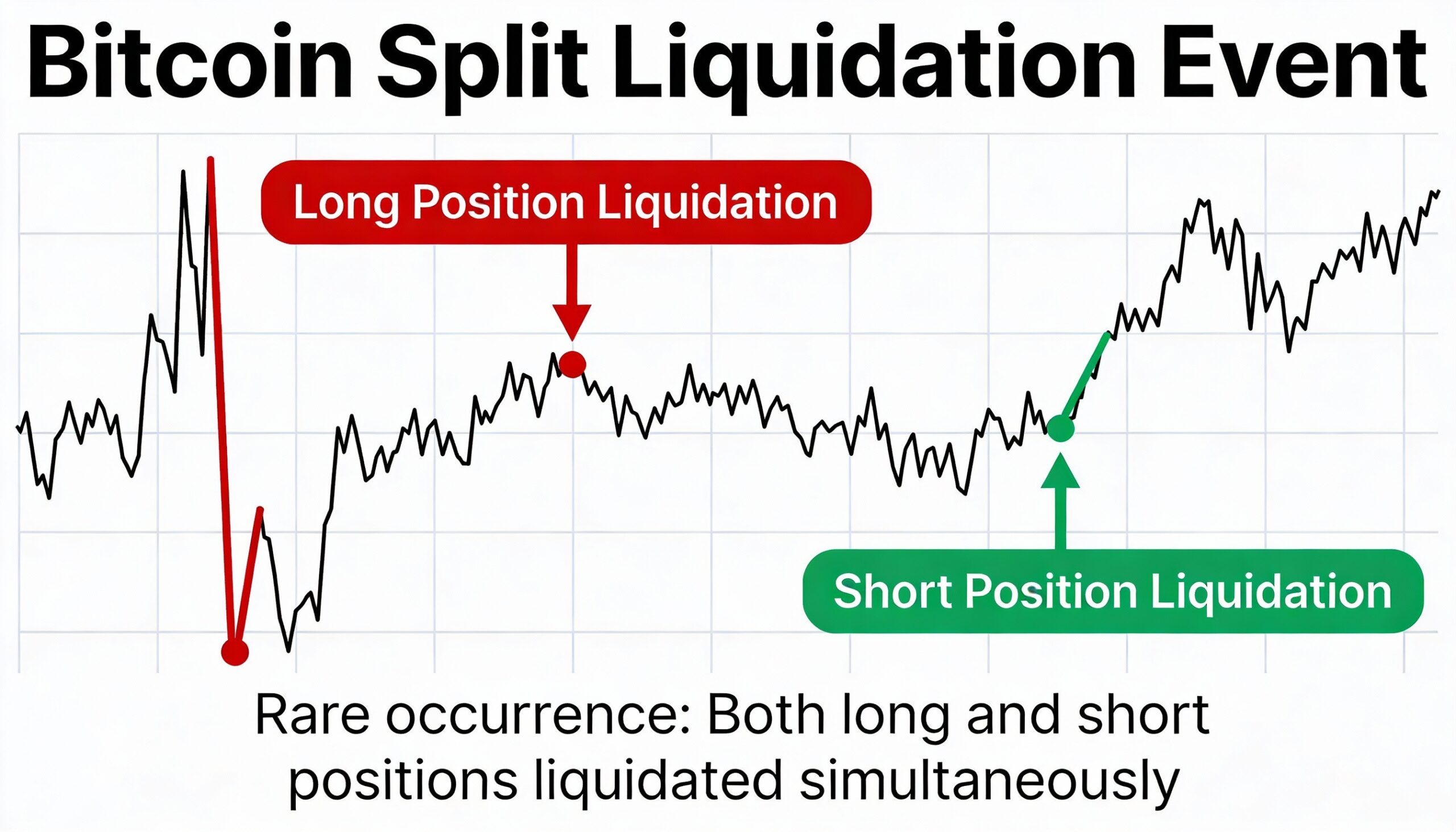

Bitwise told clients to prepare for a different bitcoin market next year, as the asset matures alongside rising institutional participation. The firm noted that bitcoin’s traditional four-year cycle is weakening: halvings are less impactful, interest rates are expected to fall, and leverage has been curtailed following major liquidations in late 2025.

“The forces that previously drove four-year cycles—the bitcoin halving, interest rate cycles, and leverage-fueled booms and busts—are significantly weaker than in past cycles,” Hougan wrote in a Monday blog post. Historically, halvings cut miner rewards by 50%, slowing supply growth.

Hougan highlighted that spot ETF inflows and broader access via major brokerages could drive bitcoin to new highs instead of the typical post-halving drop. He also noted that bitcoin has been less volatile than Nvidia (NVDA) in 2025, with price swings trending lower over the past decade as ETF ownership expands.

Looking ahead, Hougan expects bitcoin’s correlation with U.S. stocks to decline, with crypto-specific catalysts, regulation, adoption, and product innovation increasingly shaping performance. Bitwise sees these trends potentially making 2026 a breakout year for bitcoin as a portfolio asset, attracting tens of billions in institutional capital.