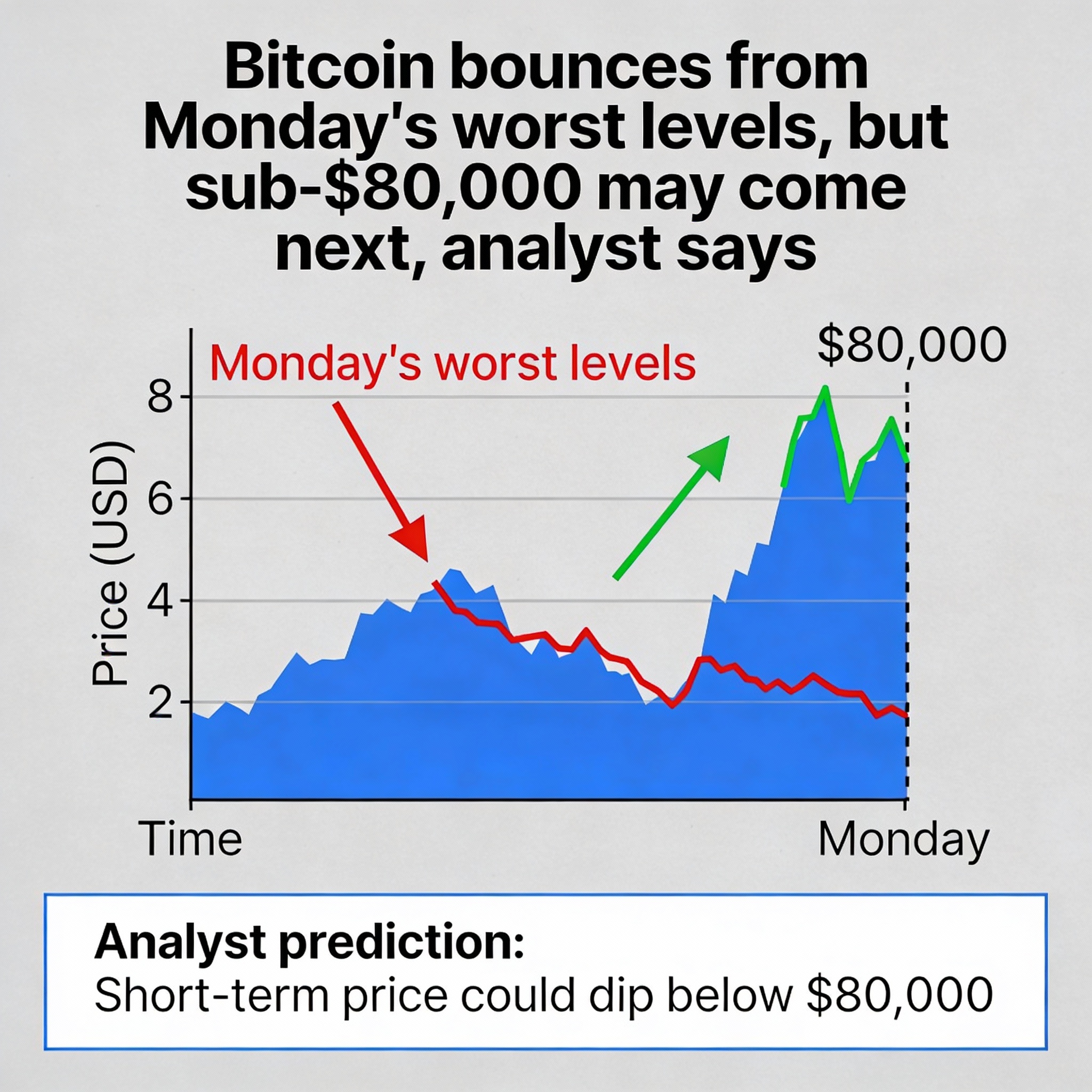

Bitcoin Stabilizes After Sharp Selloff, But Sub-$80K Remains in Play

Cryptocurrency markets steadied on Tuesday following Monday’s heavy selloff, though analysts caution that risks remain high. Bitcoin (BTC$88,196.85) bounced above $87,000 in early U.S. trading, gaining roughly 3% from overnight lows. Ether (ETH$2,940.38) lagged with a 1.4% rise, while major altcoins such as BNB (BNB$845.97), XRP ($1.9106), and SUI ($1.4240) saw stronger gains of 3%–6%.

Crypto-related equities also rebounded. MicroStrategy (MSTR) and Robinhood (HOOD) rose 3%–4%, while Circle (CRCL), issuer of the $78 billion USDC stablecoin, jumped 9%. In an unusual move, crypto outperformed U.S. equities, with the S&P 500 down 0.5% and the Nasdaq off 0.3%.

Monday’s volatility followed U.S. employment data showing November’s unemployment rate climbed to a four-year high of 4.6%, although the market still prices only a 24% chance of a January Fed rate cut.

Samer Hasn, senior analyst at XS.com, described bitcoin’s recent rebound from the $80,000 November low as a “corrective high” and warned that a drop below $80,000 could come next. He highlighted $750 million in long liquidations over the past two days, including $250 million in bitcoin futures, leaving the market “fragile.”

David Hernandez of 21Shares noted that BTC faces short-term selling pressure as traders reassess risks, but its finite supply keeps it attractive for long-term accumulation amid macroeconomic uncertainty.