Sell-side analysts moved quickly to adjust their outlooks on Robinhood after the brokerage reported a mixed fourth quarter, sending shares down 10% in early Wednesday trading.

The trading platform posted earnings per share of $0.66, topping consensus estimates of $0.63. Revenue, however, fell short of expectations, coming in at $1.28 billion versus the $1.33 billion analysts had projected. Shares were trading around $76.50 following the release.

A sharp slowdown in cryptocurrency activity weighed on the quarter. Crypto revenue declined 38% year over year to $221 million, dragging total transaction revenue to $776 million, below forecasts. The weakness followed a late-year pullback in digital asset markets.

Net interest revenue also disappointed, totaling $411 million and missing estimates amid softer securities lending activity and lower yields.

Among the analysts revising their outlooks, JPMorgan cut its price target on Robinhood to $113 from $130 while maintaining a Neutral rating. The bank said more challenging 2025 comparisons could raise the performance bar heading into 2026. Even so, the revised target implies upside of more than 50% from current levels.

JPMorgan analysts, led by Kenneth Worthington, noted that while January trading volumes improved on a year-over-year basis, growth across key metrics is moderating. As a result, the bank lowered its top-line forecasts.

Compass Point struck a more constructive tone, though it also trimmed its price target to $127 from $170 while reiterating a Buy rating. Analyst Ed Engel highlighted encouraging January KPIs across all segments, including crypto volumes that came in better than feared despite the weak fourth quarter.

Still, Engel pointed to a 9% EBITDA miss, driven by lower securities lending revenue and declining take rates in both crypto and options trading. He said the most notable development was management’s guidance for 18% operating expense growth in 2026.

Engel expects elevated spending to support expansion across crypto, decentralized finance (DeFi), and prediction markets — investments he believes could begin to pay off in the second half of 2026. In the interim, however, investors may temper EBITDA expectations.

Looking longer term, he cited several potential tailwinds, including the internalization of prediction markets and possible major IPOs from companies such as SpaceX, Anthropic, and OpenAI.

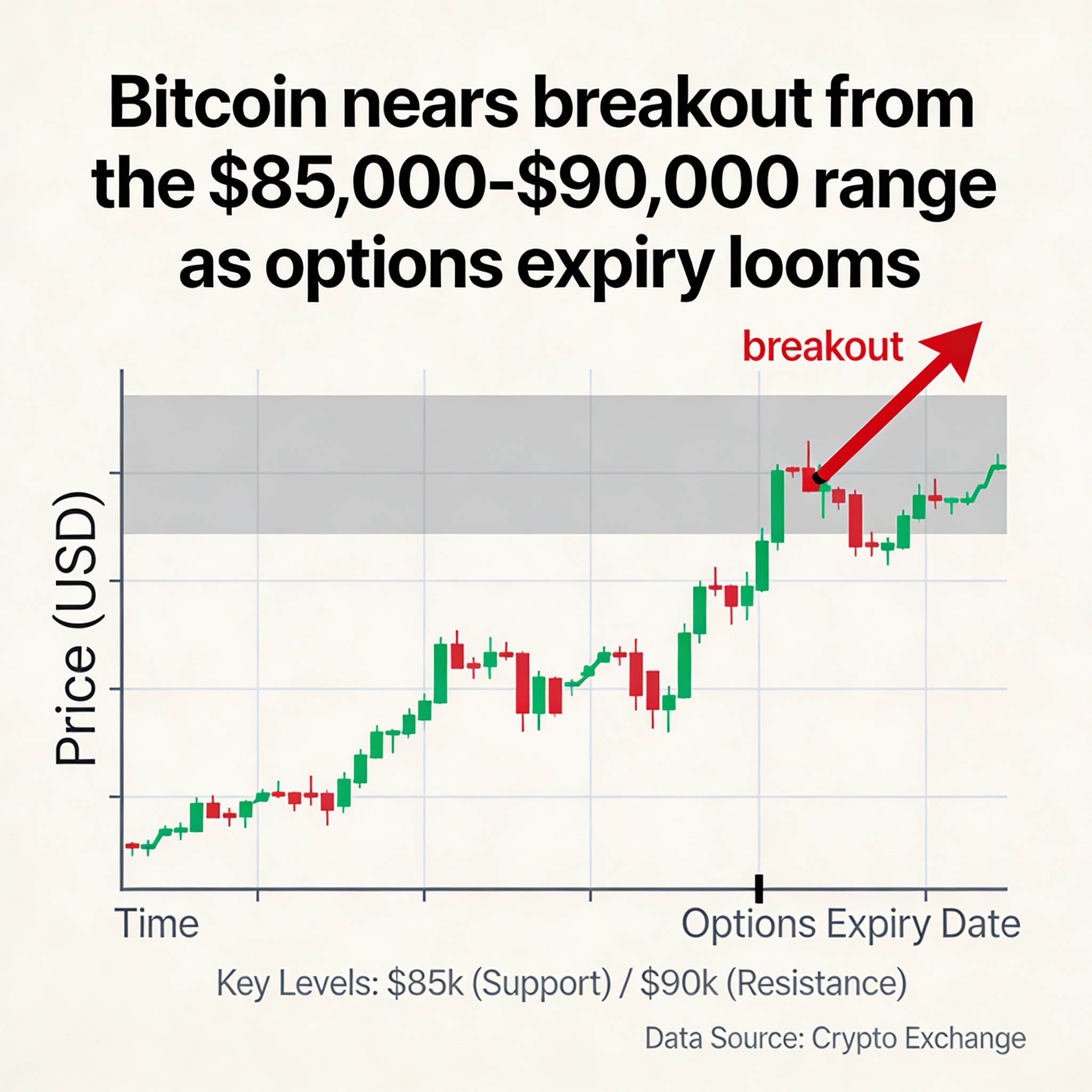

Engel also flagged continued pressure on crypto monetization, noting that Robinhood’s crypto take rate declined by three basis points quarter over quarter in the fourth quarter and has fallen an additional five basis points so far in 2026, as higher-volume traders account for a larger share of activity.