The Crypto Fear & Greed Index collapsed to 11 on Monday, plunging deeper into “extreme fear” and reaching its lowest level since late 2022.

Bitcoin’s November downturn intensified on Friday as the leading cryptocurrency slid below $85,000 for the first time since April. A wave of leveraged unwinds and collapsing sentiment has made this one of bitcoin’s sharpest monthly declines since the 2022 crypto winter. BTC briefly touched $81,600 before recovering to around $84,000, wiping out its gains for the year and pulling prices back to levels seen before January’s ETF-driven rally.

Selling pressure spread rapidly across the market. Ether dropped under $2,750, falling nearly 14% in a week. Solana tumbled more than 10% in a single day, while XRP, BNB and Cardano logged declines ranging from 8% to 15%. Major tokens have now retraced 20%–35% from their November highs, with smaller altcoins suffering even deeper losses.

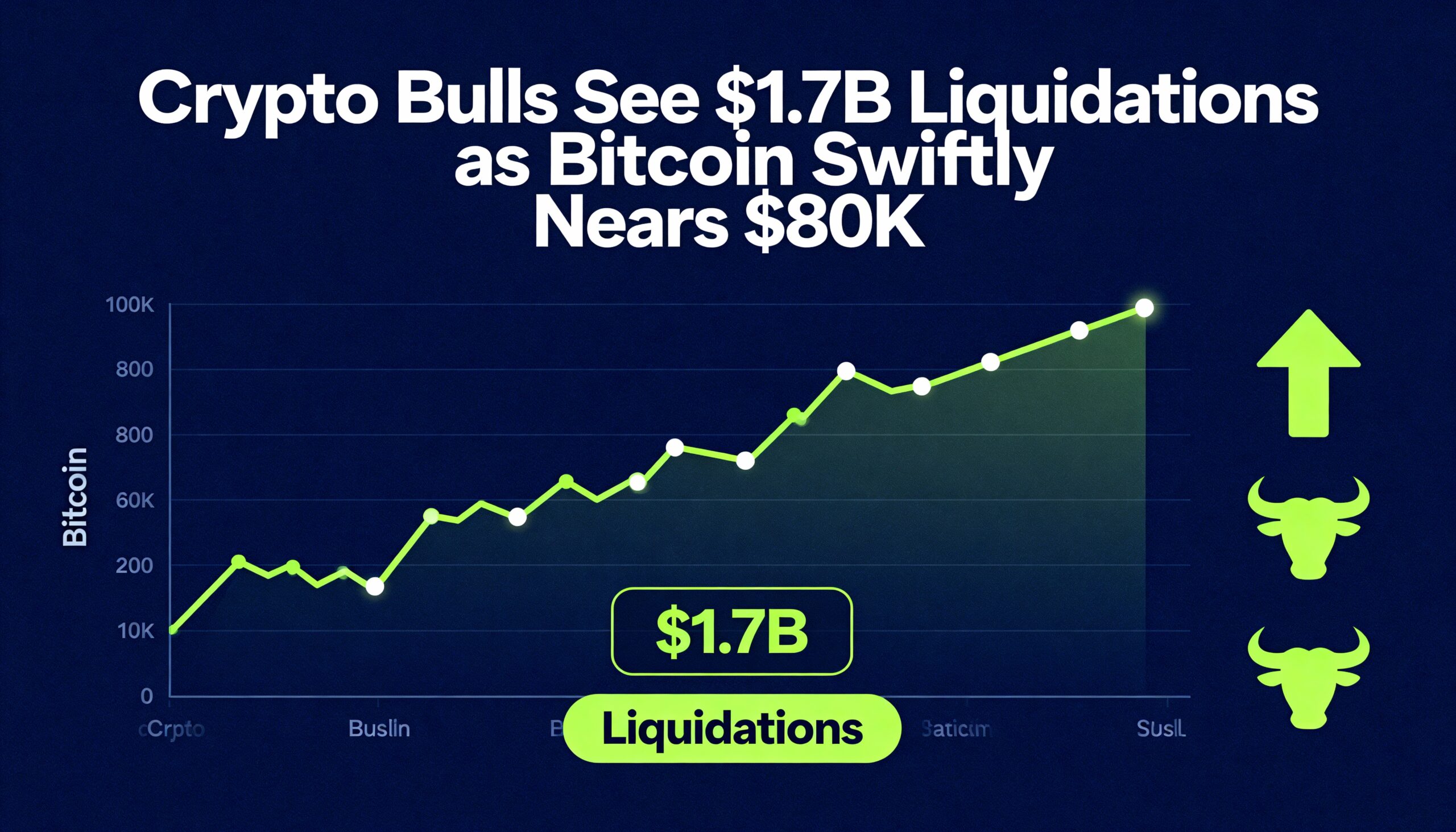

Nearly $2 billion in leveraged positions were liquidated over the past 24 hours, according to CoinGlass. Bitcoin accounted for $964 million of those liquidations and ether for $407 million, alongside widespread forced selling across altcoins. Around 396,000 traders were wiped out, including a $36.7 million BTC position on Hyperliquid — the day’s largest single liquidation.

Macro headwinds continue to amplify the pressure. Global stocks just posted their worst week in seven months as concerns around stretched AI-driven valuations and fading odds of a December Fed rate cut weighed on risk appetite. The MSCI All Country World Index dropped more than 3% for the week, U.S. tech shares extended their pullback and Treasuries rallied as investors shifted toward safety.

Crypto-specific flows show similar weakness. U.S.-listed bitcoin ETFs recorded more than $900 million in net outflows on Thursday — their second-worst day since going live in early 2024. Perpetual futures open interest has plunged 35% from October’s peak near $94 billion, reducing liquidity and magnifying market swings.

Retail sentiment is deteriorating just as quickly. The Fear & Greed Index’s plunge to 11 highlights the depth of current market anxiety. While such extreme readings have historically coincided with major cyclical bottoms, bitcoin’s break of key support levels and the reversal in institutional flows suggest the market has yet to show clear signs of stabilization.