Bitcoin Struggles to Regain Momentum as ETF Outflows and Regulatory Jitters Weigh on Market

Bitcoin traded near $113,700 on Thursday, slipping below the critical $115,000 level as the 50-day moving average acted as firm resistance. The modest 1% gain in the broader crypto market, now valued at $3.86 trillion, was widely viewed as a temporary rebound rather than the start of a sustained recovery.

“Weakness in the tech sector is spilling over into crypto, with Bitcoin’s failure to reclaim $115K highlighting broader market fragility,” said FxPro’s Alex Kuptsikevich.

The caution was echoed in ETF flows. According to SoSoValue, Bitcoin ETFs recorded net outflows of $523 million on Monday, followed by $311 million on Wednesday and another $192 million on Thursday. Ether-focused ETFs fared no better, shedding over $500 million during the same period.

Kronos Research attributed the outflows to profit-taking and liquidations, following BTC’s record high earlier this month.

Market sentiment was further pressured by regulatory headlines. The SEC has launched an investigation into Alt5 Sigma’s $1.5 billion deal with World Liberty Financial — a company reportedly linked to U.S. President Donald Trump — intensifying uncertainty around crypto regulation.

On-chain data for Ethereum reflected cooling investor interest. Active addresses have dropped 28% since July 30, suggesting declining retail participation. ETH was last trading at $4,289, up 0.4% on the day, but still more than 7% off recent highs.

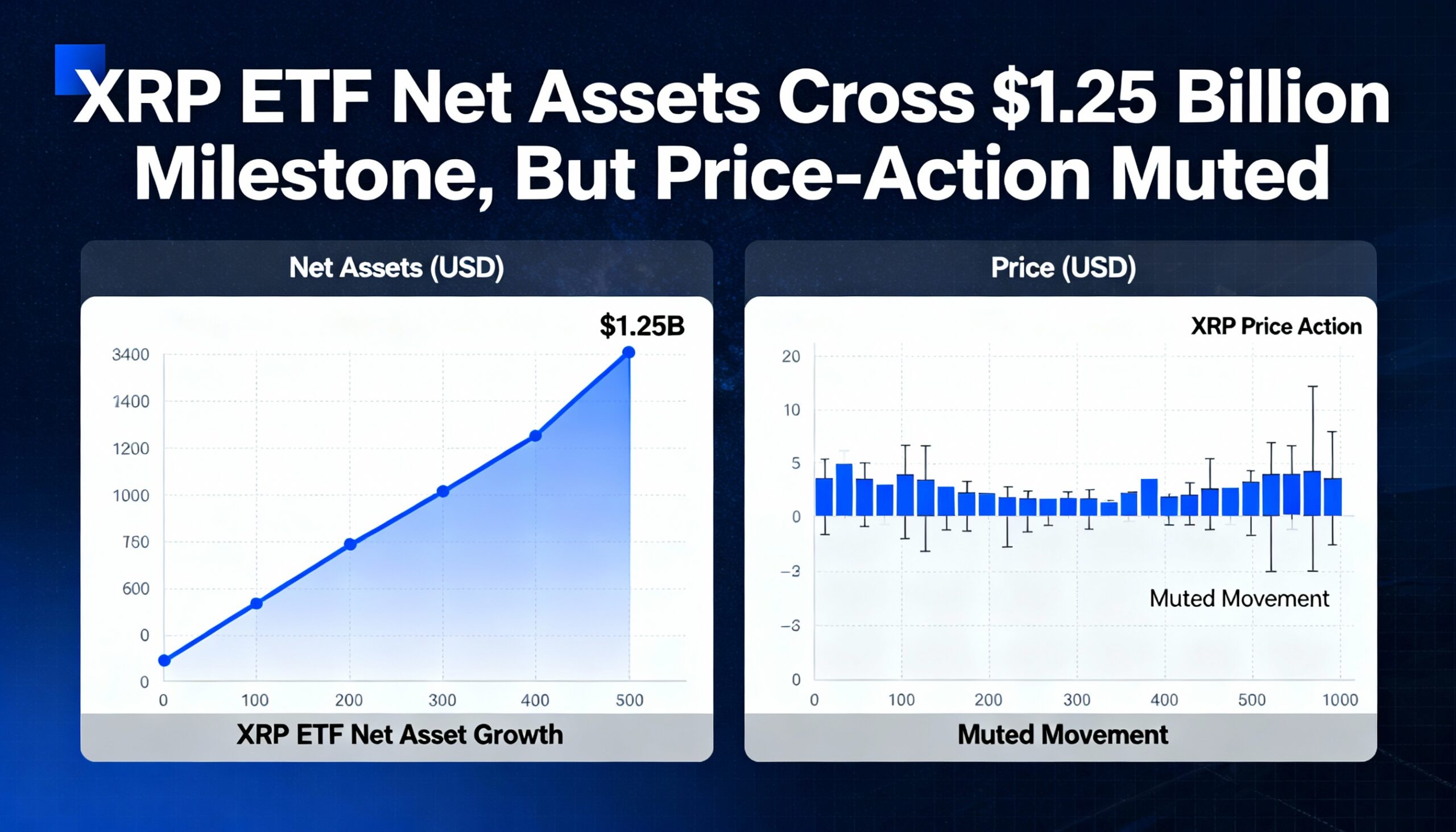

XRP and Solana mirrored the trend, down over 6% each this week. XRP traded at $2.87, while SOL hovered near $183. Analysts say a dovish shift from the Federal Reserve could offer short-term relief, but persistent outflows may cap any meaningful upside.

Derivatives data pointed to rising downside hedging. The 30-day delta skew in Bitcoin options climbed to 12% — the highest since April — indicating growing demand for protective positioning.

“This isn’t a crypto-specific downturn — it’s part of a broader risk-off sentiment driven by macroeconomic factors,” said Ruslan Lienkha, chief of markets at YouHodler.

Lienkha added that the current pullback could either be a correction within a longer uptrend or the start of a broader reversal. “It’s unclear whether this is late-cycle positioning or the first leg of a more sustained decline.”

Still, longer-term optimism remains. Bitwise suggested that allocations from U.S. pension funds could send Bitcoin to $200,000 by year-end — potentially surpassing the impact of ETF approvals. The firm expects the first institutional inflows to arrive as early as this autumn.

In the short term, however, all eyes are on Federal Reserve Chair Jerome Powell’s speech at Jackson Hole on Friday. A dovish message could ease selling pressure across risk assets, while a neutral or hawkish tone may deepen the current correction, which has already shaved 9% off Bitcoin’s recent peak.