Shares of Blue Owl Capital (OWL) dropped nearly 15% this week after the firm said it would sell $1.4 billion in loans to generate liquidity for investors seeking to exit one of its retail-focused private credit funds — a development that has unsettled parts of the market.

Although major stock indexes have avoided broader damage, Blue Owl’s stock is now down more than 50% over the past year. Other alternative asset management heavyweights, including Blackstone, Apollo Global Management and Ares Management, also posted notable declines during the week.

Comparisons to 2007 emerge

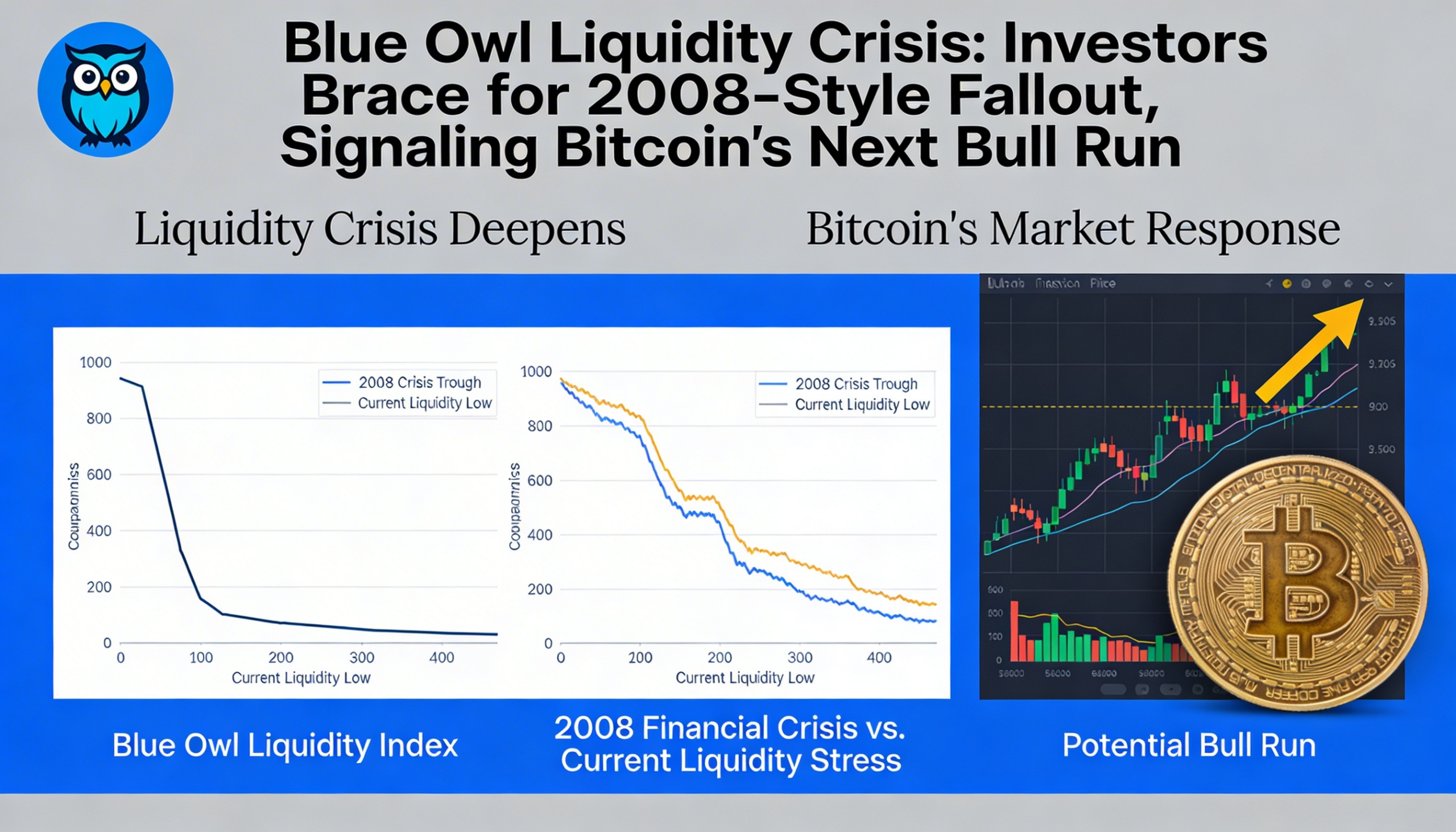

The forced asset sales have drawn comparisons to early warning signs preceding the global financial crisis. In mid-2007, two Bear Stearns hedge funds collapsed under mounting subprime mortgage losses. Shortly thereafter, BNP Paribas suspended withdrawals in several funds due to valuation concerns tied to U.S. mortgage assets — moves that signaled deeper stress in credit markets.

Former Pimco chief Mohamed El-Erian raised the possibility that Blue Owl’s liquidity action could represent a “canary in the coal mine” moment. However, he emphasized that current risks do not yet appear comparable in scale to the systemic breakdown of 2008. He also pointed to stretched valuations in artificial intelligence-linked investments as another potential pressure point.

Short-term pain, long-term opportunity?

For Bitcoin holders, a private credit shock would not necessarily translate into immediate gains. Historically, tightening liquidity conditions tend to pressure risk assets, including crypto.

Bitcoin was not yet trading during the 2008 crisis, but its behavior during the early stages of the COVID-19 market panic provides a useful reference. Between mid-February and mid-March 2020, BTC fell roughly 70% as investors rushed to de-risk across all asset classes.

The turning point came when central banks intervened aggressively. Massive stimulus from the Federal Reserve injected trillions into the financial system, helping propel bitcoin from below $4,000 in March 2020 to over $65,000 within a year.

Crisis as catalyst

The 2008 meltdown also played a direct role in bitcoin’s creation. The cryptocurrency was introduced by the pseudonymous Satoshi Nakamoto as a decentralized alternative to a banking system that required extraordinary government bailouts.

Bitcoin’s Genesis Block, mined on Jan. 3, 2009, famously embedded the headline: “Chancellor on brink of second bailout for banks,” referencing rescue efforts in the U.K. at the time.

Nearly two decades later, bitcoin has transformed from an obscure experiment into a trillion-dollar asset embraced by institutional investors. What began as an anti-establishment monetary alternative has increasingly become integrated into mainstream finance through exchange-traded products and corporate treasury allocations.

Watching for the next domino

Whether Blue Owl’s liquidity move proves to be a contained event or the first sign of broader stress in private credit markets remains uncertain. If pressures intensify and prompt large-scale monetary easing, bitcoin could once again benefit from renewed liquidity — though likely after an initial period of volatility.

For now, investors are monitoring whether this episode fades as an isolated incident or evolves into a more systemic challenge for global credit markets.