Renewed geopolitical friction and a more tentative tone across U.S. equities are restraining risk appetite, with several strategists cautioning that markets could revisit their 2024 troughs before a more lasting recovery unfolds.

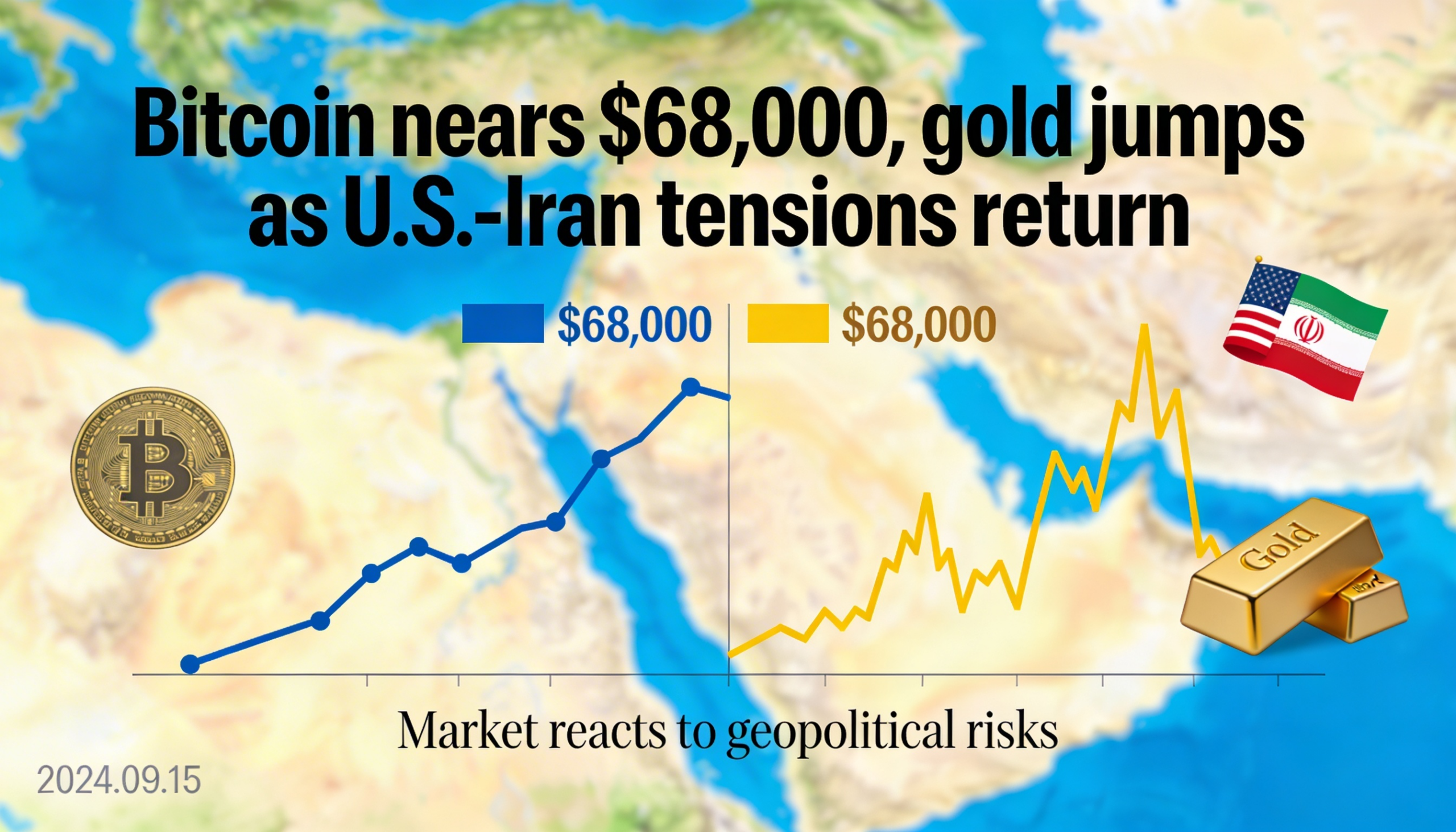

Digital assets edged higher in Asian trading on Friday, as bitcoin advanced toward the $68,000 mark after a turbulent week that unsettled broader risk sentiment.

The uptick extended to most major tokens. XRP, Solana’s SOL, DOGE and Cardano’s ADA rose by as much as 2%, while ether trailed peers, dipping modestly and holding below $2,000. Market participants appear to view that level as a key defensive line rather than a breakout point.

The rebound carried the characteristics of a relief rally rather than a definitive trend reversal. Recent weeks have been defined by sharp, reactive moves: brief spikes draw in dip buyers, only for supply to surface near price zones where sidelined investors can exit at reduced losses.

However, this week’s bounces have looked incrementally more stable, hinting that forced liquidations may be subsiding, even if strong, conviction-driven inflows remain limited.

Broader macro forces and geopolitical developments continue to temper enthusiasm. Gold steadied near $5,000 per ounce after consecutive sessions of gains, as investors factored in rising tensions in the Middle East.

U.S. President Donald Trump said Thursday that talks on a potential nuclear agreement with Iran would be given a 10- to 15-day window, while reports pointed to an expanded U.S. military presence in the region. The combination has reinforced demand for safe-haven assets and made it harder for higher-risk markets to build sustained momentum.

Wenny Cai, COO at SynFutures, said traders are recalibrating following the release of the latest Federal Reserve minutes, which struck a more hawkish tone even if further rate hikes are not the base case.

“The message isn’t that hikes are imminent,” Cai noted, “but that policymakers have clearly kept the option open if inflation fails to cool, effectively raising the threshold for near-term easing.”

That repricing has supported the dollar and slightly tightened financial conditions, she added, a shift reflected in softer equities and renewed demand for cash-like instruments and short-duration Treasuries.

Alex Kuptsikevich, chief market analyst at FxPro, offered a cautious assessment of the broader backdrop. Given recent market structure and the increasingly defensive stance in U.S. stocks, he said the probability of a retest of local lows — levels last observed in the second half of 2024 — has risen.

On ether specifically, Kuptsikevich highlighted that the token is holding above a long-term support line dating back to 2020, aligning with the $2,000 region. A confirmed breakdown, however, would likely require a decisive move below recent lows near $1,500.

Beneath the surface, on-chain signals suggest some large holders may be positioning to sell into strength. Data from CryptoQuant shows that bitcoin inflows from major holders to Binance have reached record levels, a pattern that can precede increased spot supply.

Research firm K33 has drawn comparisons between the current environment and the later stages of the 2022 bear market, which eventually transitioned into a prolonged consolidation phase.

For now, the crypto market appears capable of staging rebounds, but converting those rallies into a sustained uptrend remains challenging. Until spot demand convincingly outweighs supply clustered around key psychological levels, advances may continue to face resistance.