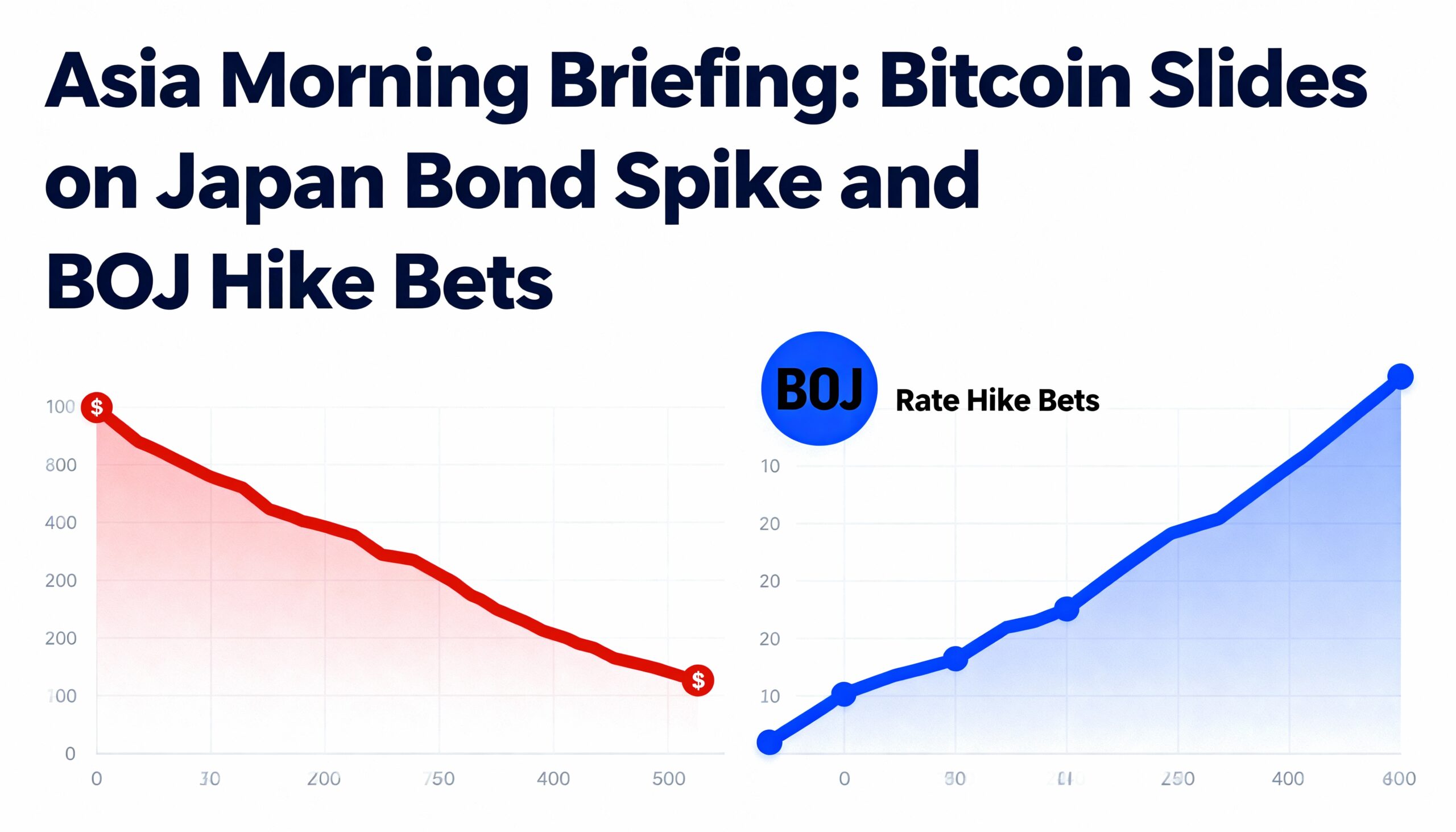

Bitcoin Falls Below $87,500 as Japanese Yields Spike to 17-Year Highs

Bitcoin slid under $87,500 during Hong Kong morning trading as Japan’s short-term government bond yields surged to levels not seen since 2008, prompting risk-off moves across regional markets.

Japan’s 2-year government bond yield briefly hit 1.01%, fueled by speculation that the Bank of Japan may end its long-standing near-zero interest rate policy. BOJ Governor Kazuo Ueda recently said the board will assess whether a rate hike is appropriate at this month’s meeting.

The yen strengthened in Tokyo, triggering the unwinding of yen-funded carry trades that have supported risk assets this year. Crypto markets, particularly sensitive to short-term liquidity in Asia, took the brunt of the sell-off. Bitcoin’s slide sparked over $150 million in long liquidations, while Ether dropped toward $2,850, seeing roughly $140 million in liquidated long positions.

Polymarket data shows traders now price the probability of a December BOJ rate hike at roughly 50%, up seven percentage points from earlier estimates, highlighting uncertainty over Japan’s policy path.

Market Highlights:

- Crypto: Rising Japanese yields and a stronger yen could continue to pressure leveraged positions, adding volatility to Bitcoin and Ether.

- Gold: Nearly 70% of institutional investors expect gold to keep climbing, with many forecasting prices above $5,000 by 2026, according to Goldman Sachs.

- Equities: Asia-Pacific markets slipped Monday. Japan’s Nikkei 225 fell 1.3% as traders awaited China’s manufacturing data and priced in an 87% chance of a Fed rate cut.

Traders will closely monitor BOJ guidance and yen movements this week, as further tightening signals could trigger additional volatility across both regional markets and crypto assets.