Asia Kicks Off with ETH Strength, Institutional Tailwinds, and Crypto-AI Convergence

Ethereum Leads Derivatives Market, Eyes $3K Amid Institutional Rotation

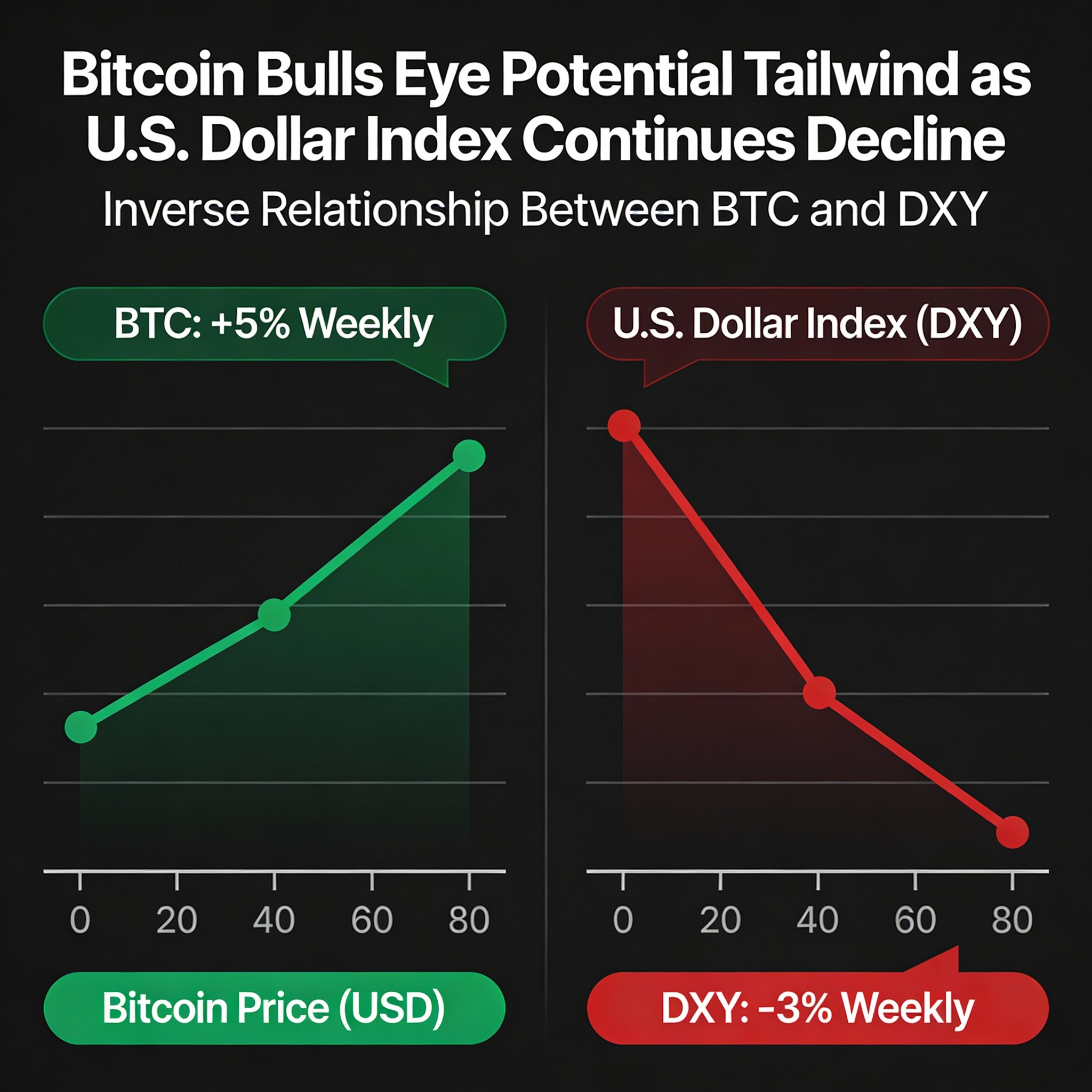

As Asia opened its Thursday session, Ethereum (ETH) held near $2,770, riding a wave of institutional enthusiasm that has pushed it up 11% this month — more than double Bitcoin’s 5% gain.

On OKX, ETH now dominates perpetual futures markets, accounting for 45.2% of volume versus BTC’s 38.1%. This shift underscores ETH’s growing role as a bridge between decentralized finance (DeFi) and traditional markets, says Lennix Lai, OKX’s chief commercial officer.

“ETH’s rise in derivatives reflects deeper institutional conviction and structural growth narratives,” Lai noted. Similar trends are mirrored on Deribit, reinforcing Ethereum’s expanding footprint in professional crypto trading.

Glassnode reports that long-term holders continue to absorb BTC’s volatility, raking in nearly $1 billion in daily profits during recent rallies without triggering broader distribution — a dynamic the firm calls “highly atypical for late bull markets.”

While risk remains — from geopolitical tensions to market-moving political drama — ETH is increasingly seen as the preferred on-chain exposure for institutional allocators. Analysts say a break above $2,900 could open the path to $3,000 in the near term.

Stablecoins Hit All-Time High, Tron Absorbs Capital Like a Magnet

The stablecoin market surged to a record $228 billion, fueled by increased investor confidence, a successful Circle IPO, and rising DeFi yields. Centralized exchange reserves of stablecoins reached $50 billion, according to CryptoQuant, with USDC leading inflows.

Tron has emerged as the primary beneficiary of this liquidity. The chain notched $6B in net stablecoin inflows in May, outpacing Ethereum and Solana, according to Presto Research. Its strong Tether integration and low-fee model continue to attract capital, with daily activity rivaling top chains.

Ethereum and Solana, meanwhile, saw outflows amid stagnant protocol upgrades and fading yield opportunities. Base and Tron are now leading the charge in TVL and user activity growth.

AI Agents Need Crypto to Function in Open Ecosystems

As AI agents grow more autonomous, crypto is emerging as the connective tissue that allows them to operate in decentralized environments. A16z Crypto’s Scott Duke Kominers says that without blockchain rails, agents remain siloed and dependent on closed APIs.

Projects like Halliday, Skyfire, and Catena are using crypto tools to allow agents to pay one another, commission tasks, and operate without human input. Coinbase is quietly backing infrastructure that could enable this new machine-to-machine economy — with blockchains providing the transparency and composability needed for autonomous coordination at scale.

If successful, this agent economy could become crypto’s most compelling real-world use case yet.

Web3 Gaming: Fun Must Come First, or the Sector Risks Collapse

Despite remaining the most-used category in the decentralized app space, Web3 gaming is under pressure. DappRadar reports that funding for blockchain games has plunged, falling to just $9M in May — from over $220M in late 2024.

Flagship titles like Nyan Heroes and Ember Sword have shut down, a reflection of the industry’s failure to prioritize engaging gameplay. Many teams over-indexed on tokenomics and marketing, leaving underdeveloped games that failed to retain players.

The message is clear: without great games, even the best economic models won’t matter.

Markets Summary: Volatile, But Fundamentally Strong

- BTC: Fell 2% to $108.5K on geopolitical noise, though ETF inflows remain robust.

- ETH: Broke $2,800 on strong institutional flows and bullish guidance on staking from U.S. regulators.

- Gold: Gained 0.97% as softer CPI raised hopes of Fed rate cuts.

- Nikkei 225: Down 0.22% amid mixed global cues.

- S&P 500: Largely flat as traders digest inflation and trade deal news.