Short covering and steady dip buying are helping bitcoin stay anchored near $90,000, according to updates from Flowdesk and QCP, though prediction markets continue to show little confidence in a move toward $96,000.

Flowdesk notes that bitcoin’s recovery above $90,000 resembles a broad year-end risk reset rather than a crypto-specific breakout. The firm says rising expectations for a December Fed rate cut have encouraged traders to cover shorts and pick up discounted positions, helping stabilize prices after last week’s sharp selloff.

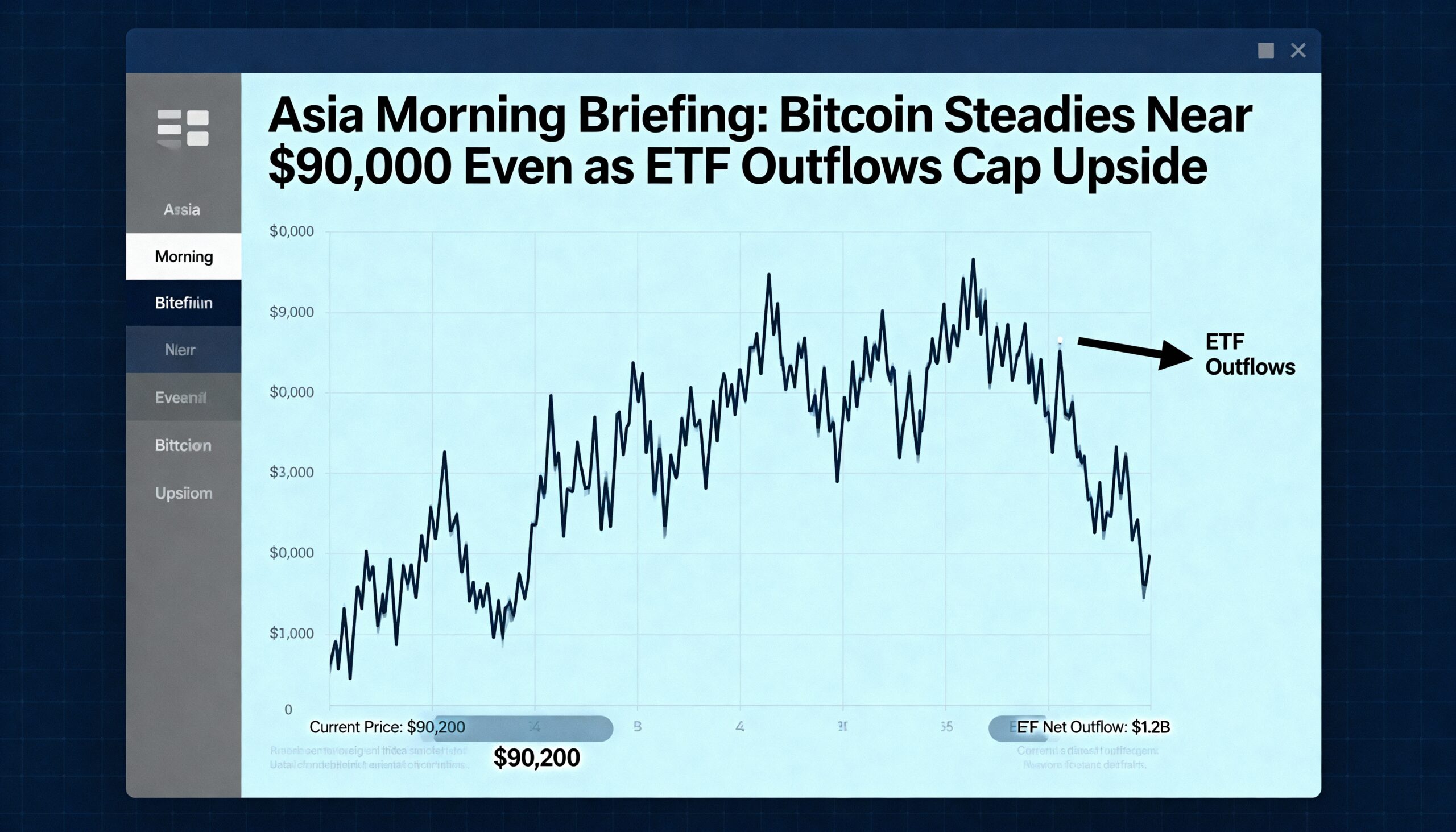

QCP, meanwhile, highlights several macro risks that could challenge the current relief rally. The firm points to sticky inflation, weakening labor indicators, and credit stress emerging in AI-exposed equities — all of which suggest the rebound may remain fragile. ETF outflows also continue to weigh on sentiment and are limiting bitcoin’s ability to build sustained upside momentum.

Prediction markets echo this capped outlook. Polymarket pricing shows a 74% probability that bitcoin’s weekly high will remain near $92,000 through the end of November. Odds of a push to $96,000 or higher remain in single-digit territory, reinforcing trader expectations that any rally into the mid-$90,000s will meet ETF-driven supply.

Support is still clustered in the $80,000–$82,000 range following last week’s washout. With volatility sharply subdued during the U.S. holiday period and market focus turning to the Federal Reserve’s Dec. 12 meeting, crypto continues to behave like a macro-linked asset rather than responding to sector-specific developments. Absent a shift in macro drivers, the path of least resistance appears to be sideways.

BTC: Bitcoin is treading water in a tight band in the low $90,000s. Short covering has lifted prices off the lows, but steady ETF outflows are capping each attempt to break higher.

ETH: Ether is trading slightly above $3,000, benefiting from measured dip buying but still lacking clear momentum after a month of underperformance relative to bitcoin.

Gold: Gold remains supported by falling yields, a softer dollar, elevated geopolitical risk, and fading AI- and crypto-related enthusiasm. Wells Fargo strategist Sameer Samana told Kitco News the uptrend is intact, with prices consolidating between $4,150 and $4,170 after failing to hold above $4,160.

Nikkei 225: Asia-Pacific markets were mixed on Friday as flat U.S. futures left the Nasdaq on track to end its seven-month winning streak. Traders also weighed Tokyo inflation, which again topped the Bank of Japan’s 2% target, with the Nikkei 225 slipping 0.19% ahead of India’s GDP data release.