WhiteFiber’s first long-term colocation agreement at its NC-1 campus provides early confirmation of the company’s retrofit-focused strategy, according to B. Riley.

In a note issued Tuesday, the investment bank said the deal with Nscale Global supports management’s execution and adherence to its original deployment timeline. Analysts Nick Giles and Fedor Shabalin said the milestone highlights both operational progress and the advantages of WhiteFiber’s retrofit model.

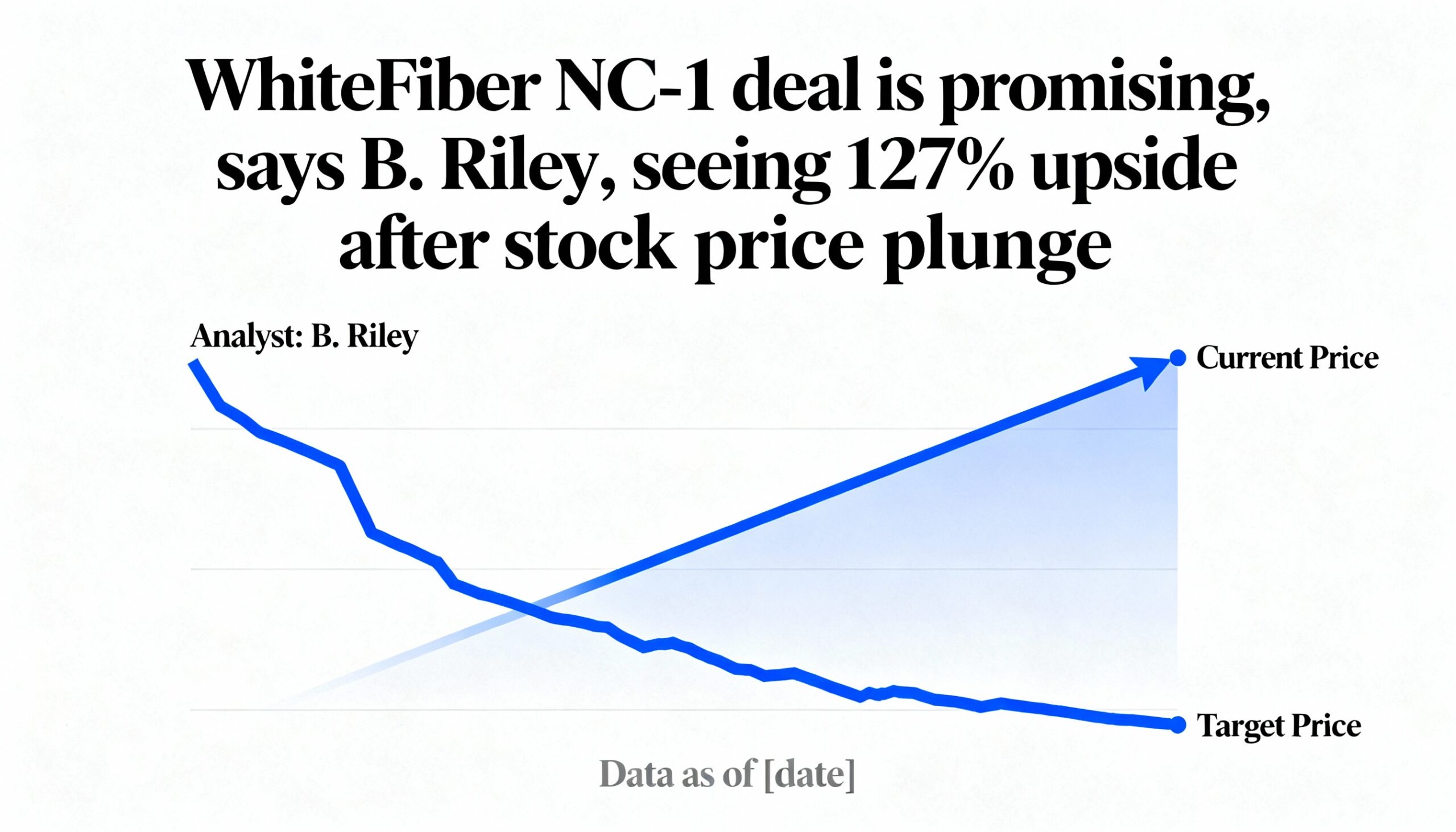

B. Riley reaffirmed its buy rating on WhiteFiber (WYFI) while lowering its price target to $40 from $44, reflecting more cautious assumptions for the Cloud Services business. The revised target still represents about 127% upside from the stock’s most recent close of $17.62. Shares are down more than 50% from their peak reached roughly two months ago.

The analysts also said WhiteFiber is in advanced discussions with lenders regarding a construction financing facility expected to close in early 2026. The facility could include an accordion option and credit enhancements, potentially reducing the company’s cost of capital.

On valuation, B. Riley said WhiteFiber is trading at roughly 11 times estimated 2026 EV/EBITDA and about 8 times EV/EBITDA based on its fourth-quarter 2026 adjusted EBITDA run rate, which the firm views as a significant discount compared with peers trading in the mid- to high-teens.