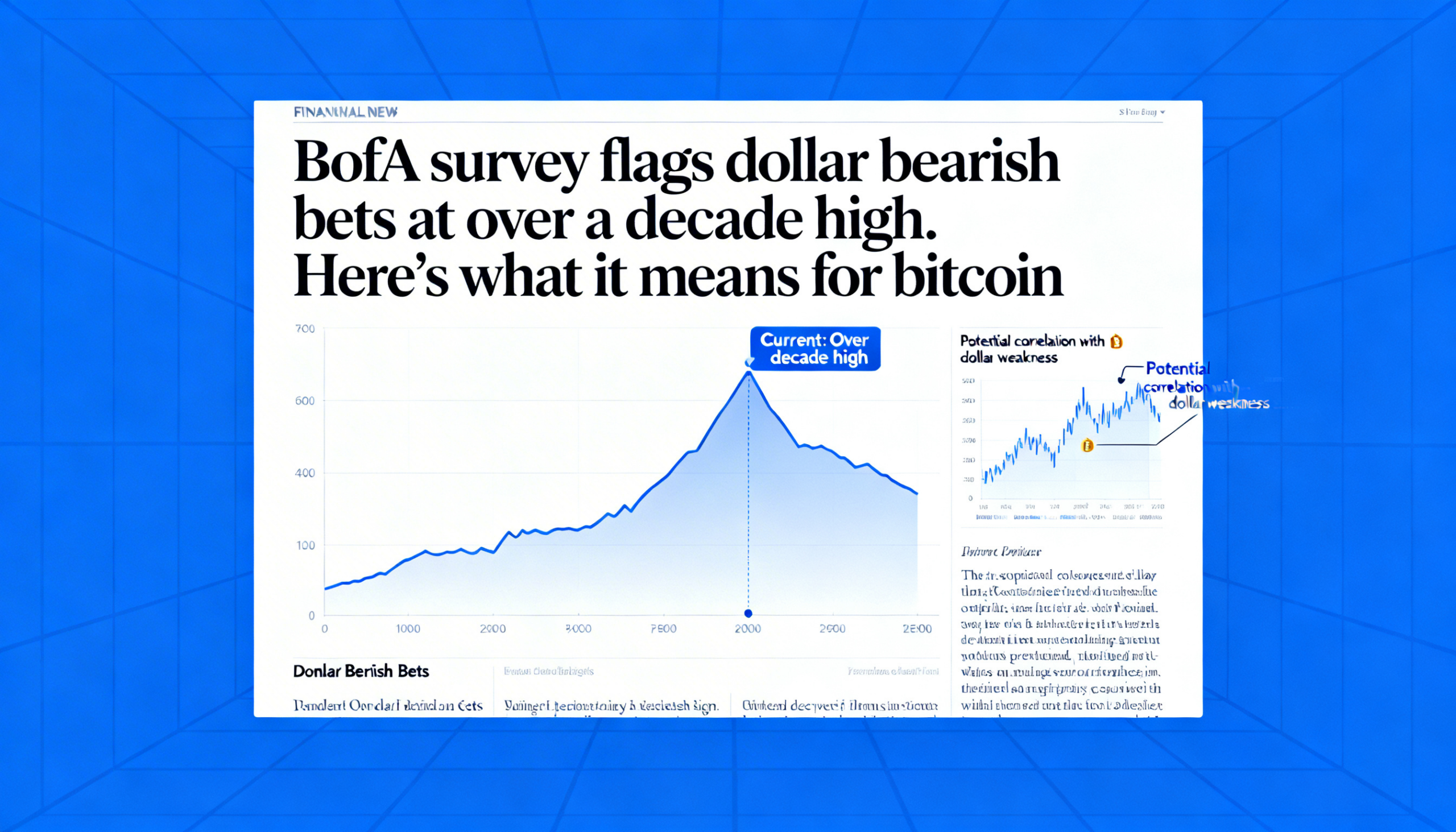

Investor positioning against the U.S. dollar has reached its most extreme level in more than a decade, according to Bank of America’s February fund manager survey — a development that could heighten volatility in bitcoin, though perhaps not in the way crypto bulls expect.

The survey shows net exposure to the greenback has dropped to its most underweight reading since at least early 2012. Respondents pointed to growing concerns about a cooling U.S. labor market, which could pressure the Federal Reserve to begin cutting interest rates.

Historically, bitcoin has tended to move inversely to the U.S. Dollar Index (DXY). Because BTC is priced in dollars, a weaker greenback generally makes it more attractive to international buyers. At the same time, dollar strength tightens global liquidity conditions, often weighing on risk assets such as cryptocurrencies. By that framework, record bearish positioning in the dollar would typically be viewed as supportive for bitcoin.

Recent market behavior, however, suggests the relationship may be shifting.

Since early 2025, bitcoin has shown a positive correlation with the dollar. The DXY fell more than 9% last year and has edged lower again this year, yet bitcoin has also declined — down 6% in 2025 and roughly 21% year-to-date. Data from TradingView indicate the 90-day correlation between BTC and the dollar index recently climbed to 0.60, its highest level since April 2025.

If that positive correlation persists, further weakness in the dollar could coincide with additional downside in bitcoin — a departure from the historical inverse pattern. On the other hand, an abrupt rebound in the greenback could lift BTC alongside it.

One catalyst for such a rebound could be a short squeeze. With positioning heavily skewed toward dollar weakness, any upside surprise — such as stronger-than-expected economic data — could force traders to unwind short bets quickly. That rapid buying could send the dollar sharply higher and amplify cross-asset volatility.

“Record short positioning raises the risk of volatility in major USD pairs; downside may extend on weak U.S. data, but crowded trade dynamics increase potential for sharp short-covering rallies,” said Eamonn Sheridan, chief Asia-Pacific currency analyst at InvestingLive.

At the time of writing, the dollar index was trading 0.25% higher at 97.13, while bitcoin changed hands near $68,150, down about 1% on the day, according to data from CoinDesk.