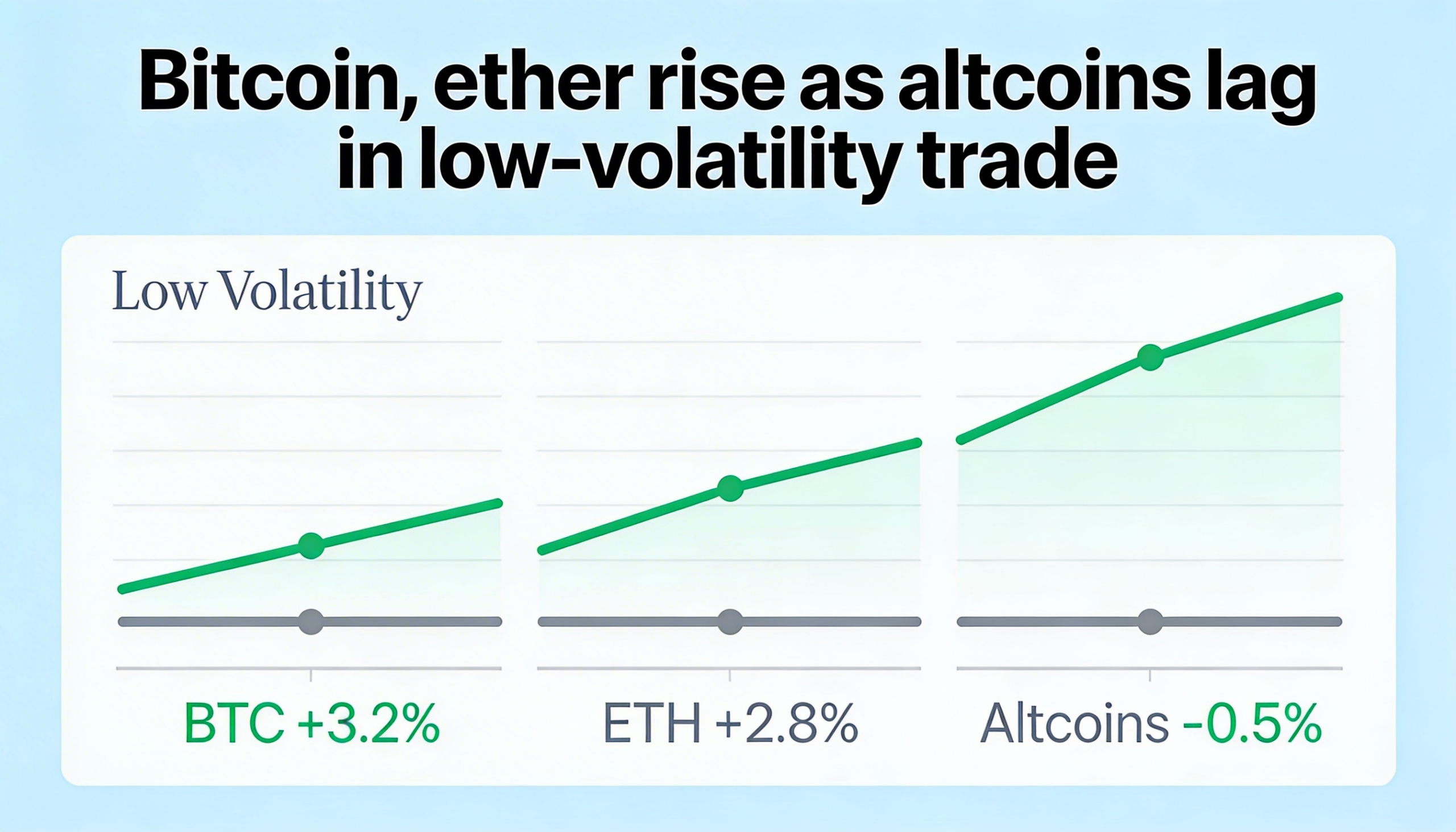

Bitcoin and ether posted modest gains overnight, but weak participation across altcoins, elevated liquidations and persistent demand for short-term hedges suggest traders remain defensive.

Bitcoin rose roughly 0.9%, recently changing hands near $67,000 after briefly dipping to $66,000 on Wednesday. Ether advanced by a similar margin to around $1,970, rebounding from $1,924 but still struggling to decisively reclaim the psychologically important $2,000 level.

Market volatility has eased since the sharp selloff on Feb. 5. Two weeks of sideways consolidation have left investors debating whether the current calm precedes another downside leg or marks the formation of a broader macro bottom before a potential recovery into 2025.

A forum hosted by World Liberty Financial at Mar-a-Lago on Wednesday failed to spark bullish momentum, despite the presence of CFTC Chairman Michael Selig and executives from firms including Goldman Sachs.

From a broader technical standpoint, bitcoin remains in a downtrend after peaking near $126,600 in early October. The chart continues to reflect a sequence of lower highs and lower lows, punctuated by choppy consolidation phases between major moves.

Derivatives positioning

Market structure has stabilized somewhat, with open interest holding at $15.38 billion — a shift from aggressive deleveraging toward a more stable base.

Retail sentiment shows tentative improvement, as funding rates have turned flat to slightly positive, with Binance back near 4%. Institutional positioning, however, remains subdued, with the three-month annualized basis anchored around 3%.

In options markets, bitcoin volumes are now evenly split between calls and puts. The one-week 25-delta skew has edged higher to 12%, while the implied volatility term structure remains in short-term backwardation. The elevated front-end implied volatility suggests traders are still paying a premium for near-term protection, even as longer-dated volatility steadies around 49%.

Data from CoinGlass shows $218 million in liquidations over the past 24 hours, with longs accounting for 77% of that total. Bitcoin led with $75 million in liquidations, followed by ether at $53 million and other tokens at $22 million. Meanwhile, Binance’s liquidation heatmap highlights $67,400 as a key level to watch should prices push higher.

Token watch

Altcoins are increasingly feeling the strain of thin liquidity conditions.

Shares of WLFI fell more than 10% during Wednesday’s event in a classic “sell the news” reaction. Axie Infinity’s AXS token is retesting its Feb. 6 lows after sliding 5.9% since midnight UTC. Lending protocol Morpho’s native MORPHO token has erased all of Wednesday’s gains, trading near $1.39 after dropping 4.2% overnight.

Broadly, 97 of the top 100 cryptocurrencies — excluding stablecoins and tokenized gold — are in negative territory over the past 24 hours, underscoring the weak market breadth.

Sentiment indicators reflect that caution. The crypto fear and greed index currently stands at 11 out of 100, up slightly from February’s trough of 6, but still firmly in “extreme fear” territory.