Tentative signs of optimism are emerging in crypto derivatives markets, with leverage largely flushed out, funding rates turning positive and institutional basis ticking higher — even as traders continue to pay up for near-term downside protection.

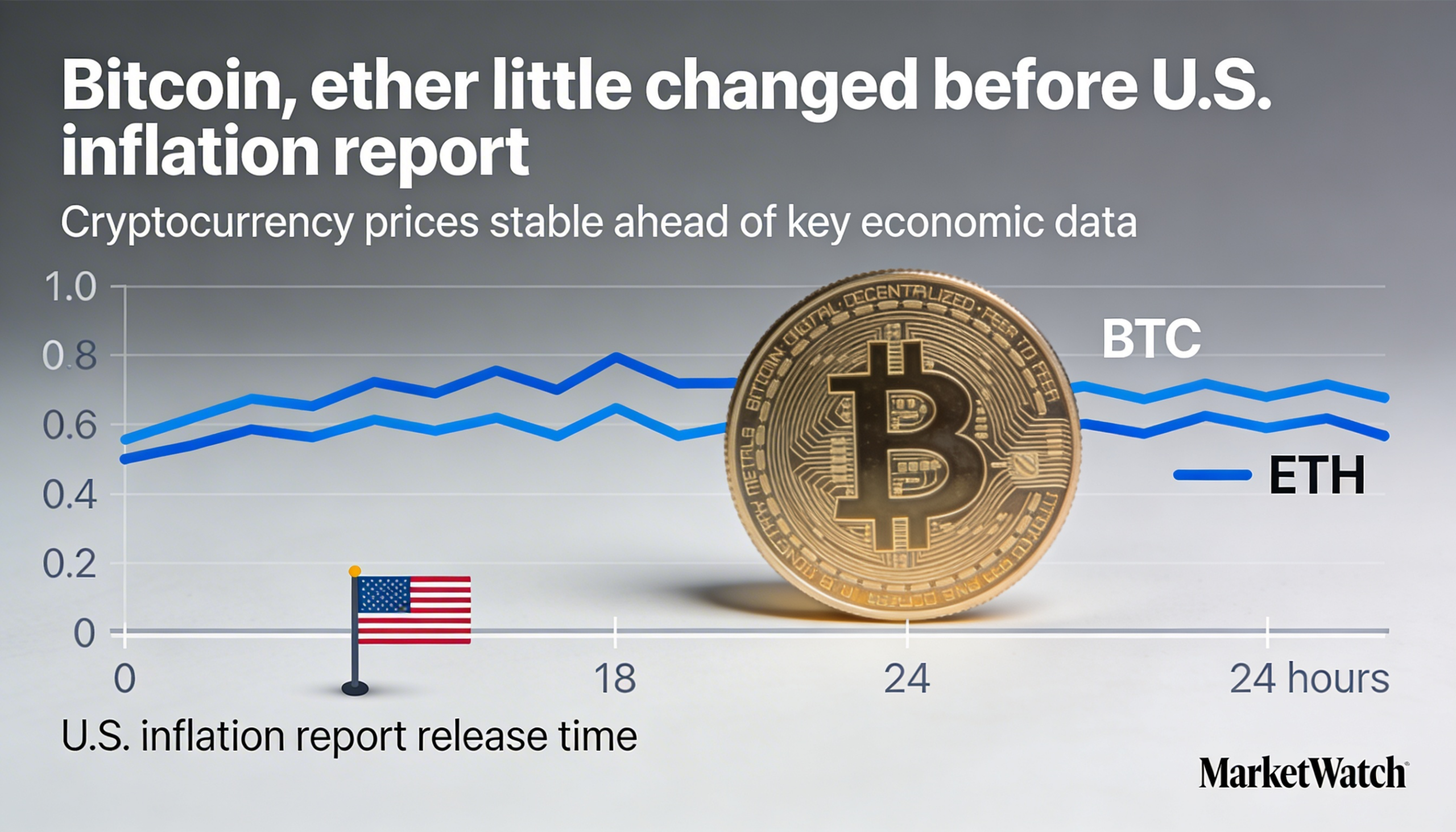

Bitcoin climbed to test $67,000 early Friday before retreating, but remained about 1% higher since midnight UTC. Ethereum rose roughly half as much. The broader market, as measured by the CoinDesk 20 Index, was little changed, up around 0.7% over the same period.

The modest rebound follows weakness during Thursday’s U.S. session, when prices slid back toward last week’s lows. Even so, bitcoin is still on track for a fourth consecutive weekly decline — its longest losing streak since mid-November. Softer trading activity and declining volatility have also weighed on overall volumes.

Investors are now focused on the upcoming U.S. Consumer Price Index (CPI) release for direction. A hotter-than-expected inflation reading could push bond yields and the dollar higher, adding pressure on risk assets. Conversely, a softer print may revive expectations for easier financial conditions, potentially supporting crypto and other speculative markets.

Still, a much stronger move would be required to lift bitcoin toward $85,000 — a level that Deribit Chief Commercial Officer Jean-David Péquignot has said would signal that the cryptocurrency’s long-term rally is no longer “broken.”

Derivatives Snapshot

- Open interest has fallen to $15.5 billion, suggesting that late-cycle leverage has been largely washed out.

- Perpetual futures funding rates have shifted from neutral to positive across major venues, ranging between 0% and 8%. Institutional sentiment appears to be improving as well, with the three-month annualized futures basis climbing to just above 3%, marking a pickup in professional positioning.

- In options markets, call volume has risen to 65%, while the one-week 25-delta skew eased to 17.9%. Despite signs of bottom-fishing, the implied volatility term structure remains in short-term backwardation, indicating traders are still paying a premium for immediate downside hedges.

- Data from Coinglass shows $256 million in liquidations over the past 24 hours, split roughly 69% longs to 31% shorts. Bitcoin accounted for $112 million, ether $52 million and other tokens about $16 million in notional liquidations.

- The Binance liquidation heatmap highlights $68,800 as a key level to watch in the event of further upside.

Token Talk

PUMP, the token tied to Solana-based memecoin launchpad Pump.fun, has gained more than 5% over the past 24 hours.

The platform introduced a new feature enabling token communities to allocate fees directly through its mobile app, including integration with GitHub accounts. The update simplifies automatic fee distribution to creators and lays the groundwork for additional social features.

Under the new system, communities can direct a portion of token-generated fees to support creators on GitHub, who must claim payouts via the mobile app.

Pump.fun played a central role in last year’s memecoin trading surge, when its monthly volumes exceeded $11 billion. Activity has since cooled sharply, with volumes dropping to around $1 billion last month, according to data from DeFiLlama.