Bitcoin Rebounds to $93K as Altcoins Lag, Metals Surge

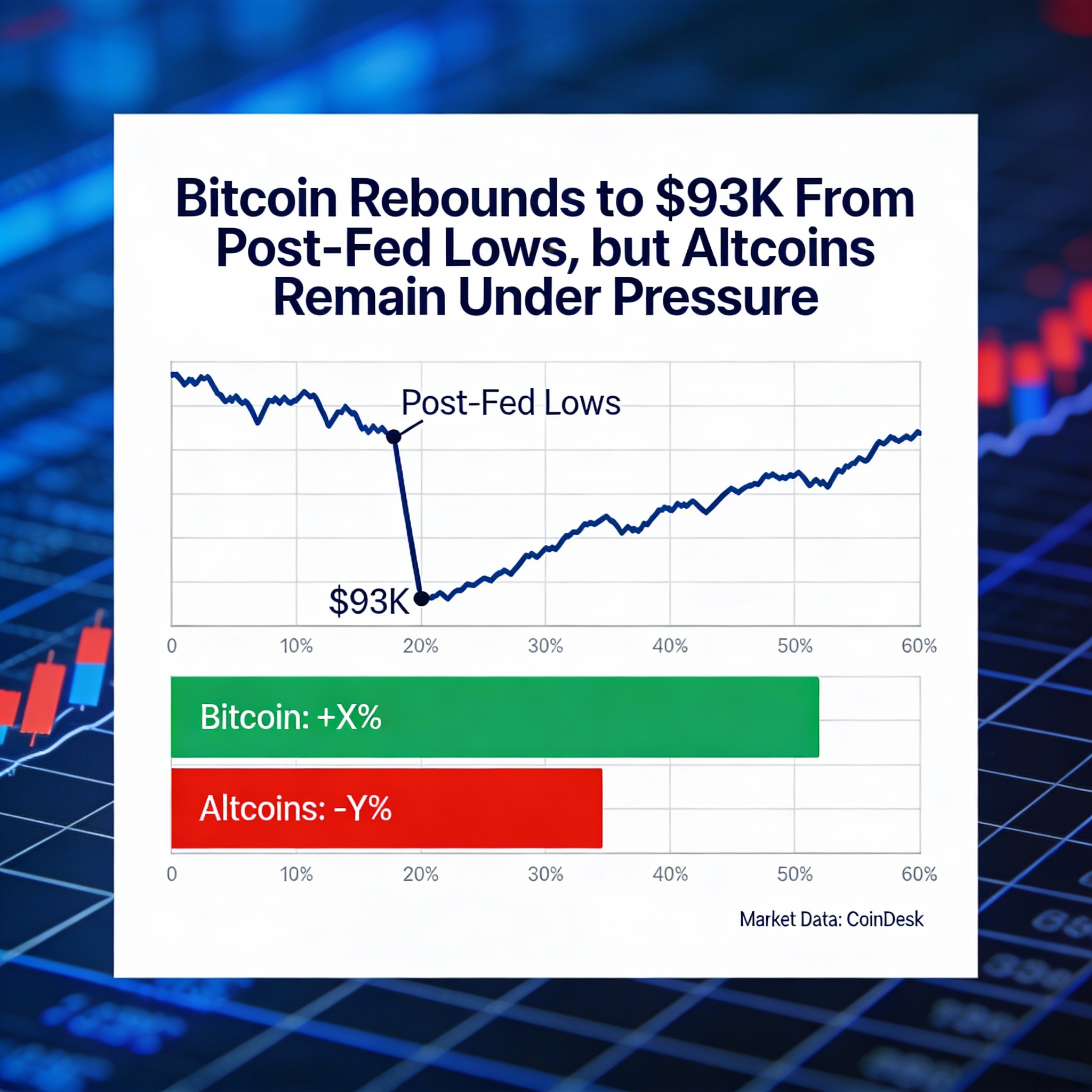

Bitcoin (BTC) recovered to $93,000 on Thursday after dropping to $89,000 following Wednesday’s Federal Reserve rate cut and a weak U.S. stock open. While selling pressure is easing, analysts caution the market is not fully out of the woods.

Most altcoins failed to follow Bitcoin’s bounce. Cardano (ADA) and Avalanche (AVAX) led declines, falling 6%-7%, while Ether (ETH) slipped 3%, holding above $3,200.

The late-day rebound in Bitcoin coincided with modest gains in U.S. equities: the Nasdaq closed down just 0.25% after earlier losses of 1.5%, the S&P 500 ended slightly positive, and the Dow Jones gained 1.3%.

Precious metals outperformed, with silver surging 5% to a record $64 per ounce and gold climbing over 1% to near $4,300, aided by a weaker U.S. dollar index, which hit its lowest level since mid-October.

Crypto exchange Gemini jumped over 30% after receiving regulatory approval to offer U.S. prediction markets.

Crypto Decouples from Equities

Jasper De Maere, desk strategist at Wintermute, said crypto continues to diverge from equities around macro events. “Yesterday fit the pattern: equities rallied while crypto sold off, suggesting the Fed’s rate cut was priced in,” he noted. He added that attention is shifting toward U.S. crypto regulation and early stagflation concerns ahead of 2026.

Bitcoin Selling Pressure Eases

Analytics firm Swissblock noted that Bitcoin’s downward momentum is slowing. “The second wave of selling is weaker than the first. Stabilization signs are emerging, though confirmation is still pending,” the firm said.