Bitcoin surged past $90,000 on Wednesday, breaking through key resistance and quickly climbing above $93,000 as U.S. investors drove the rally. After facing multiple rejections at the $90,000 mark earlier in the week, the cryptocurrency broke through that barrier in the U.S. morning hours, setting a new record above $93,000.

The price surge came just as U.S. markets opened, pointing to strong demand from U.S. traders. According to CryptoQuant, Bitcoin’s Coinbase Premium Index — a key measure of U.S. demand — jumped to 0.2, its highest level since April, indicating that buying pressure from American investors was substantial.

The Coinbase Premium Index tracks the price difference between Bitcoin on Coinbase, a U.S.-based exchange, and Binance, a global exchange. A higher premium means U.S. traders are willing to pay more for Bitcoin, signaling a bullish market sentiment among American investors.

It wasn’t just retail investors driving the rally. U.S.-listed Bitcoin ETFs also saw strong trading volumes. BlackRock’s iShares Bitcoin Trust ETF, the largest Bitcoin ETF with $40 billion in assets, saw over $1.2 billion in trading volume in the first hour of the session, making it one of the top-traded ETFs that morning, according to Barchart data.

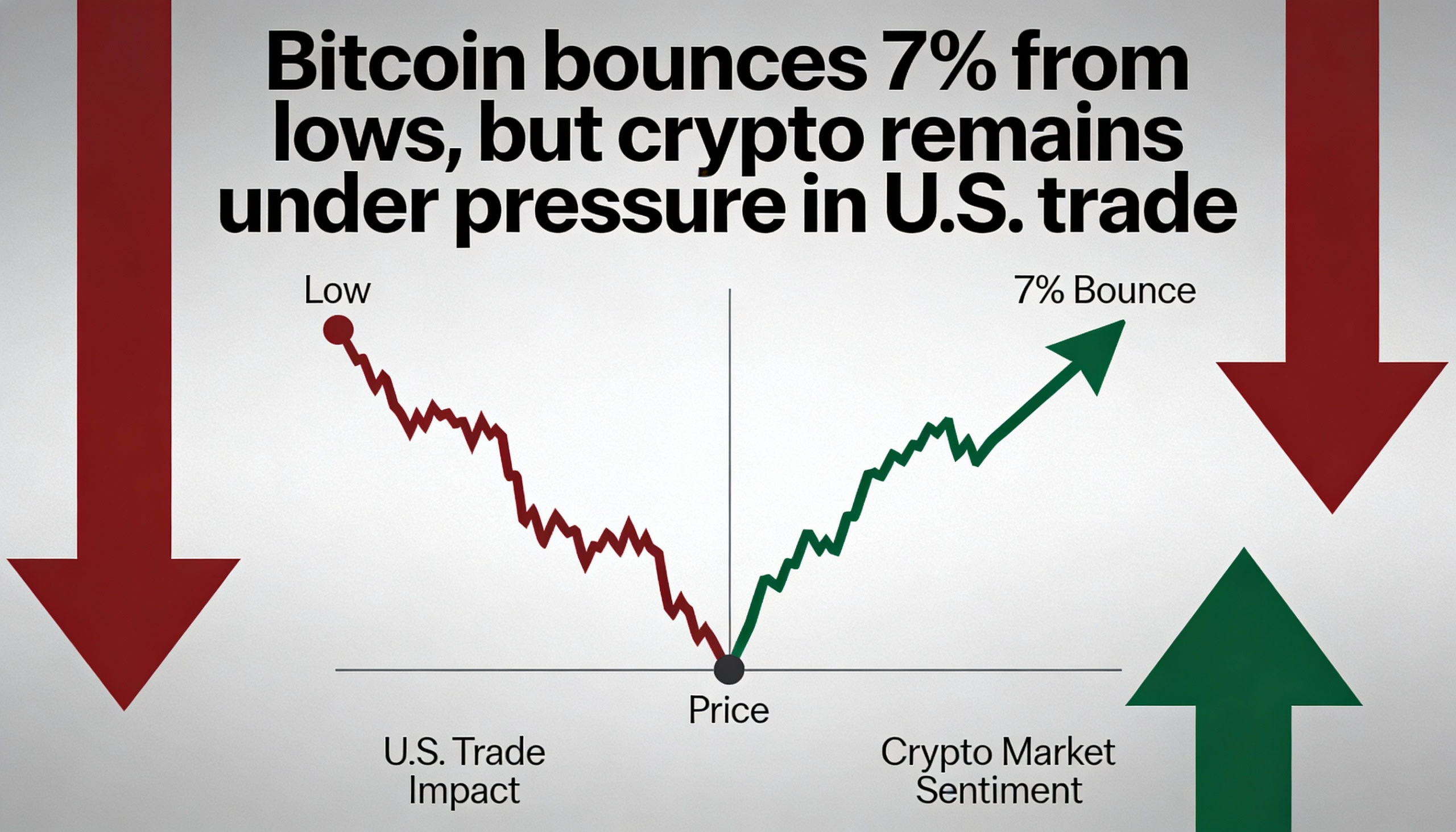

As of the latest data, Bitcoin had slightly pulled back to $92,200, still up nearly 7% over the past 24 hours. The broader market also saw gains, with the CoinDesk 20 Index rising by 3.5%. Ethereum (ETH) and Solana (SOL) also posted gains, increasing 1.6% and 2.7%, respectively.

The rally appears to be driven by spot buying, as reflected in the Spot Cumulative Volume Delta (CVD), which shows a net positive volume for buying. CoinDesk analyst James Van Straten notes that each time the CVD has spiked, the price of Bitcoin has risen, reinforcing the notion that this rally is likely to be sustainable as it’s based on actual buying, rather than futures market speculation.