Sudden, extreme price dislocations are often the result of thin liquidity and tend to occur during quieter trading hours when fewer participants are active.

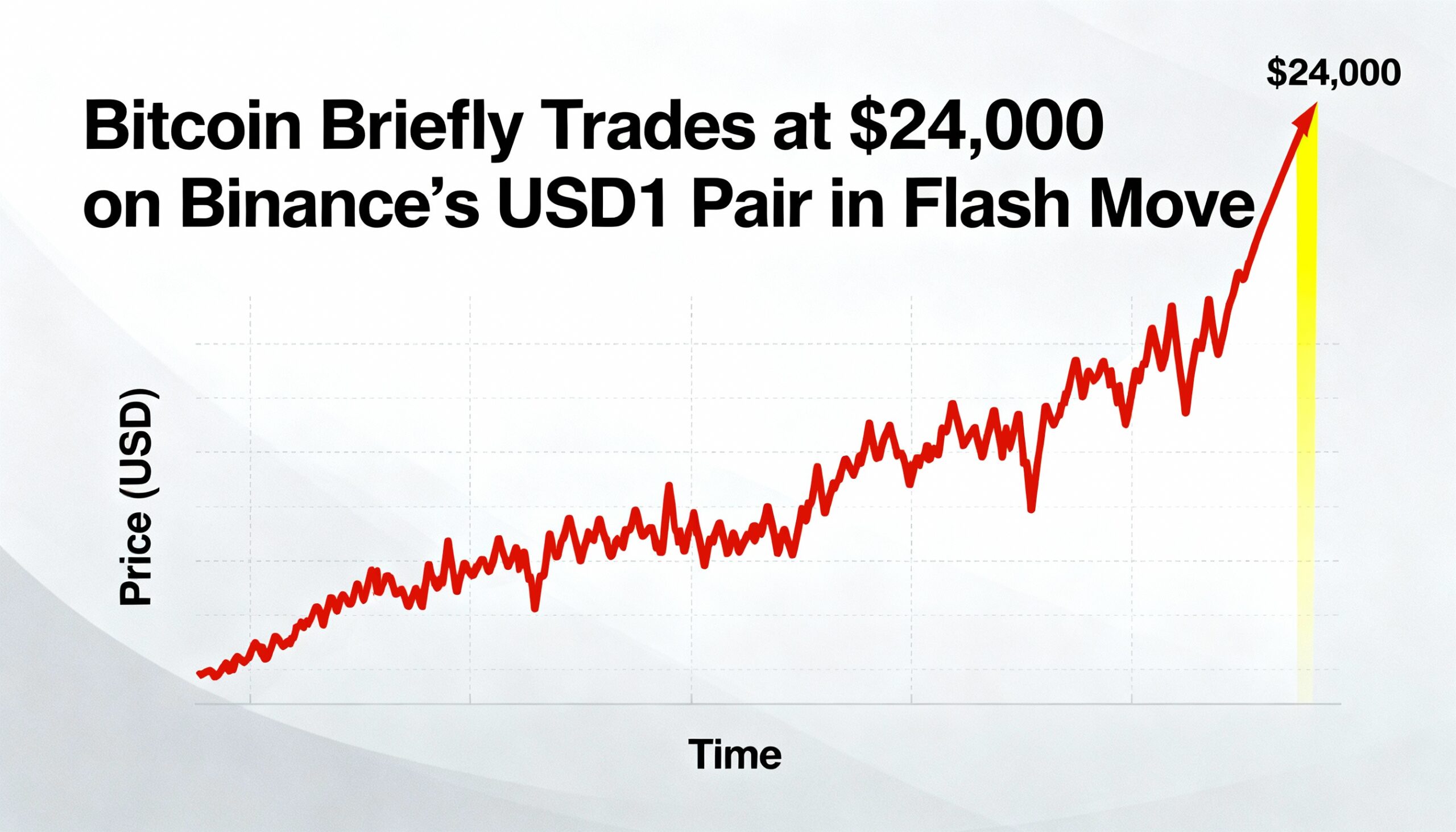

Bitcoin briefly printed as low as $24,111 on Binance late Wednesday in a sharp downward wick on the BTC/USD1 trading pair before rebounding above $87,000 within seconds, according to exchange data. The anomalous move was not reflected on other major bitcoin pairs and appeared isolated to USD1, a stablecoin launched by Trump family-backed World Liberty Financial.

Trading on the pair later normalized, with bitcoin returning to levels in line with the broader market.

Such abrupt “wicks” are typically driven by shallow order books — or, in some cases, display or pricing issues — rather than signaling a broader market selloff. Newly launched or lightly traded stablecoin pairs often have fewer market makers providing tight quotes, leaving them vulnerable to sharp moves.

In these conditions, a single large market sell order, forced liquidation, or automated trade routed through the pair can rapidly sweep available bids, causing prices to momentarily print far below prevailing market levels until buying interest returns.

Temporary spread widening, erroneous quotes from liquidity providers, or algorithmic trading systems reacting to abnormal prints can further exacerbate these dislocations. The impact is often magnified during off-peak hours, when reduced participation limits the market’s ability to quickly absorb order flow.

While visually dramatic on price charts, traders generally view these events as microstructure anomalies rather than indicators of bitcoin’s underlying trend. Still, the episode underscores the execution risks associated with thinly traded pairs, particularly when liquidity in new stablecoins or routing paths has yet to fully develop.