MicroStrategy Unveils $500M Preferred Stock Offering to Fund More Bitcoin Purchases

MicroStrategy (MSTR), the largest corporate holder of Bitcoin, is set to raise $500 million through a new issuance of Perpetual Strife Preferred Stock (STRF), aiming to expand its BTC reserves. However, recent market conditions suggest a slowdown in investor appetite for its capital-raising strategies.

The newly announced preferred stock carries a fixed 10% annual cash dividend, payable quarterly. If dividends go unpaid, they will compound at an additional 1% per quarter, with a cap of 18%, according to the company’s SEC filing. The first scheduled dividend payout is set for June 30, 2025.

Unlike common shares, STRF holders will not have voting rights but will be prioritized in the event of liquidation, with a $100 per share preference. MicroStrategy retains the right to redeem shares under certain conditions, such as if fewer than 25% of the original shares remain. Investors also have an option to demand a buyback in case of a fundamental corporate shift.

This offering follows MicroStrategy’s previous preferred stock issuance (STRK), which had an 8% interest rate, and its past series of convertible debt financings, many of which carried little to no interest.

The STRF shares are expected to be listed on Nasdaq within 30 days, providing investors with a high-yield alternative for Bitcoin exposure. The offering is being led by major financial institutions, including Morgan Stanley, Barclays, Citigroup, and Moelis & Company, under an SEC shelf registration.

MicroStrategy’s Bitcoin buying spree has noticeably slowed in recent weeks. While the company continues to add to its holdings, its most recent purchase—130 BTC for $10.7 million—was a fraction of its past acquisitions. This brings its total Bitcoin reserves to 499,226 BTC.

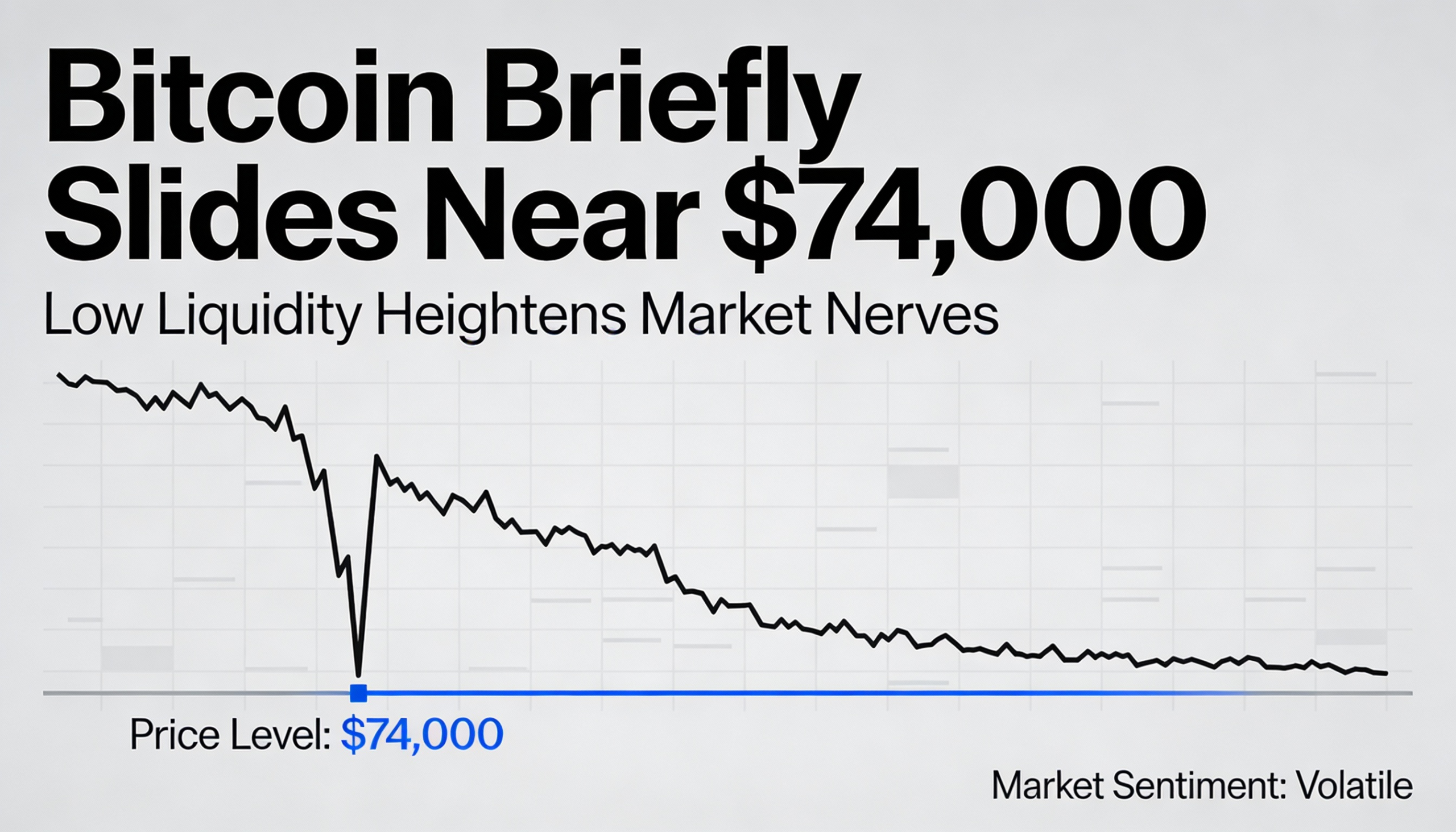

MSTR shares dropped 5% in early Tuesday trading, mirroring Bitcoin’s decline from $84,000 to $81,300 and broader weakness across financial markets.