Political developments in Venezuela and U.S. involvement plans are influencing market volatility and trading dynamics.

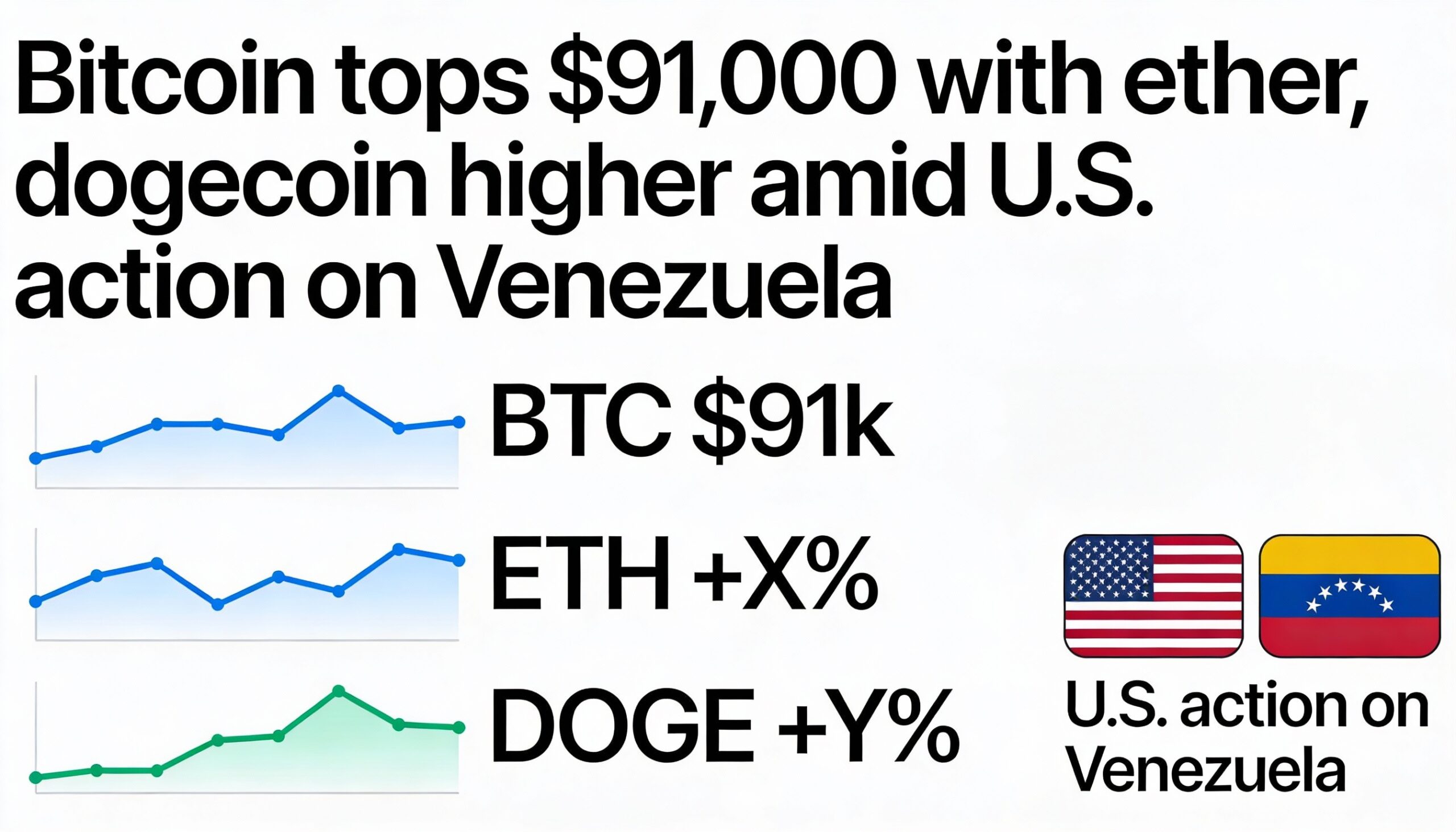

Bitcoin climbed above $91,000 on Sunday as traders extended early-2026 gains across major cryptocurrencies. Ether, Solana, and Cardano posted broad advances amid heightened risk appetite driven by geopolitical headlines from Venezuela.

Bitcoin traded near $91,300 during Asian morning hours, up roughly 1.4% on the day and over 4% on the week. Ether rose about 1% to around $3,150, gaining roughly 7% over seven days, while Solana added 1.6% and climbed more than 8% for the week. XRP hovered just above $2, up 0.6% on the day and nearly 10% over seven days, while Cardano recorded modest daily gains and rose roughly 8% for the week.

The rally followed a sharp liquidation flush that cleared crowded positioning and reset near-term leverage. Data showed approximately $180 million in futures positions liquidated over the past 24 hours, with $133 million from shorts and $47 million from longs. The imbalance suggests traders betting against the rally were forced into buybacks as prices moved higher.

Sunday’s gains were also influenced by the fast-moving political situation in Venezuela. Former President Donald Trump stated that the U.S. plans to “run” Venezuela, though the White House provided few details on the specifics. Meanwhile, Venezuela’s Supreme Court granted Vice President Delcy Rodríguez full presidential powers in an acting capacity after ousted President Nicolás Maduro was taken into U.S. custody.

Trump also emphasized a U.S. focus on Venezuela’s oil resources, suggesting that troops on the ground would not be necessary if Rodríguez “does what we want.”

Crypto traders typically treat such headlines as volatility catalysts rather than direct macro drivers, though the risk tone can still influence markets. In periods of thin liquidity, even modest spot demand can push prices through key technical levels and trigger stop-driven moves in futures markets. This effect is amplified when short positions are concentrated, as forced covering can turn gradual gains into sharper rallies.