Crypto Sinks as Risk-Off Trade Leaves Digital Assets Lagging

Cryptocurrencies once again emerged as the clear underperformer on Thursday as broader markets sold off, with losses accelerating sharply during U.S. trading hours.

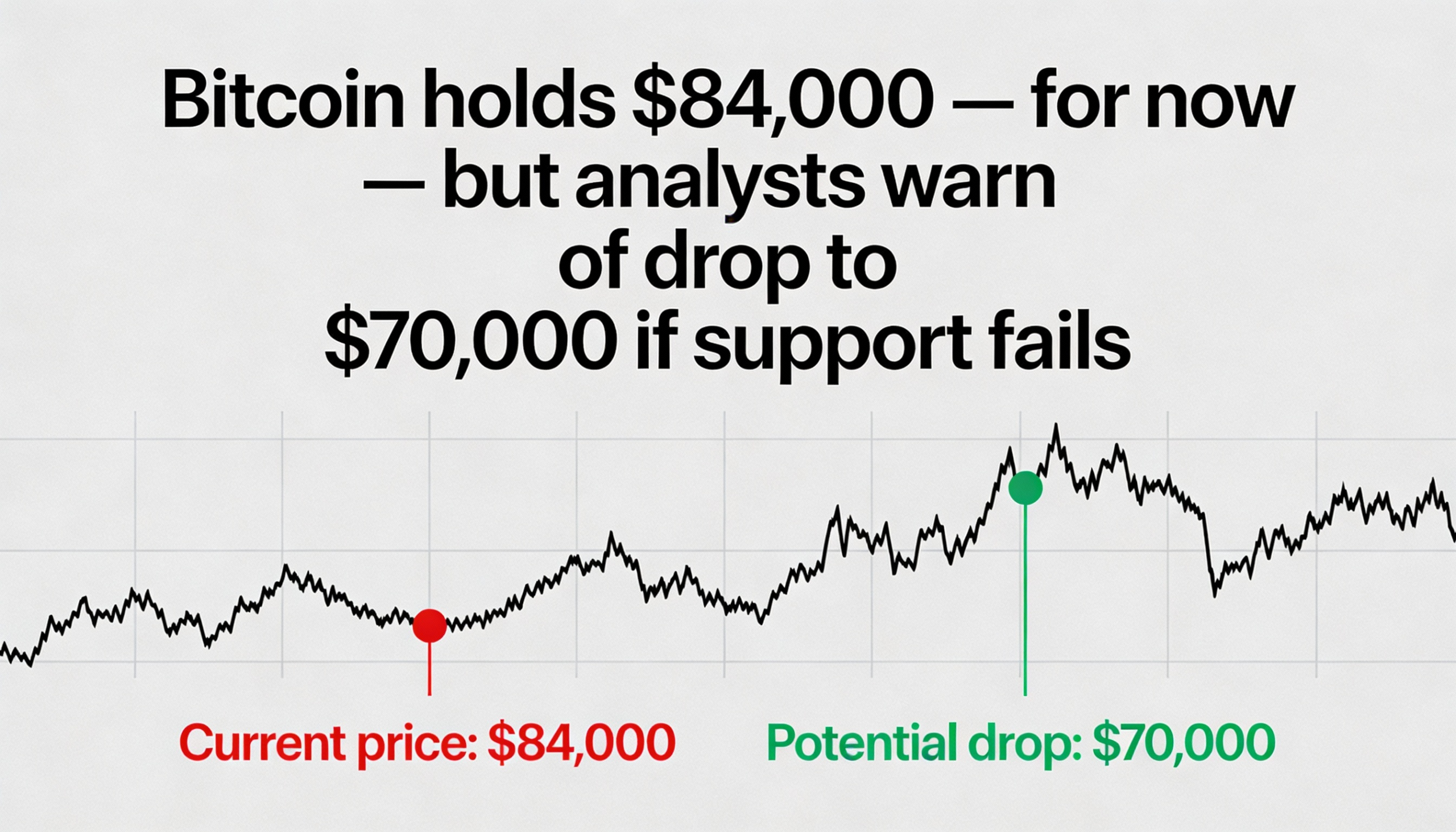

What began as modest overnight declines turned into a steep rout after the Nasdaq fell more than 2% and gold slid nearly 10% from an overnight record. While both markets staged meaningful afternoon recoveries—the Nasdaq closing down just 0.7% and gold rebounding above $5,400 an ounce—crypto prices remained pinned near session lows. Bitcoin was trading just above $84,000 at press time, down nearly 6% over the past 24 hours and threatening to break below its two-month trading range, a move that could signal a deeper pullback.

Losses were widespread across the sector. Ethereum, Solana, XRP, and Dogecoin were all down roughly 7% over the past day. Crypto-linked equities also came under pressure, with Coinbase (COIN), Circle (CRCL), and bitcoin treasury firm Strategy (MSTR) posting declines of 5% to 10%.

Matt Mena, crypto research strategist at 21Shares, said holding above the $84,000 level is “critical” for Bitcoin. A breakdown, he warned, could open a move toward $80,000—where buyers emerged in November—followed by the $75,000 lows seen during the April 2025 tariff-driven selloff.

Despite the weakness, Mena described current prices as a “compelling entry point,” reiterating his expectation that Bitcoin could reach $100,000 by the end of the first quarter, or potentially surge to a new high near $128,000 if macro conditions improve.

Other analysts were more cautious. John Glover, chief investment officer at bitcoin lender Ledn, said the selloff is part of a broader correction from October’s record highs and could ultimately pull Bitcoin down to $71,000—a roughly 43% drop from its early October peak near $126,000.

Glover added that ongoing U.S.-driven uncertainty is pushing investors toward alternative havens such as gold and the Swiss franc, rather than traditional safe assets like the U.S. dollar and Treasuries. While Bitcoin is often described as “digital gold,” he said, it continues to trade as a risk asset, falling alongside equities.

Still, Glover believes the weakness is temporary. “I do think this is a transitory phase, and we’ll see a rebound in bitcoin prices over the coming quarters,” he said.

Not everyone shares that optimism. “Most key technical levels have already been broken on the downside, and there’s limited support here,” said Russell Thompson, chief investment officer at Hilbert Group, who warned Bitcoin could fall as low as $70,000. “The Clarity markup from the committee is bullish longer term, but right now this is simply a broad risk-off move.”