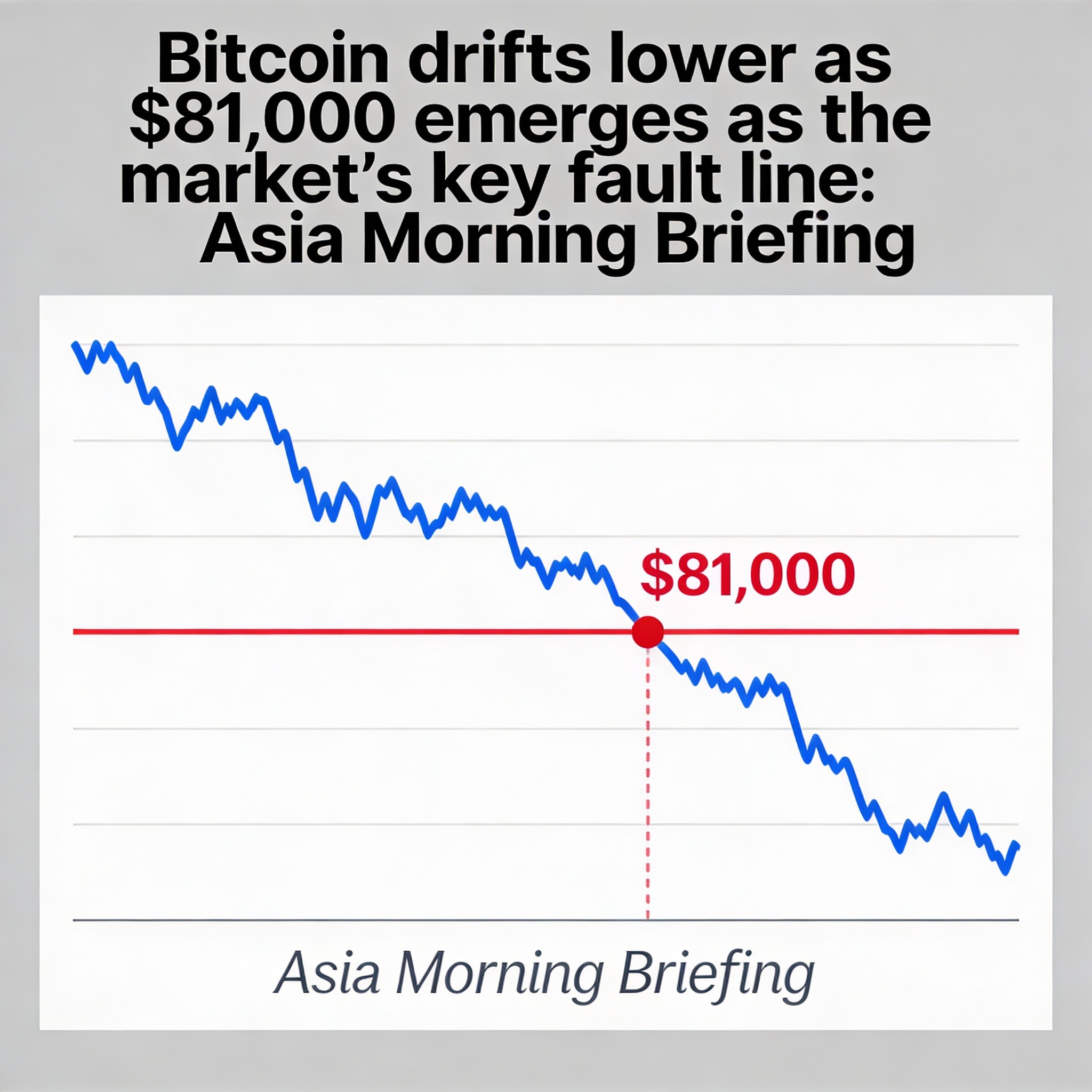

Glassnode has highlighted bitcoin’s True Market Mean, currently near $81,300, as a key dividing line between time-based drawdowns and phases of more forceful loss realization. In the post-October market environment, that threshold has gained added importance.

Correlation data helps explain why the level carries significance beyond bitcoin itself. Over the past 90 days — particularly since the October 10 flash crash — large-cap crypto assets have remained tightly linked to bitcoin’s movements, reinforcing its role as the market’s anchor.

A sustained move below the True Market Mean would therefore have implications beyond extending weakness in already struggling tokens. Historical Glassnode data shows that when bitcoin trades below this level for prolonged periods, selling pressure has tended to spread across the broader crypto market.

With large-cap assets still moving closely in line with bitcoin while higher-beta tokens have already seen sharp declines, a break below $81,300 risks drawing that weakness back into the market’s core. The focus, then, is less on predicting an imminent breakdown and more on identifying where the market’s balance currently sits.

As long as bitcoin remains above the True Market Mean, losses are likely to stay uneven and compartmentalized. However, if $81,300 fails to hold and prices do not quickly recover, Glassnode’s historical analysis suggests selling pressure would be more likely to extend beyond the long tail of assets. In a post-October market characterized by thin liquidity and tight large-cap correlations, such a move would mark a transition from a slow, grinding drawdown to a more synchronized market reset.

Market Movement

BTC: Bitcoin was trading little changed near $86,400, down about 1% on the day and roughly 6.5% over the past week as the recent pullback persisted.

ETH: Ether hovered around $2,830, down roughly 3.6% over the past 24 hours and about 15% on the week, underperforming bitcoin as broader market weakness continued.

Gold: Gold has climbed to record highs in 2025, with prices doubling over the past two years to above $4,300 an ounce. Central bank demand, geopolitical risks, U.S. fiscal concerns and a broadening investor base have led major banks to forecast prices approaching $5,000 in 2026.