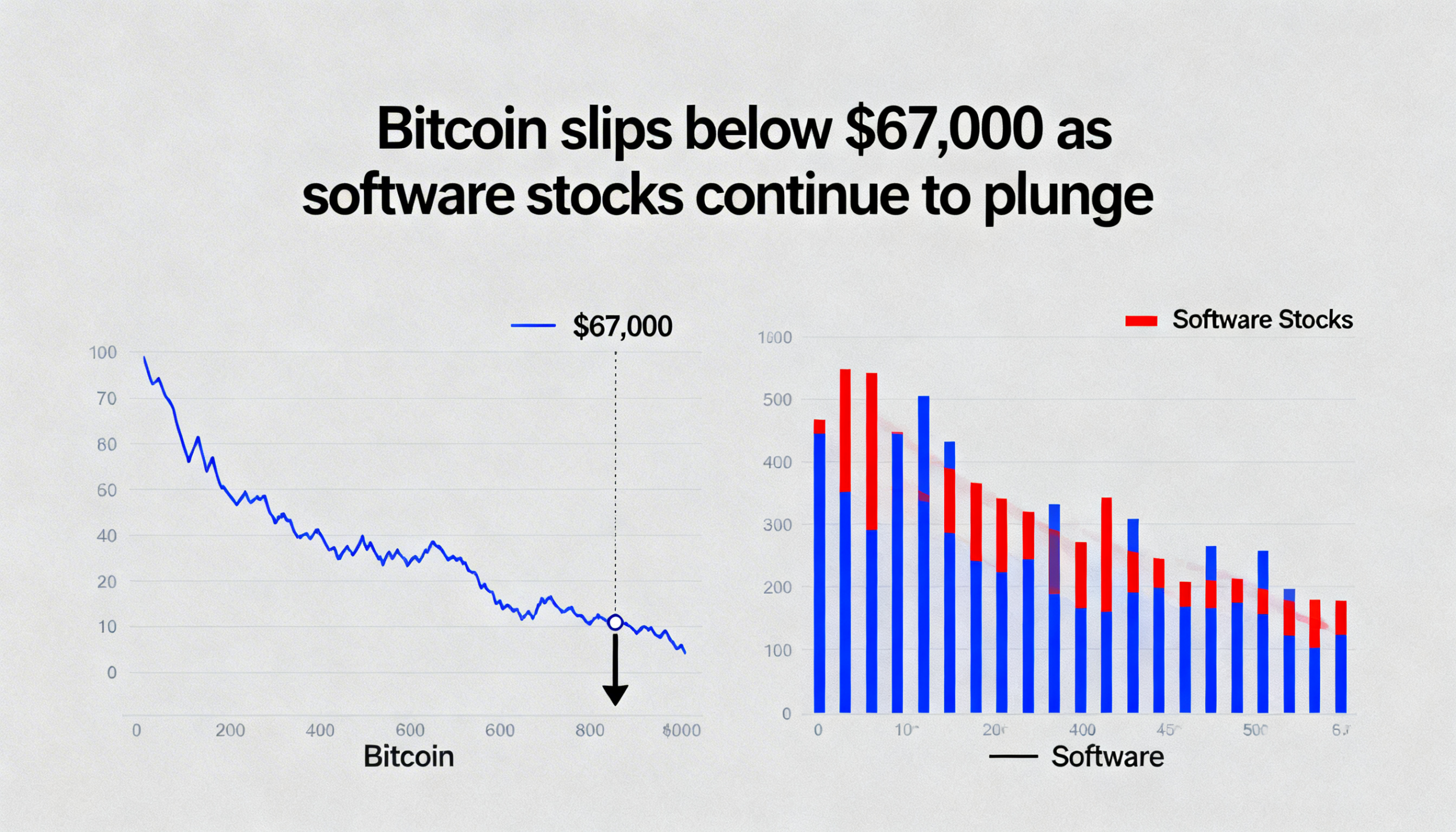

Bitcoin dropped beneath $67,000 on Tuesday as continued selling in U.S. software stocks weighed on broader risk sentiment, tightening the link between crypto and the tech sector.

The largest cryptocurrency broke below its weekend consolidation range of $68,000 to $70,000, trading around $67,173 at the time of writing. The slide coincided with a weaker start for U.S. equities, led by fresh losses in software names.

The iShares Expanded Tech-Software Sector ETF fell another 3% on the day and now sits roughly 30% below its October high. Software stocks have faced mounting pressure amid concerns that rapid advances in artificial intelligence could undermine existing business models.

Market participants have increasingly treated bitcoin as a tech-adjacent asset. As sentiment around software deteriorates, crypto has struggled to decouple. The broader Nasdaq Composite slipped 0.8%, while the S&P 500 declined 0.6%.

Meanwhile, the rally in precious metals continued to unwind. Gold fell 3% to around $4,860 per ounce, and silver dropped 6%, leaving it approximately 40% below its late-January peak.

Crypto-linked stocks also retreated, reversing part of Friday’s rebound. Strategy (MSTR), the largest corporate holder of bitcoin, fell about 5%, while Circle (CRCL) posted a similar decline. Bitcoin miners and data center operators — including Riot Platforms (RIOT), MARA Holdings (MARA), CleanSpark (CLSK), Cipher Mining (CIFR) and TeraWulf (WULF) — slid between 4% and 5%.

Searching for a catalyst

Paul Howard, senior director at Wincent, said crypto remains tightly linked to macroeconomic sentiment.

“Over the past year, macro developments have been closely correlated with crypto’s risk profile,” Howard noted, adding that expectations for softer economic data continue to support a risk-off mindset.

He suggested that an upcoming tariff ruling from the Supreme Court of the United States could serve as a more meaningful short-term catalyst than routine economic releases.

For now, Howard anticipates further consolidation as bitcoin and the broader digital asset market look for a narrative strong enough to draw capital away from AI-driven equities and commodities.

“Crypto still needs to reassert itself as a compelling asset class,” he said, adding that current price levels alone have not been sufficient to reignite investor enthusiasm.