Digital assets pushed modestly higher on Friday, brushing off fresh trade-policy turbulence after the Supreme Court of the United States struck down President Donald Trump’s sweeping tariff rollout.

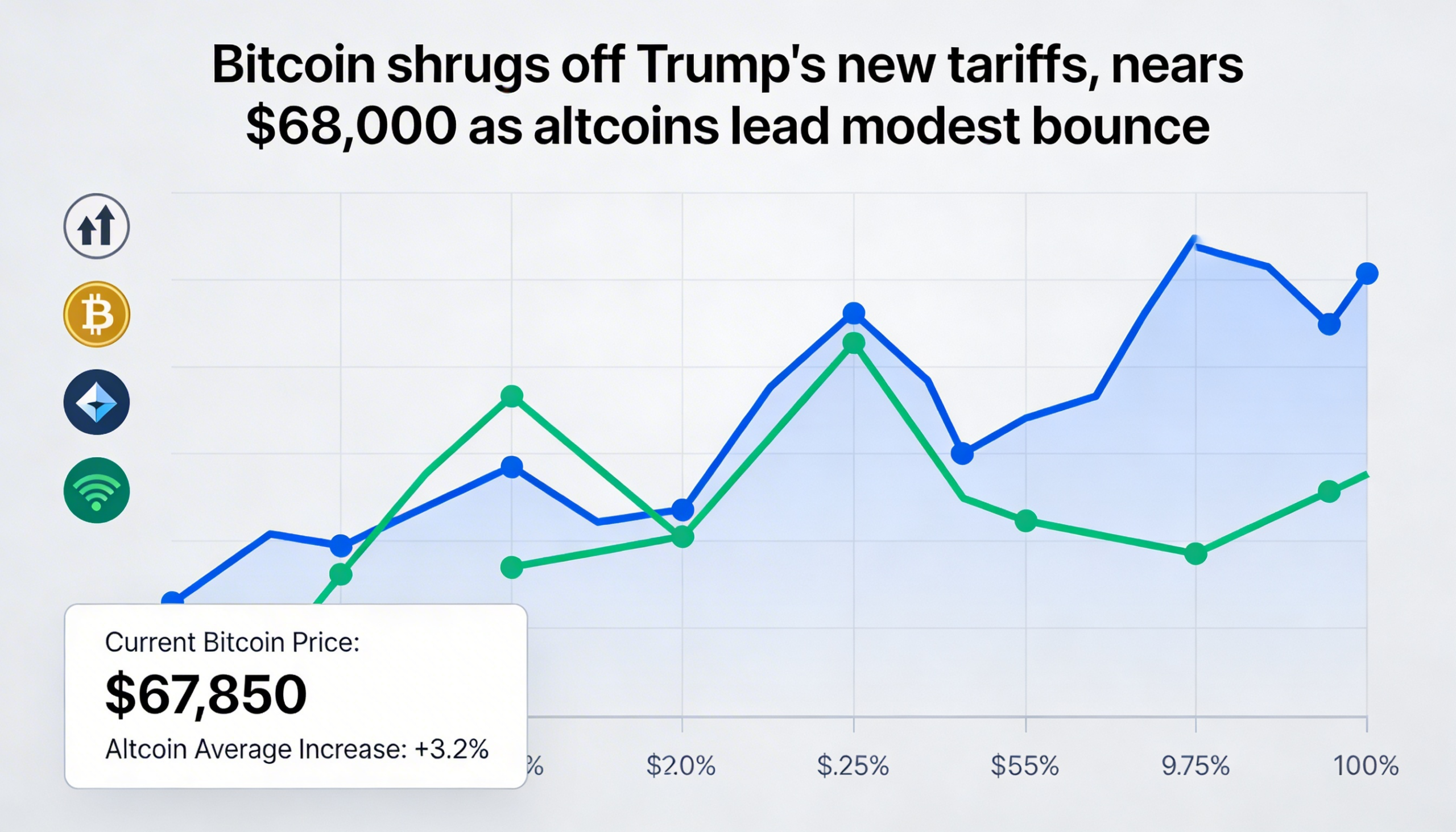

Bitcoin traded near $67,600 and edged closer to the $68,000 mark, while several large-cap altcoins outperformed with stronger percentage gains.

Trade uncertainty lingers

The session opened with the Supreme Court ruling Trump’s global tariff measures unlawful. While the decision invalidated the framework, it did not clarify the fate of previously collected tariff revenue. Nor did it definitively end the administration’s broader trade push, as alternative executive and legal avenues remain available.

Later in the day, Trump announced a new 10% global tariff under Section 122, scheduled to take effect within three days and last for roughly five months. Despite the added levy — layered on top of existing tariffs — financial markets showed little sign of panic.

Altcoins lead modest advance

Risk assets climbed steadily through the session. The CoinDesk 20 Index rose 2.5% over the past 24 hours. BNB, Dogecoin, Cardano and Solana each gained between 3% and 4%, outpacing bitcoin’s move. Bitcoin hovered just below $68,000.

Traditional markets also advanced. The S&P 500 climbed 0.9%, while the Nasdaq-100 added 0.7%.

Crypto-related equities mirrored the broader strength. Shares of Coinbase, Circle and Strategy each rose more than 2%. However, bitcoin miners with exposure to AI-driven infrastructure expansion lagged, as Riot Platforms, Cipher Mining, IREN and TeraWulf fell between 3% and 6%.

Rangebound outlook remains

Paul Howard, director at digital asset trading firm Wincent, said the modest rally reflects a view that tariffs could weigh on the macro environment, potentially supporting risk assets in the near term.

Still, he cautioned that trading volumes remain muted, limiting conviction in a sustained breakout. Absent a significant macroeconomic or geopolitical catalyst, crypto prices are likely to remain rangebound.

One potential risk factor cited by market participants is escalating tension with Iran, following weeks of military buildup in the region — a development that could quickly shift global risk sentiment if it intensifies.