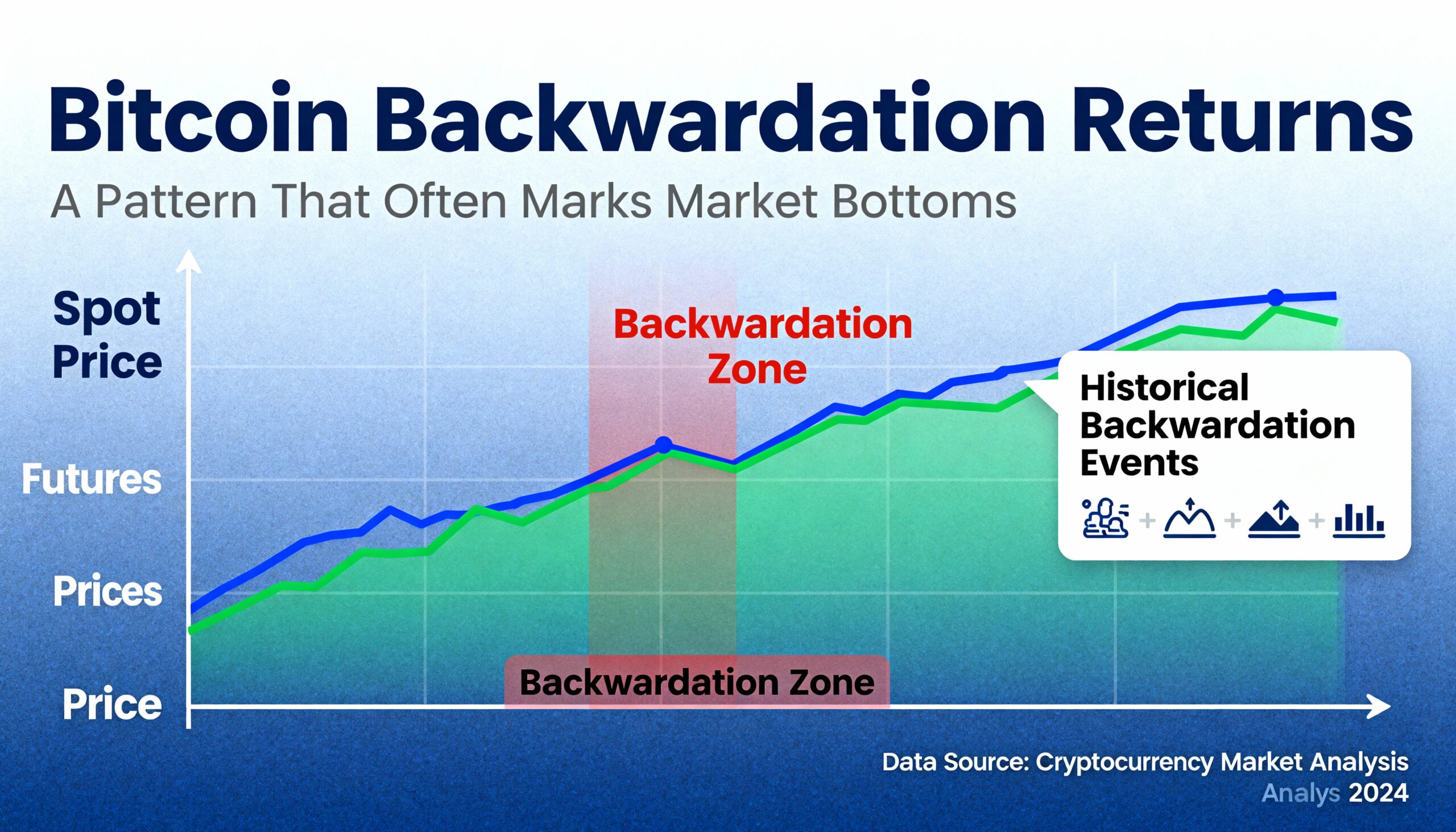

Bitcoin Futures Flip Into Backwardation as Market Stress Deepens, Historically a Precursor to Bottoms

Bitcoin futures have slipped below the spot price, pushing the market into backwardation — a structure often associated with heightened fear, heavy hedging, and capitulation. The shift comes as BTC’s decline from its record high has deepened to nearly 30%.

In an X post, RUMJog Enterprises Managing Partner Thomas Young noted that backwardation in bitcoin is unusually rare and typically appears during periods of forced de-risking. “When backwardation shows up, it usually signals stress, forced deleveraging, or a short-term capitulation point,” he said, suggesting the setup may offer a contrarian opportunity.

According to Young, markets at this stage generally follow one of two paths: either a sharp rebound as panic unwinds or a final washout that completes the correction. Both scenarios have historically aligned with significant market lows.

Backwardation has an established track record of marking BTC bottoms:

• November 2022: signaled the exact cycle low near $15,000 during the FTX collapse.

• March 2023: reappeared as bitcoin dipped under $20,000 amid the SVB crisis and USDC instability.

• August 2023: emerged during the Grayscale ETF–related sell-off toward $25,000, preceding a swift rebound.

Today, the three-month annualized futures basis has dropped to roughly 4%, its lowest reading since November 2022. The basis — the return from buying spot BTC while simultaneously selling a three-month futures contract — normally trades positive, reflecting a mild contango. During strong bull phases, the spread widens as traders pay up for forward exposure; it reached 27% in March 2024 during bitcoin’s surge to $73,000.

The sharp compression of that premium indicates fading demand for leveraged longs and a broader risk-off tone. While bitcoin typically maintains a modest contango structure, periods of extreme sentiment can swing the curve sharply in either direction.

The current backwardation underscores a cautious market still digesting recent volatility — but one that, historically, has been close to major turning points