U.S. stocks retreated Thursday after Oracle Corp. reported its steepest one-day drop in nearly a year, as heavy AI spending raised concerns about profitability. Traders appeared focused on maintaining trend structure rather than chasing gains, concentrating flows in large-cap names.

Oracle Weighs on Tech

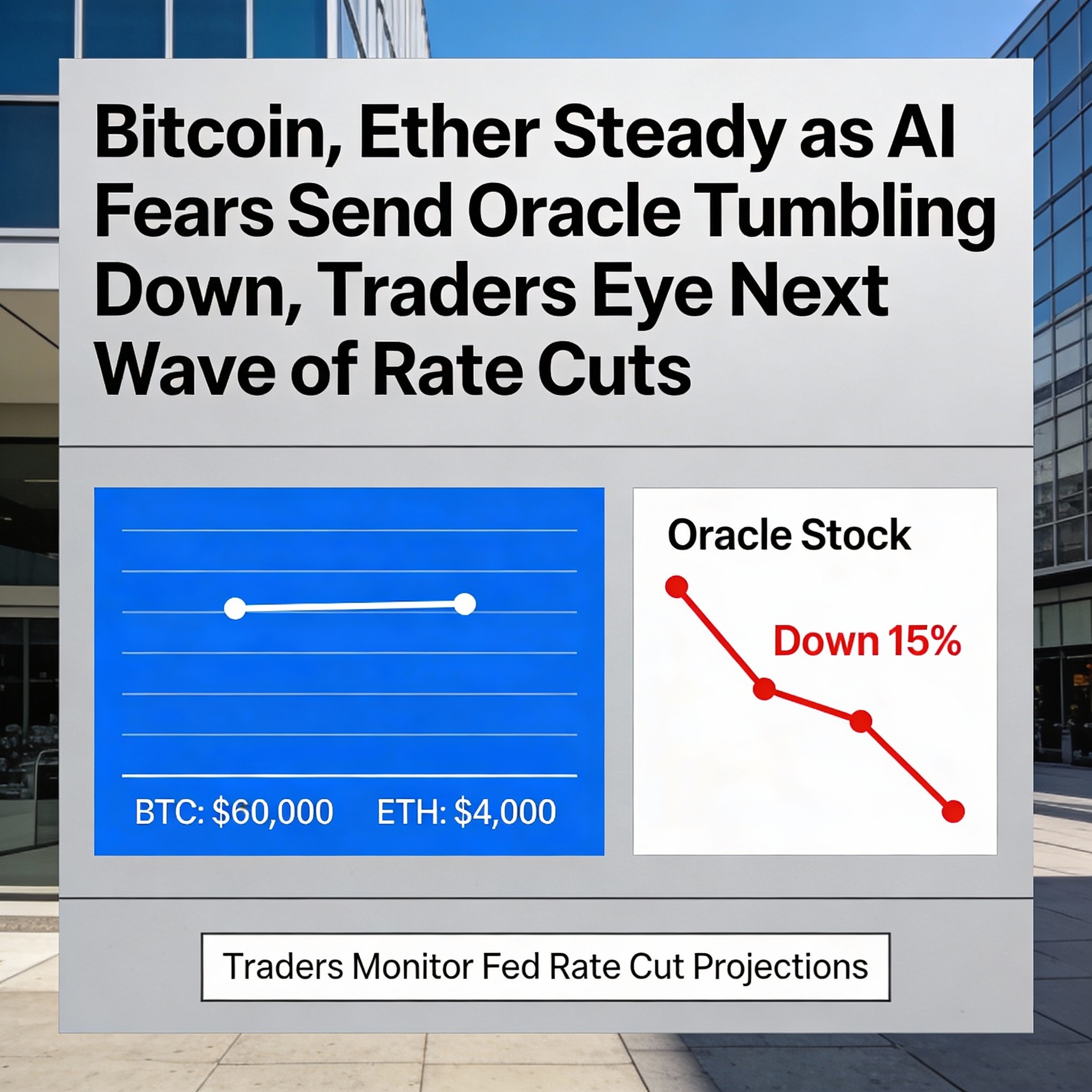

Oracle shares fell more than 11% following disclosure of sharply higher capital expenditures tied to AI infrastructure. Quarterly spending hit around $12 billion, exceeding expectations, while the company raised its full-year capex forecast to $50 billion — a $15 billion increase from September.

The surge in spending sparked doubts over when AI investments will translate into meaningful cloud revenue, driving Oracle to its lowest level since early 2024 and pushing a measure of its credit risk to a 16-year high. Broader tech sentiment, particularly among AI-linked stocks that powered much of this year’s rally, weakened, with the Nasdaq 100 slipping as investors rotated cautiously into other sectors.

Crypto Holds Ground

Meanwhile, crypto markets traded with relative stability, modestly decoupling from equity weakness as traders remained selective about risk. Bitcoin rebounded above $92,000, gaining roughly 2.6% after briefly dipping into the low $90,000s earlier this week.

Ether moved in tandem, climbing toward $3,260, while SOL outperformed with a jump of more than 6%, reflecting renewed interest in higher-beta layer-1 tokens. XRP and BNB posted smaller gains, staying range-bound as investors awaited clarity on spot ETF developments and broader market direction. Dogecoin edged higher but remained lower on a weekly basis, tracking broader sentiment rather than token-specific drivers.

“Major institutions are increasingly divided on the Fed’s next steps,” analysts at Bitunix told CoinDesk. “Some see improving inflation supporting further cuts in March, while others anticipate a January pause, a wait-and-see approach through H1, or a delay until after June.”

The analysts added that the “hawkish cut” underscores the FOMC’s growing challenge in maintaining cohesion under Chair Powell.

Market Outlook

With markets digesting both a fractured Fed outlook and heightened scrutiny of AI spending, investors appear set to remain tactical. Near-term direction is likely to hinge on whether earnings and liquidity can justify the next leg of risk-taking across equities and crypto.

For now, flows remain concentrated in large-cap equities and top-tier crypto, as traders weigh selective upside against macro uncertainty and corporate spending pressures.