Japan’s move toward higher interest rates and a firmer yen could pose fresh challenges for global risk assets, including cryptocurrencies, even as U.S. policy turns more supportive.

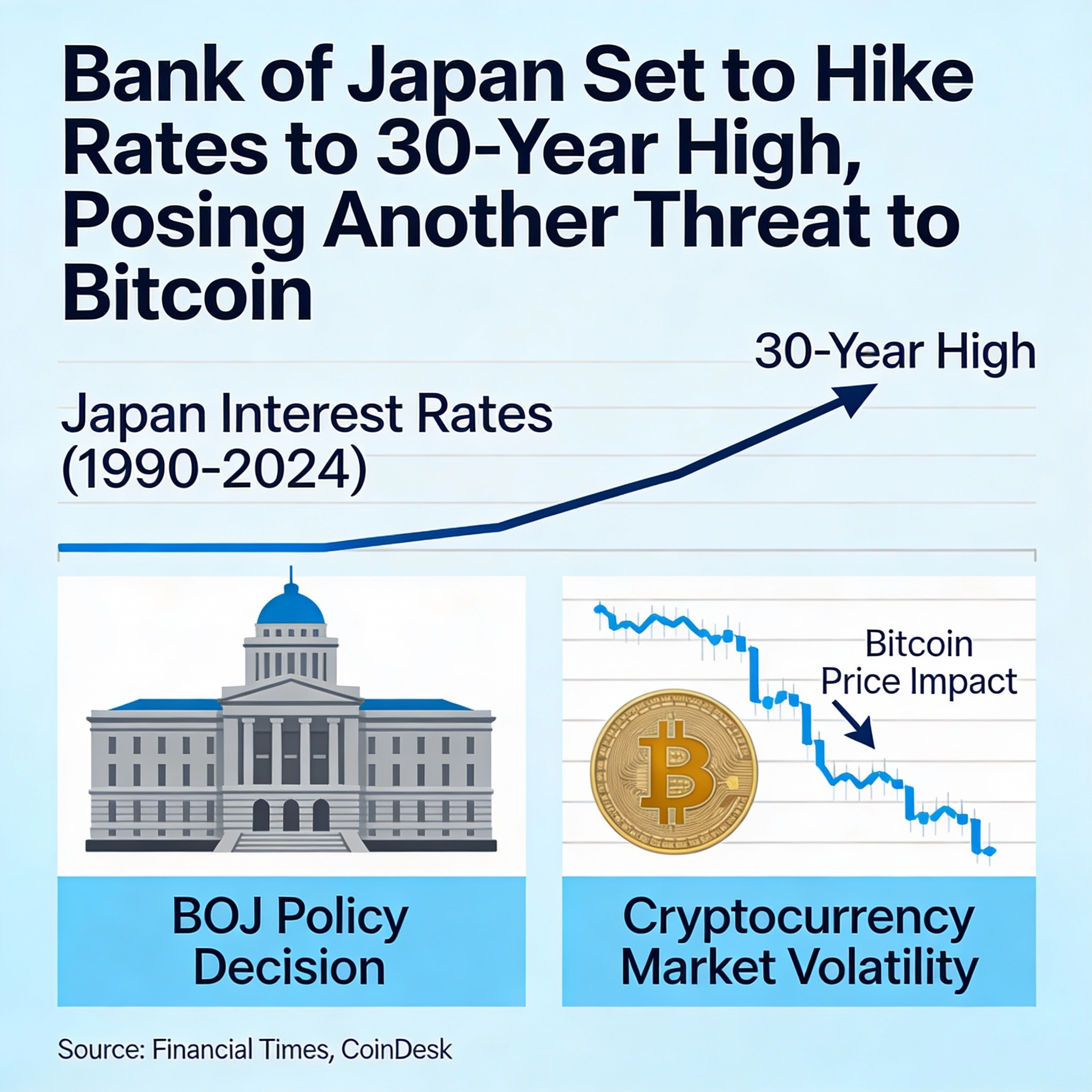

The Bank of Japan is expected to raise its policy rate by 25 basis points to 0.75% from 0.50%, according to Nikkei, marking the first increase since January. A decision is due on Dec. 19 and would take Japanese borrowing costs to their highest level in around 30 years.

Although the broader market impact remains uncertain, shifts in Japan’s monetary stance have historically pressured bitcoin and the wider digital asset complex. Periods of yen strength have often coincided with weakness in BTC, while a softer yen has tended to coincide with stronger crypto prices. A stronger yen generally tightens global liquidity—conditions under which bitcoin has struggled.

The currency is currently trading near 156 against the dollar, slightly stronger than its late-November peak above 157.

A BoJ rate hike could also weigh on crypto indirectly through equity markets by reducing the appeal of the yen carry trade. For decades, investors have borrowed yen at ultra-low or negative rates to fund positions in higher-risk assets such as U.S. stocks and Treasurys, a strategy enabled by Japan’s prolonged accommodative policy.

Raising rates could weaken this trade, potentially reversing capital flows and prompting broader risk aversion across equities and digital assets.

Such risks are grounded in recent history. When the BoJ last lifted rates to 0.5% on July 31, 2024, the yen rallied sharply, contributing to a wave of risk-off sentiment in early August that pushed bitcoin from roughly $65,000 to about $50,000.

Why this hike may have a muted impact

This time, however, the market reaction could be less severe. Speculative positioning in the yen is already net long, which reduces the likelihood of a sharp post-decision rally. That contrasts with mid-2024, when positioning data showed traders were largely bearish on the currency.

In addition, Japanese government bond yields have risen steadily throughout the year, reaching multi-decade highs at both the short and long ends of the curve. As a result, the anticipated rate hike appears to reflect policymakers aligning official rates with market conditions rather than delivering a surprise tightening.

At the same time, U.S. monetary policy is moving in the opposite direction. The Federal Reserve this week cut rates by 25 basis points to a three-year low and introduced additional liquidity measures, while the dollar index slid to a seven-week low.

Taken together, these factors suggest the likelihood of a sharp yen carry unwind or broad year-end risk-off move remains limited.

Still, Japan’s longer-term fiscal outlook warrants close attention. With debt approaching 240% of GDP, investors are watching for signs that fiscal dynamics could emerge as a source of market volatility in the year ahead.

“Under Prime Minister Sanae Takaichi, large fiscal expansion and tax cuts are being implemented while inflation hovers near 3% and the BoJ continues to operate as if Japan were still mired in deflation,” MacroHive said in a market update. “With elevated debt and rising inflation expectations, concerns over central bank credibility could steepen JGB yields, weaken the yen, and shift Japan’s profile from safe haven to fiscal risk.”