Bitcoin opened the week under pressure in Asia, sliding roughly 3% to around $92,500 as a derivatives-fueled rally showed signs of exhaustion.

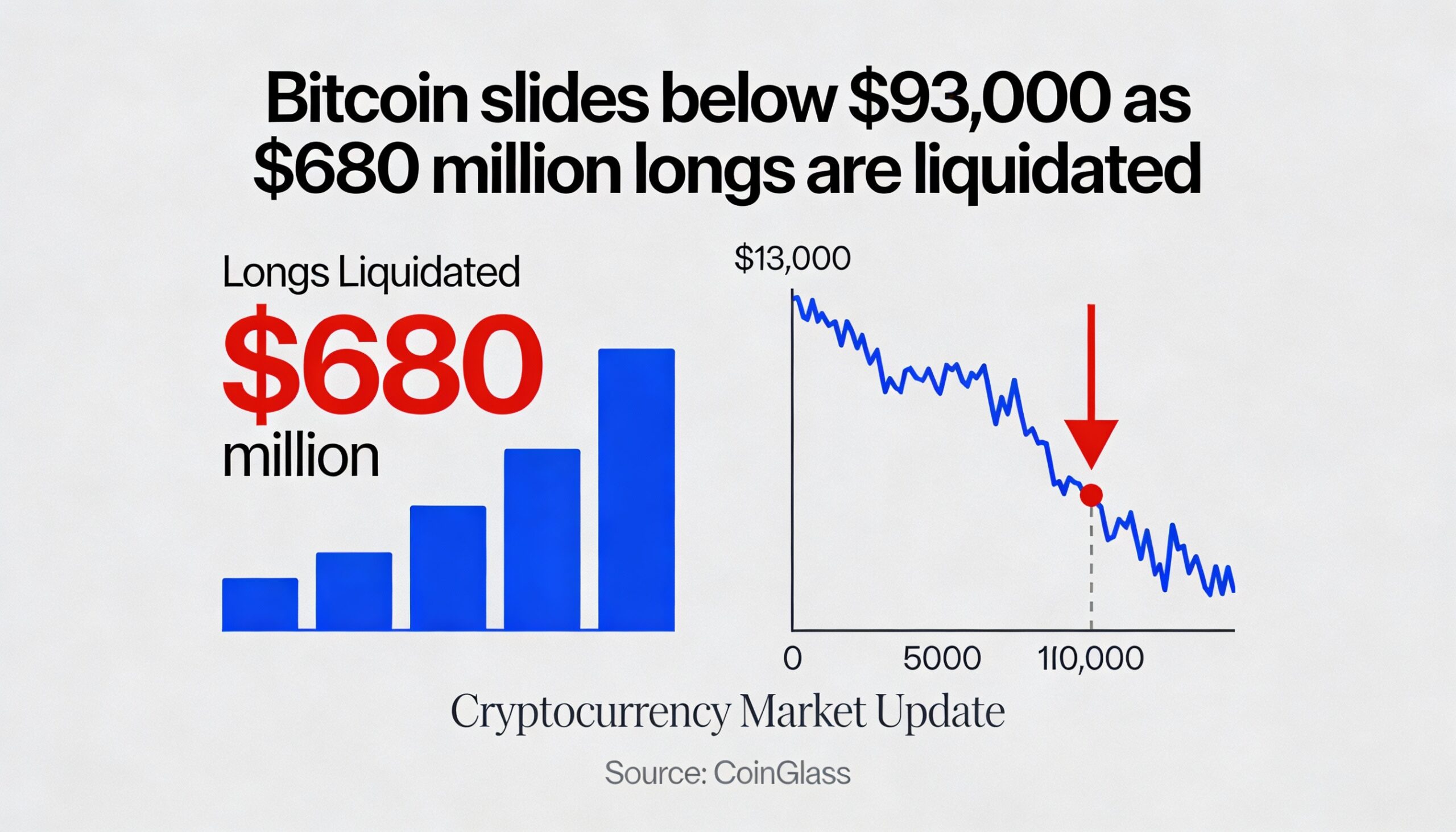

The pullback highlights the market’s fragile footing, even as indicators suggest the heavy sell pressure seen late in 2025 is beginning to ease. The world’s largest cryptocurrency has retreated from a recent advance toward the mid-$90,000s, with liquidation data pointing to an overcrowded bullish trade. CoinGlass reported more than $680 million in crypto positions liquidated over the past 24 hours, including nearly $600 million from long positions.

Altcoins bore the brunt of the move during Monday’s Asia session. Solana fell 6.7%, Sui dropped 10%, and Zcash slid 10%. Outside crypto, gold extended its rally, rising 1.7% to $4,600 after the U.S. announced a new 10% tariff on Denmark and seven other European countries, to remain in place until “a deal is reached for the complete and total purchase of Greenland.”

According to Glassnode’s latest weekly report, bitcoin’s recent push toward $96,000 was largely “mechanically” driven by derivatives activity, including short liquidations, rather than sustained spot market accumulation. The on-chain analytics firm warned that futures liquidity remains relatively thin, leaving prices vulnerable to abrupt reversals once forced buying pressure subsides.

Glassnode also pointed to a crowded supply zone created by long-term holders who accumulated near prior cycle highs, an area that has repeatedly capped recent recovery attempts.

CryptoQuant struck a more cautious tone, describing the move since late November as a potential bear market rally rather than the start of a durable uptrend. Bitcoin remains below its 365-day moving average near $101,000, a level the firm described as a historical “regime boundary.” While demand conditions have improved slightly, CryptoQuant said they have not shifted meaningfully, with apparent spot demand still contracting and U.S. spot ETF inflows remaining subdued.

Still, there are tentative signs of stabilization. Glassnode noted that long-term holder distribution has slowed markedly compared with late 2025, while spot flows on major exchanges such as Binance have become more buyer-dominant. At the same time, selling pressure led by Coinbase has eased.

Options markets continue to reflect uncertainty. Implied volatility remains low, but downside protection is still priced into longer-dated contracts, suggesting investors remain cautious.

Until sustained spot demand returns, both Glassnode and CryptoQuant warn that bitcoin is likely to remain highly sensitive to shifts in leverage and liquidity, keeping market participants on edge.