Extreme fear” continues to dominate crypto and metals markets, even as U.S. equities show relative resilience ahead of a heavy slate of corporate earnings.

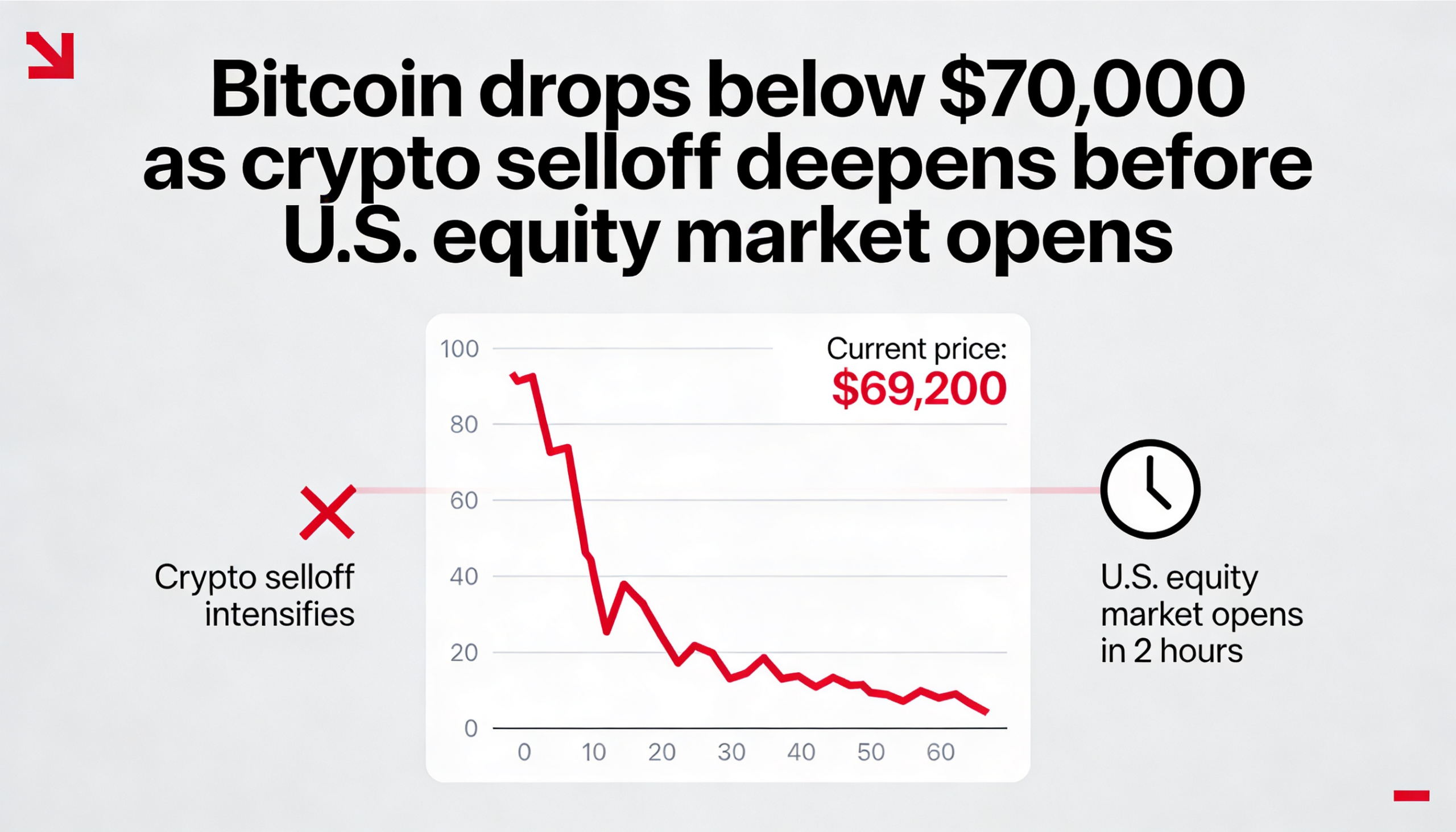

Bitcoin slipped below $70,000 as the selloff across digital assets intensified before the U.S. equity market opened. The largest cryptocurrency fell to an intraday low near $69,917, according to CoinDesk data, pushing sentiment deeper into bearish territory. The Crypto Fear and Greed Index has dropped to 11 — a level seen only a handful of times historically.

The pressure remains largely confined to crypto and precious metals. Gold declined more than 1% to below $4,900 per ounce, while silver plunged over 11%, sliding to under $79 per ounce.

U.S. equities, by contrast, were modestly higher in pre-market trading. The Invesco QQQ ETF, which tracks the Nasdaq 100, was up about 0.05%, underscoring the relative stability in large-cap technology shares.

Bitcoin-linked equities extended their losses. Strategy (MSTR), the largest publicly traded holder of bitcoin, fell more than 5% and now trades nearly 80% below its November 2024 all-time high, ahead of its fourth-quarter earnings report later Thursday. Other bitcoin treasury companies, including Strive (ASST) and Nakamoto (NAKA), dropped roughly 6%.

Crypto-related stocks were also weaker. Coinbase (COIN) slid another 2%, while Bullish — the owner of CoinDesk — was down 0.4%. Bitcoin-focused AI miners were mixed: IREN (IREN) fell 3% and Cipher Mining (CIFR) declined 2%, following sharp drops of around 15% in the previous session. Larger miners with significant bitcoin holdings, including Riot Platforms (RIOT), MARA Holdings (MARA), and CleanSpark (CLSK), were each lower by about 3%.

Some investors see potential for stabilization if historical correlations reassert themselves. The iShares Expanded Tech Software ETF (IGV), a sector bitcoin has often tracked closely, edged slightly higher. Meanwhile, Alphabet (GOOG) fell 3% despite beating fourth-quarter earnings expectations, after announcing higher capital spending of $185 billion, up from $175 billion, with projected outlays of roughly $119.5 billion.