The October flash crash laid bare the fragility of bitcoin’s rally — and marked a turning point in how the world’s largest cryptocurrency is being viewed.

Heading into 2025, bitcoin’s bull market was widely expected to be historic. Some industry forecasts projected prices climbing as high as $180,000 to $200,000 by year-end. In one sense, those predictions weren’t wrong — just premature.

Bitcoin surged to a record above $126,200 on Oct. 6, reaching its peak earlier than most models anticipated. But the rally unraveled just days later. A sudden flash crash on Oct. 10 sent prices sharply lower, rattling markets and underscoring how quickly sentiment can shift in digital assets.

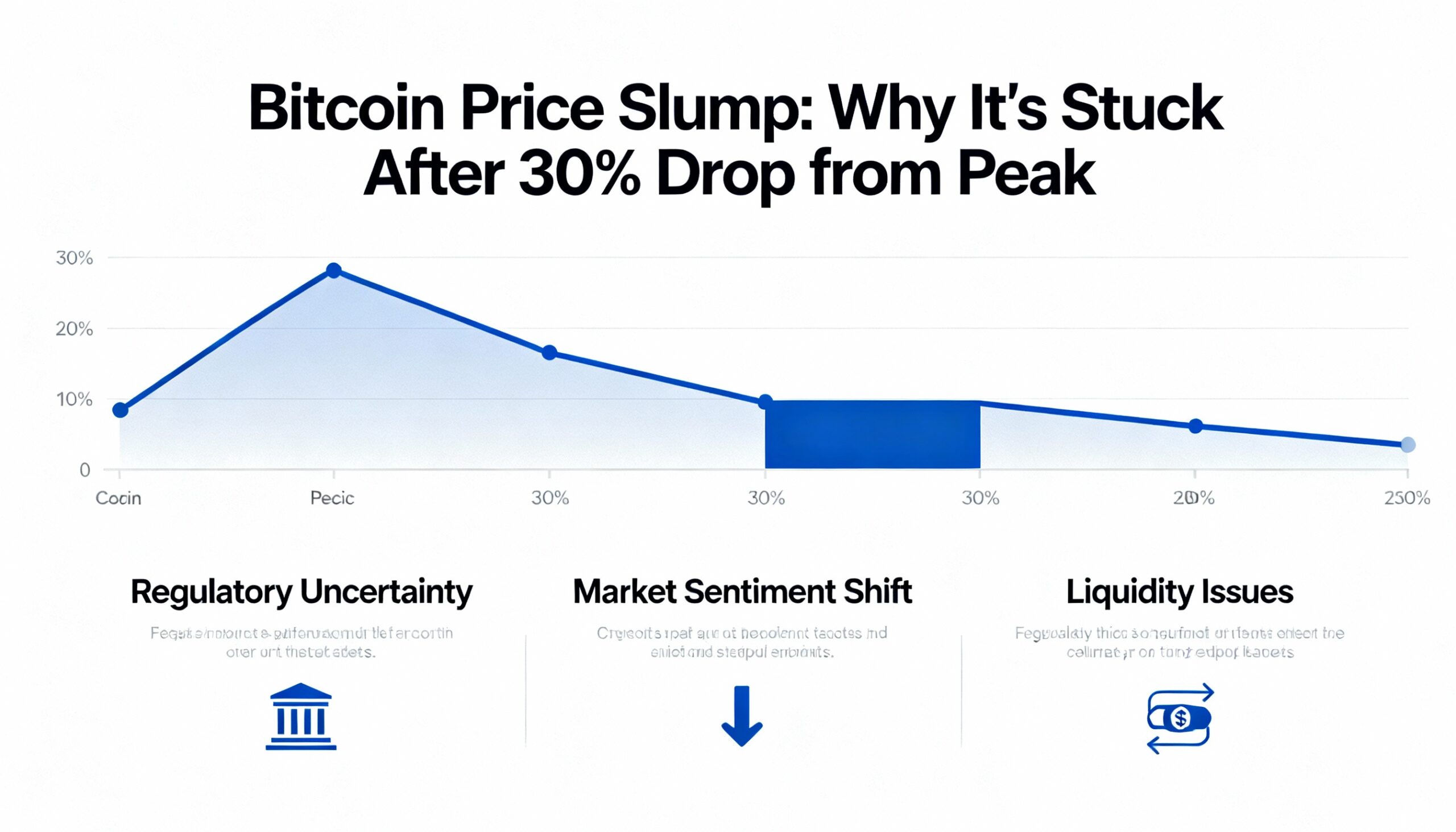

Since that October high, bitcoin has fallen roughly 30% and now sits more than 50% below many of the lofty forecasts made at the start of the year. Rather than extending its rally, the cryptocurrency has slipped about 6% in 2025 and spent much of the past two months trading in a narrow range between $83,000 and $96,000, TradingView data show.

The crash blindsided traders and erased months of leveraged bullish positioning in a matter of minutes. But it did not signal a structural breakdown, said Mati Greenspan, founder of Quantum Economics. Instead, he described it as a rebalancing — and evidence of bitcoin’s increasing integration into traditional financial markets.

“Bitcoin was repriced as a risk asset, not a revolution,” Greenspan said.

“The October 10 flash crash wasn’t a failure of bitcoin,” he added. “It was a liquidity event driven by macro stress, trade-war fears and crowded positioning, exposing how forward-loaded the cycle had become.”

The abrupt shift in market behavior has since made price forecasting far more difficult, forcing even some of the crypto industry’s most prominent analysts to rethink their assumptions.