Cryptocurrencies followed U.S. equities lower at Tuesday’s market open before staging a rapid rebound, continuing a pattern that has played out repeatedly in recent sessions.

Bitcoin slipped early in the trading day but recovered to hover near $69,200 by late morning, roughly flat compared with the same time a day earlier. Ether saw heavier pressure, falling close to 2%, while XRP and Solana posted comparable declines.

Notably, the pullback marks bitcoin’s steepest correction since the 2024 halving, yet trading activity has remained relatively muted. Market data from Kaiko shows that volumes during the decline were light, indicating that retail participants appear to be stepping back rather than engaging in panic selling.

According to Kaiko analyst Laurens Fraussen, bitcoin is now approaching important technical support zones. Whether those levels hold could determine if the asset’s historically observed four-year cycle structure remains intact or begins to break down.

Market mechanics also suggest derivatives are driving price action. Trading firm Wintermute said recent moves have been fueled largely by leveraged futures positioning instead of strong spot market demand. With spot liquidity thin, prices have been especially sensitive to crowded trades. The firm described last week’s sharp bounce as a short squeeze in perpetual futures contracts, noting that volatility returned quickly after a stretch of relative calm.

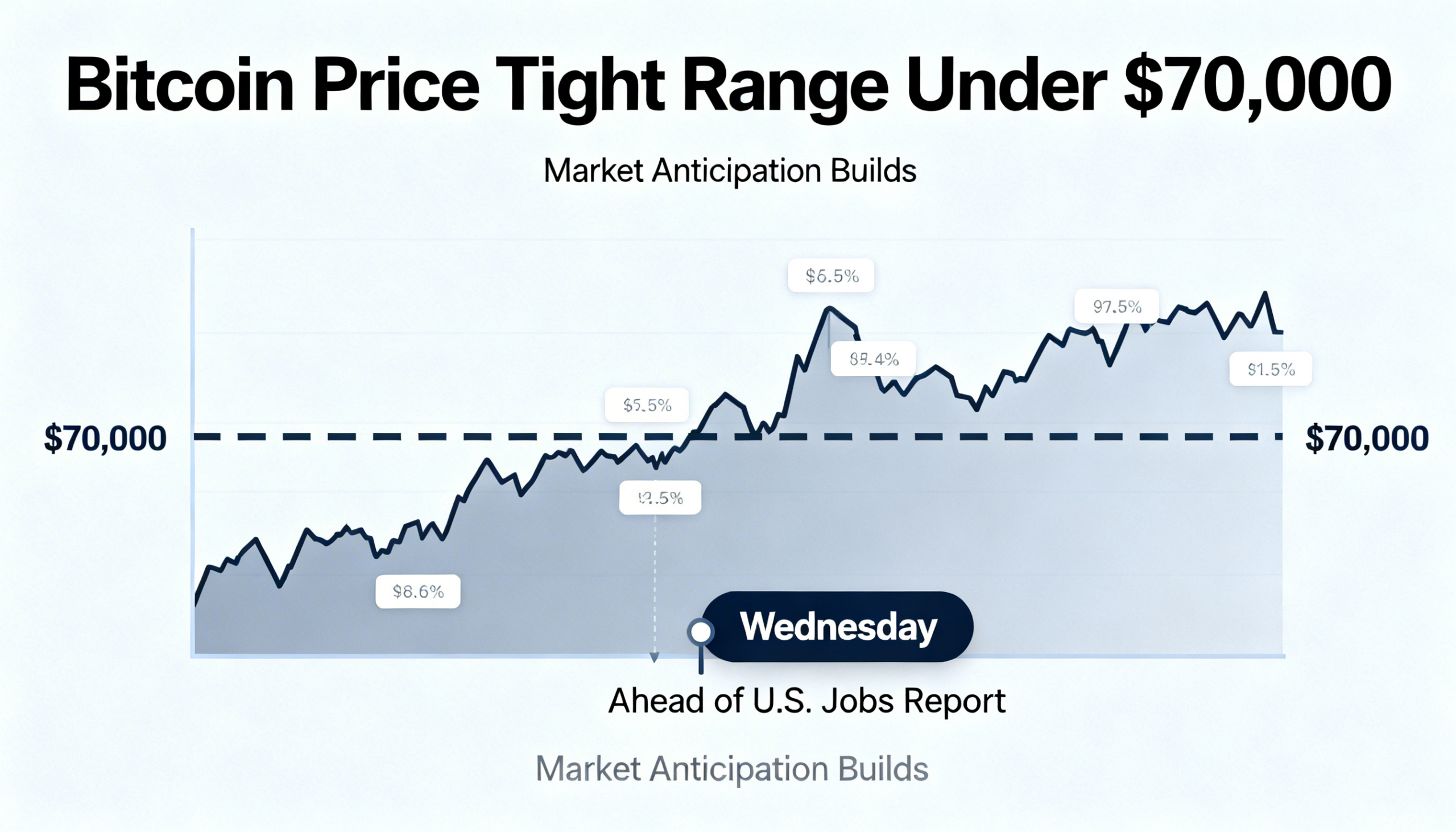

Investors are now focused on Wednesday’s release of the January Nonfarm Payrolls report, which was postponed from last Friday due to a temporary federal government shutdown. Consensus estimates call for 70,000 new jobs, up modestly from December’s 50,000 increase, with the unemployment rate expected to remain steady at 4.4%.

However, remarks from Trump administration officials have tempered expectations. White House trade counselor Peter Navarro suggested that the labor data could disappoint relative to forecasts. His comments followed similar guidance from economic adviser Kevin Hassett, who urged markets not to overreact if the report comes in weak.

The bond market appears to be positioning for softer data. The 10-year U.S. Treasury yield slipped about 5 basis points to 4.14%, signaling increased demand for safe-haven assets and expectations of potentially looser monetary conditions.

Ordinarily, falling yields and the prospect of additional Federal Reserve easing would offer support to bitcoin and other risk assets. Yet this cycle has been unusual. Even after the Fed reduced rates by 75 basis points in recent months, bitcoin has struggled to maintain upward momentum, underscoring how macro forces and crypto-specific leverage dynamics are shaping price behavior