Bitcoin is showing signs of stability after a sharp bout of volatility earlier this month, but key derivatives indicators and ETF flows suggest buying interest remains muted even as macro conditions begin to improve.

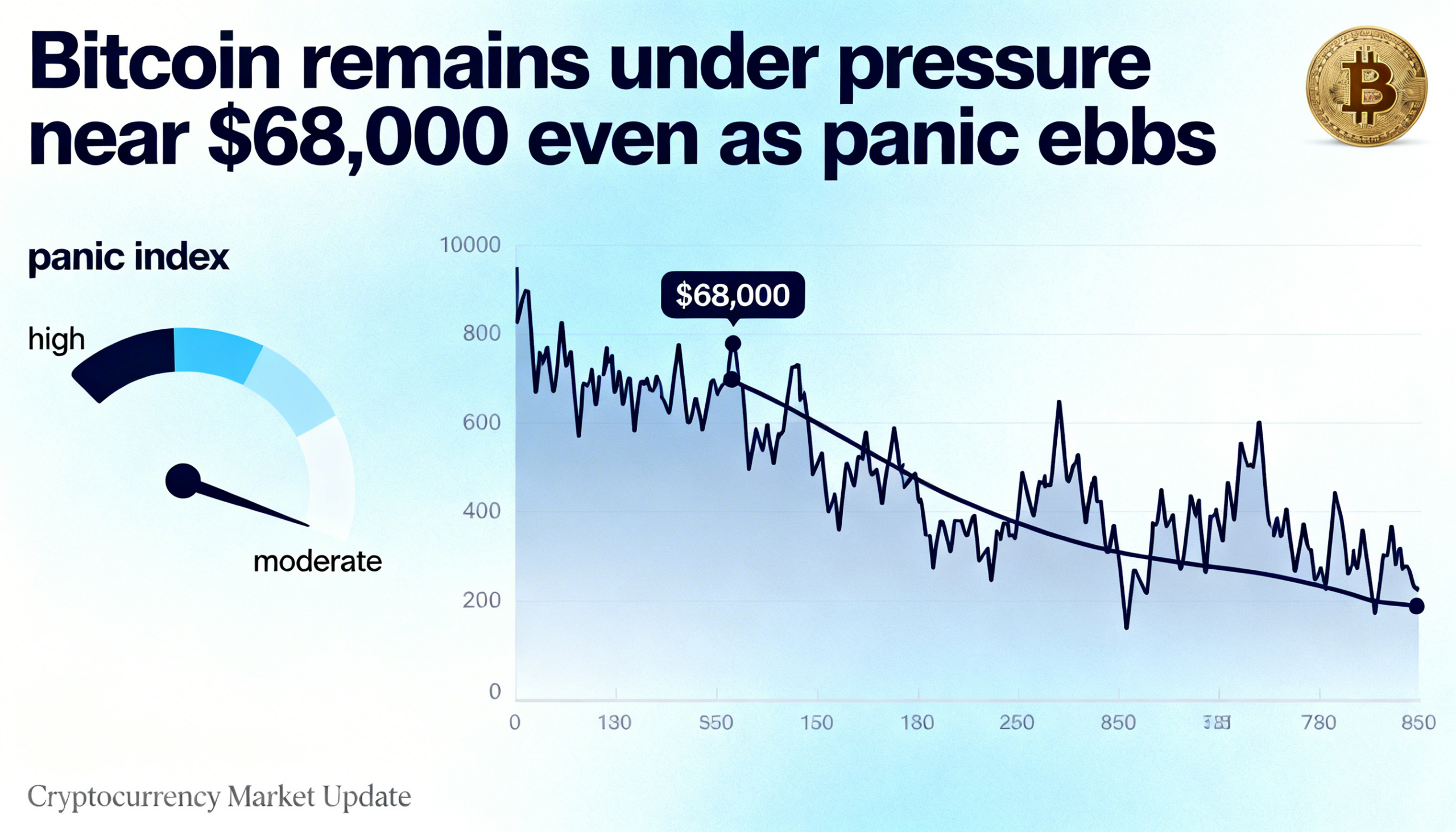

The cryptocurrency was trading near $68,000 at the time of writing, struggling to establish sustained upward momentum. While the early-February panic has subsided, the rebound from lows near $60,000 has so far failed to push prices convincingly above the $70,000 level.

One sign of calmer conditions is the drop in bitcoin’s 30-day implied volatility, a metric that reflects expectations for price swings over the next month. According to Volmex data, implied volatility has fallen to an annualized 52%, reversing a surge earlier this month when it spiked close to 100% as prices slid sharply.

Implied volatility tends to rise when traders rush to buy options for protection against large moves. A call option provides exposure to upside price swings, while a put option acts as insurance against declines. The recent cooling in volatility suggests that demand for such hedging instruments has eased, pointing to fading panic.

Analysts at Bitfinex said the sharp decline in implied volatility indicates that the deleveraging phase is losing momentum and that markets have entered a more stable phase. However, they cautioned that stability does not necessarily equate to renewed bullish conviction.

That caution is reflected in perpetual futures markets. Funding rates — periodic payments exchanged between long and short traders to keep futures prices aligned with spot — remain only slightly positive. A positive rate implies that long positions are paying shorts, signaling bullish positioning. But current levels suggest only mild optimism rather than aggressive re-leveraging.

Institutional participation also appears subdued. U.S.-listed spot bitcoin exchange-traded funds have recorded nearly $678 million in net outflows this month, according to SoSoValue, extending a three-month run of redemptions and reinforcing the narrative of soft demand.

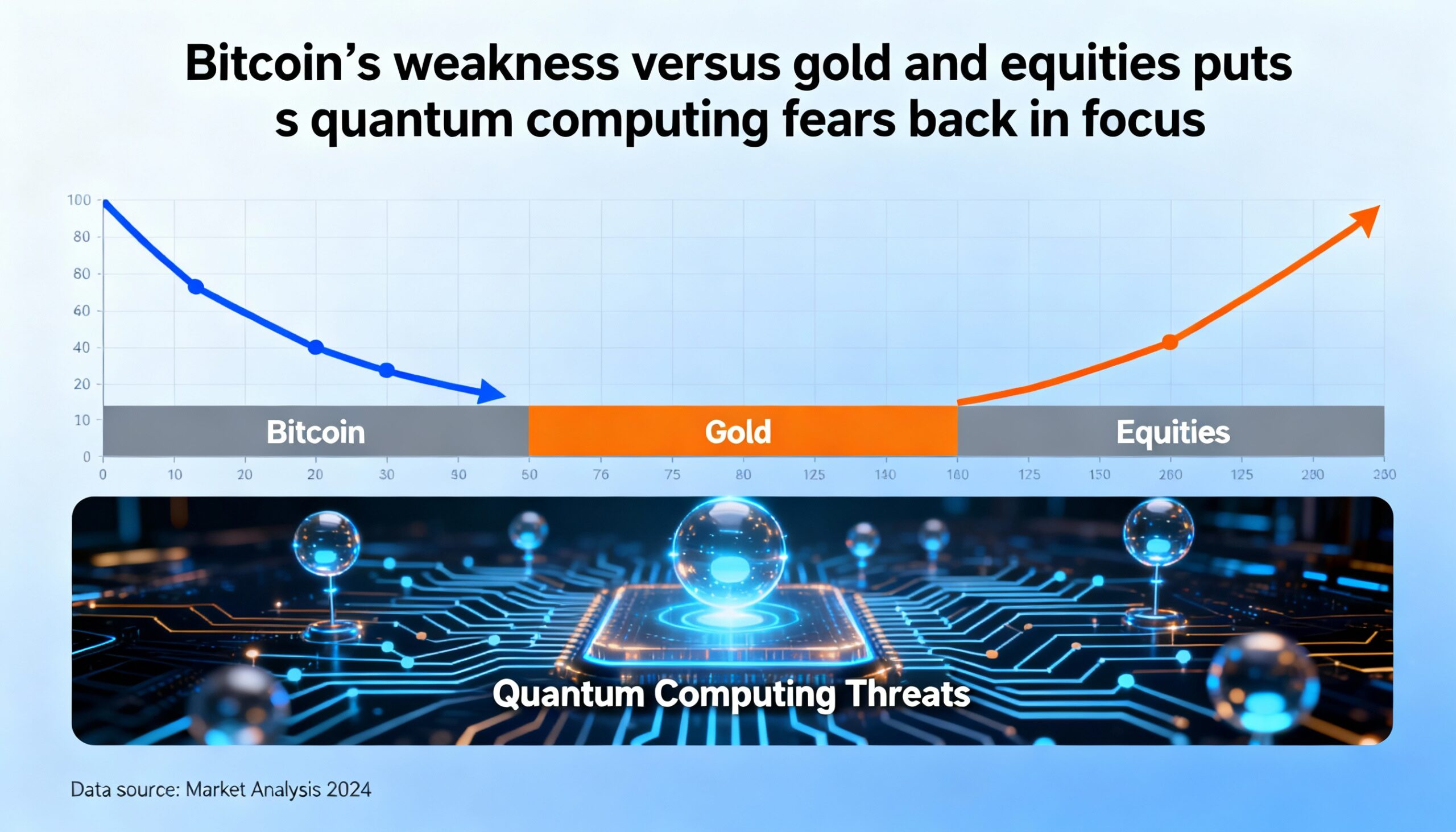

Despite the lackluster positioning data, broader macroeconomic developments could provide support.

Recent U.S. inflation data showed the consumer price index slowing to 2.4% year-on-year in January from 2.7% in December. The moderation has strengthened expectations that the Federal Reserve could implement at least two 25-basis-point interest rate cuts this year.

At the same time, the inflation-adjusted yield on the U.S. 10-year Treasury note has dropped to around 1.8%, its lowest level since early December. Lower real yields tend to make non-yielding assets like bitcoin relatively more attractive, as they reduce the opportunity cost of holding them.

Analysts at Bitfinex noted that declining real yields help narrow bitcoin’s carry disadvantage, while a softer U.S. dollar could ease global financial conditions — both factors that may eventually support risk assets.

For now, though, derivatives data and ETF flows indicate that although the panic phase has passed, meaningful buying momentum has yet to return.