Bitcoin’s year-end options expiry has kept price swings unusually subdued, even as macro conditions and broader risk assets have moved in a direction that would typically favor higher prices.

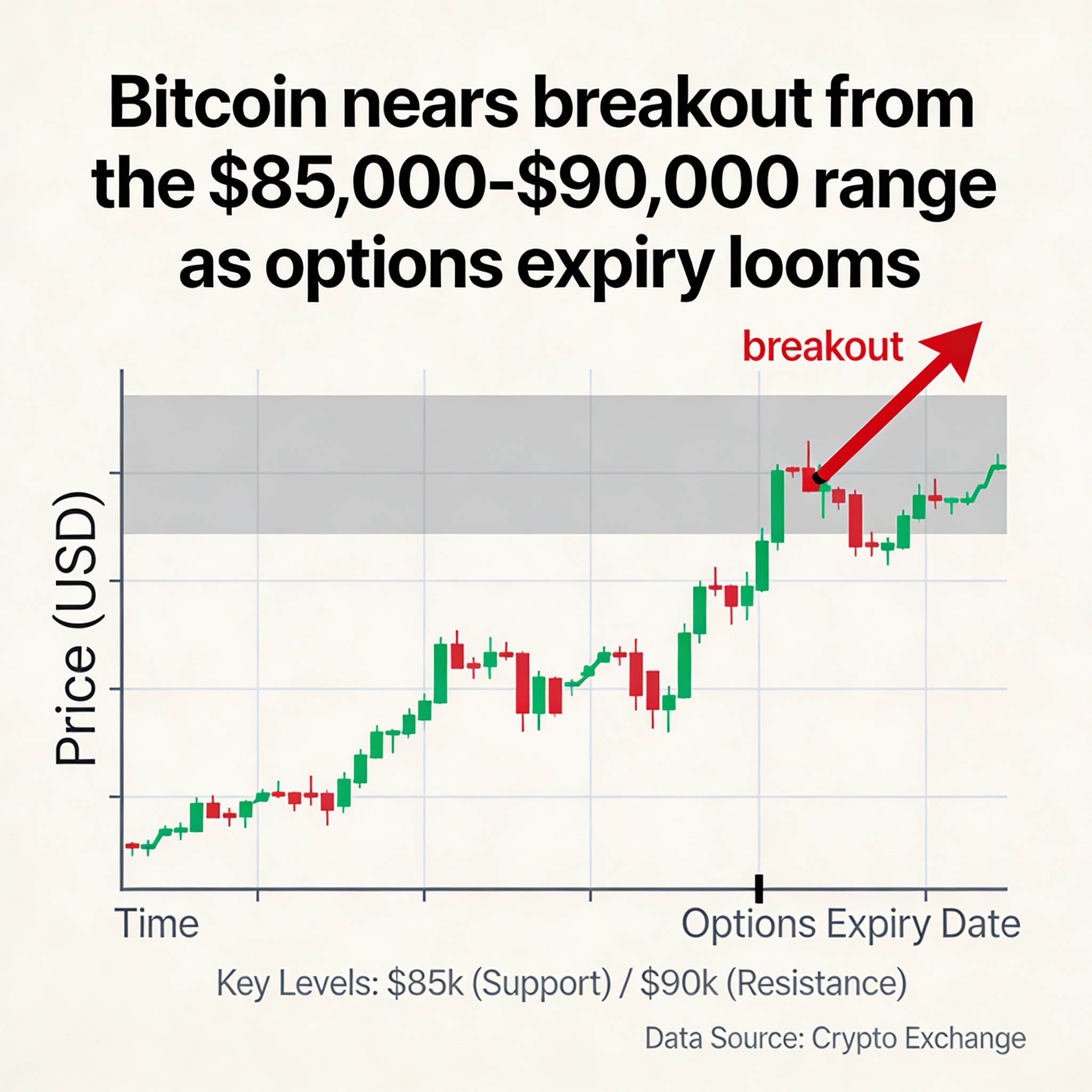

For nearly all of December, bitcoin has been trapped between $85,000 and $90,000, lagging a rally in U.S. equities and gold’s push to record highs. While that divergence has tested investor patience, the cause has been less about sentiment and more about the structure of the derivatives market.

Those same forces may soon unwind. Once the options roll off, market dynamics suggest a move toward the mid-$90,000s is more likely than a sustained break below the $85,000 level.

The tight range has been driven by a heavy clustering of options exposure around spot. Options give traders the right, but not the obligation, to buy or sell bitcoin at a predetermined price. Call options benefit from rising prices, while puts pay off on declines. Dealers on the other side of these trades hedge their exposure in spot and futures markets, guided by delta and gamma.

Delta measures how much an option’s value changes with a $1 move in bitcoin, while gamma captures how quickly that sensitivity shifts as prices move. When gamma is elevated near the current price, dealers are forced to buy on dips and sell into rallies, mechanically suppressing volatility.

According to analyst David on X, large put gamma around $85,000 acted as a downside buffer throughout December, forcing dealers to buy bitcoin as prices softened. At the same time, heavy call gamma near $90,000 capped rallies, with dealers selling into strength. The result was a self-reinforcing range driven by hedging requirements rather than strong directional conviction.

That stabilizing effect is expected to fade as roughly $27 billion in bitcoin options expire on Dec. 26. As expiry approaches, both gamma and delta decay, reducing the need for frequent dealer hedging.

This expiry is notable not just for its size, but for its bullish skew. More than half of Deribit’s open interest is set to roll off, with a put-call ratio of 0.38 — meaning call options outnumber puts by nearly three to one. Much of that open interest is concentrated in upside strikes between $100,000 and $116,000.

The “max pain” level, where options buyers would suffer the greatest losses and sellers would benefit most, sits near $96,000, reinforcing the upside bias.

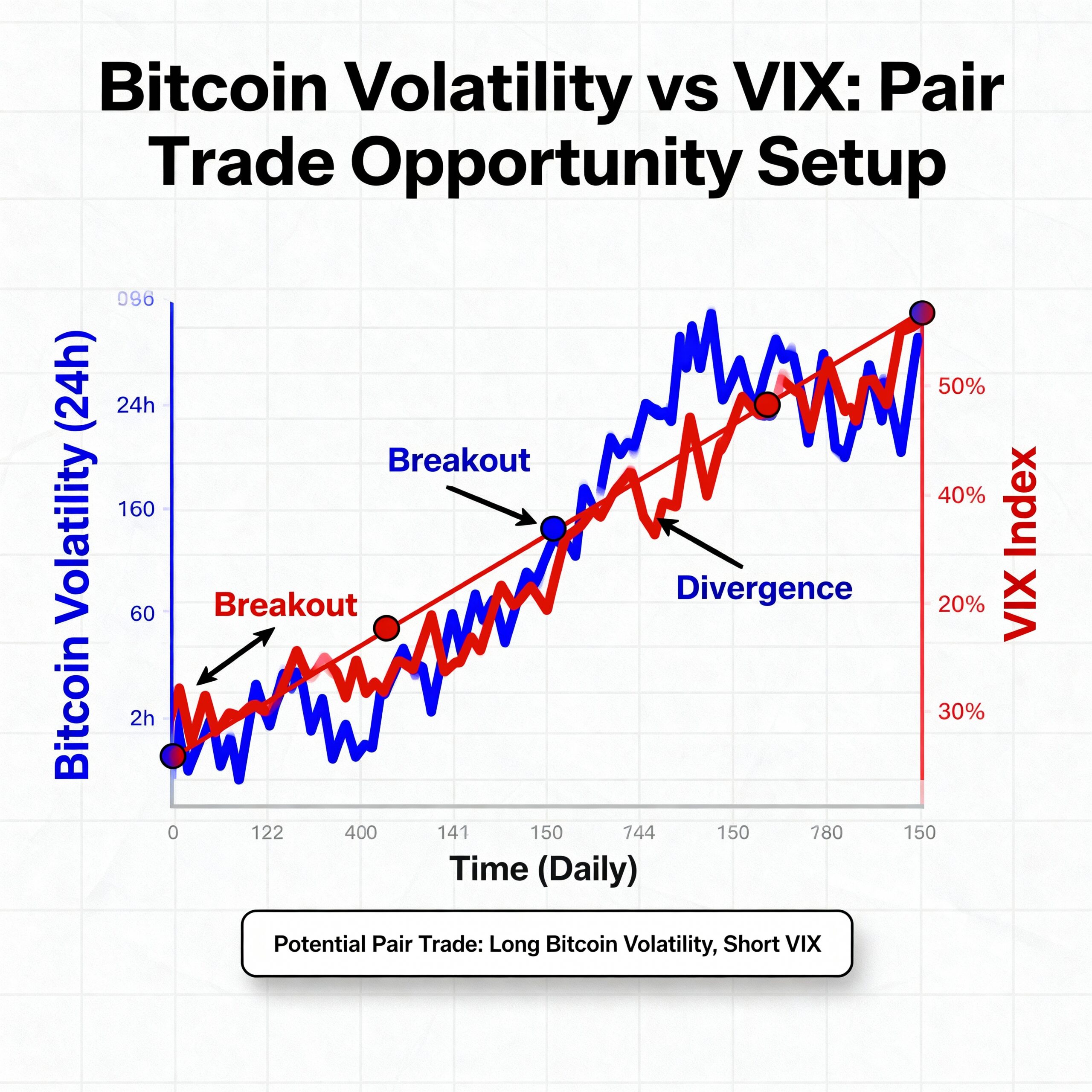

Meanwhile, implied volatility remains low. The Bitcoin Volmex implied volatility index is hovering near one-month lows around 45, suggesting traders are not pricing in elevated near-term risk — a setup that leaves room for sharper moves once the options-related pressure lifts.