Rising geopolitical strains are boosting the U.S. dollar and crude oil, compounding pressure on an already vulnerable crypto market.

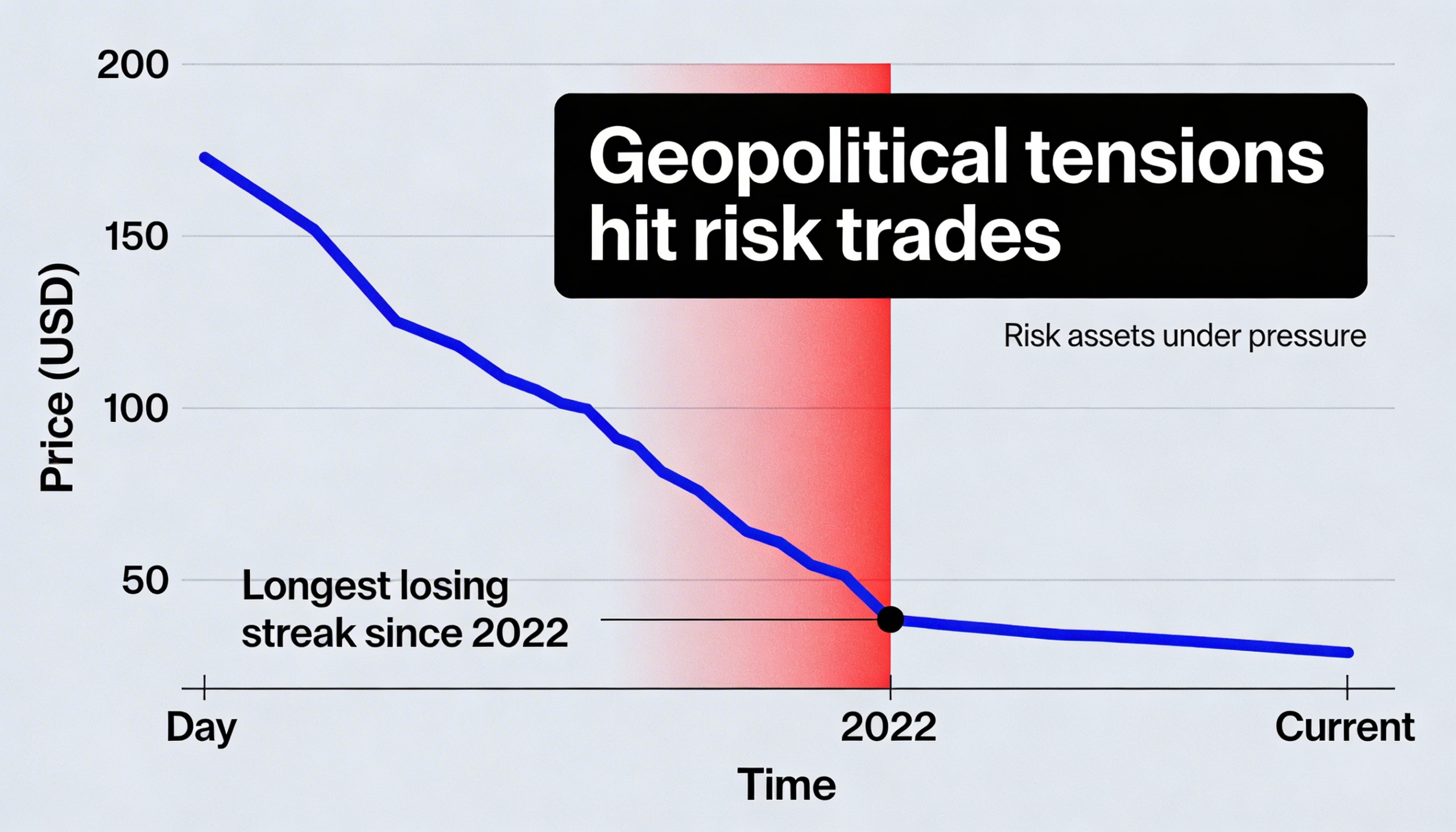

Bitcoin is heading toward its fifth straight weekly decline — its first losing streak of that length since March to May 2022, when it endured nine consecutive down weeks.

As of Thursday morning in Asia, the largest cryptocurrency by market value is off about 3% for the week, trading below $67,000, according to CoinDesk data, and remains at risk of closing in the red again.

Macro headwinds are intensifying the technical weakness. The Wall Street Journal reported that the U.S. has assembled its largest concentration of air power in the Middle East since the 2003 Iraq invasion. Although Washington is said to be positioned for potential strikes on Iran, President Donald Trump has yet to make a final call. On Polymarket, traders currently assign a 27% probability to military action occurring before month-end.

Heightened uncertainty has pushed the dollar index up to 97.7, its strongest level since early February, while WTI crude has rebounded to $65 after dipping to $62 the previous day. A firmer dollar and rising oil prices typically act as a drag on risk-sensitive assets, reinforcing downside pressure and raising the likelihood of another negative weekly close for bitcoin.

The cryptocurrency has fallen more than 50% from its October peak near $126,500 to lows around $60,000.

On a monthly basis, bitcoin has posted five consecutive declines since October — its second-longest stretch of losses on record, eclipsed only by the six-month downturn between 2018 and 2019.

Relative to gold, bitcoin has now underperformed for seven straight months, marking its longest losing streak against the precious metal in that pairing.