Bitcoin Falls 36% in Rapid Correction as Dominance Drops Unexpectedly

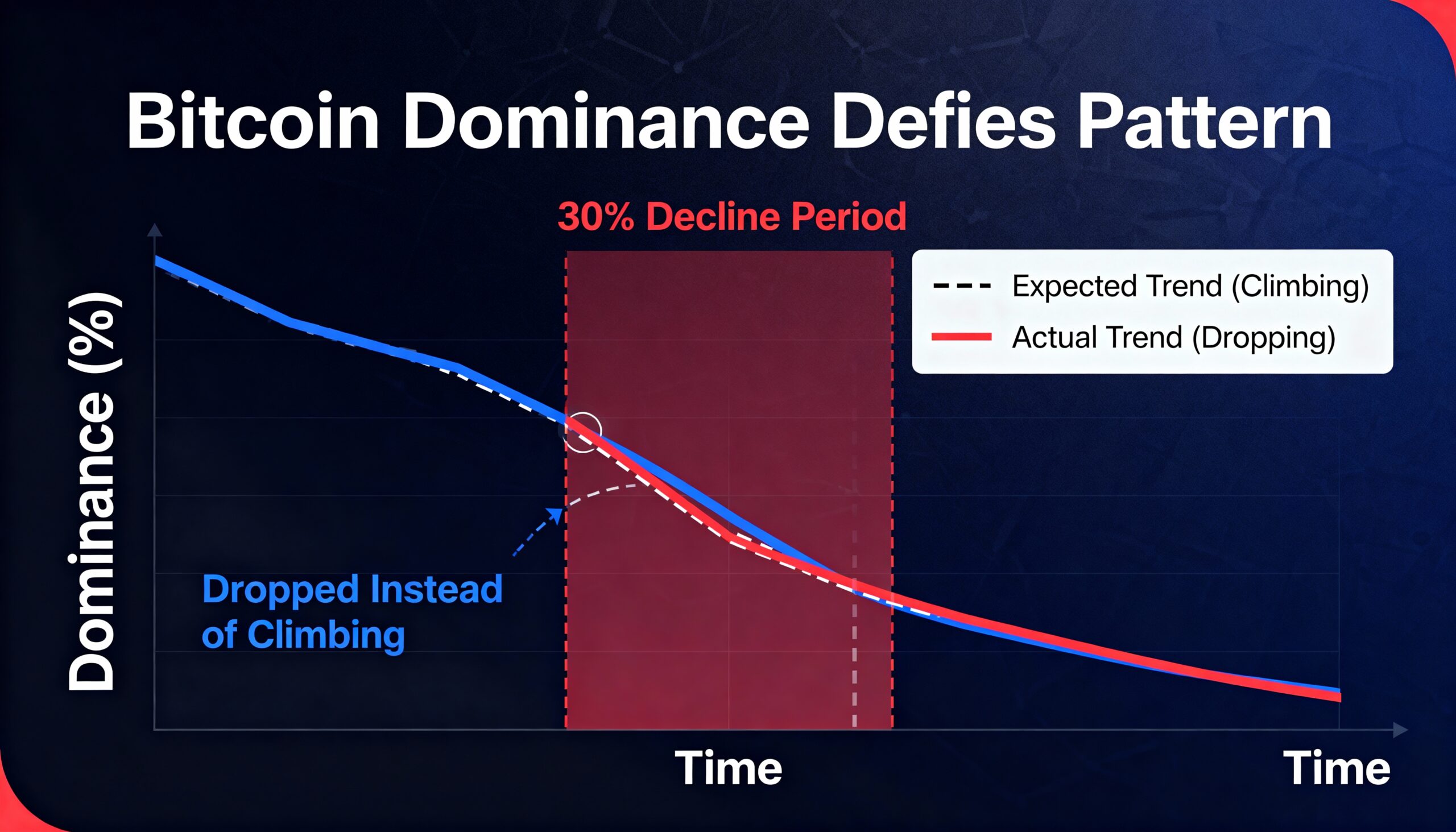

Bitcoin (BTC) has now fallen 30% or more three times in the current cycle, but the latest pullback stands out due to an unusual shift in BTC dominance. Unlike prior corrections, bitcoin’s market share fell instead of rising, defying the typical pattern observed in risk-off environments.

BTC dropped to nearly $80,000 last week, marking a 36% decline from October’s all-time high above $126,000. The move occurred amid a broad market deleveraging, with altcoins showing relative resilience.

Bitcoin dominance—measuring BTC’s share of total crypto market capitalization—usually rises during sell-offs as altcoins tend to drop faster. While this occurred in October, dominance has since fallen. Even during BTC’s recent rally to $90,000, dominance slipped from 61% to as low as 58.5%, recovering slightly to just above 59%. Typically, dominance climbs more decisively in downturns.

The contrast with previous corrections is striking. During the February–May “tariff tantrum,” dominance rose from 58% to 65%, while the August 2024 yen carry-trade unwind saw a climb from 56% to 60%. This time, the smaller rise in dominance suggests bitcoin was hit harder than the broader market.

The speed of the decline also differs. This drawdown took just 47 days from peak to trough, compared with 77 days during the tariff tantrum and 146 days in 2024, heightening market fear.

Combined, the rapid price drop and unusual dominance behavior indicate this correction broke from prior cycle patterns. With bitcoin approaching the end of its typical four-year cycle, analysts are watching whether falling dominance signals further weakness ahead.