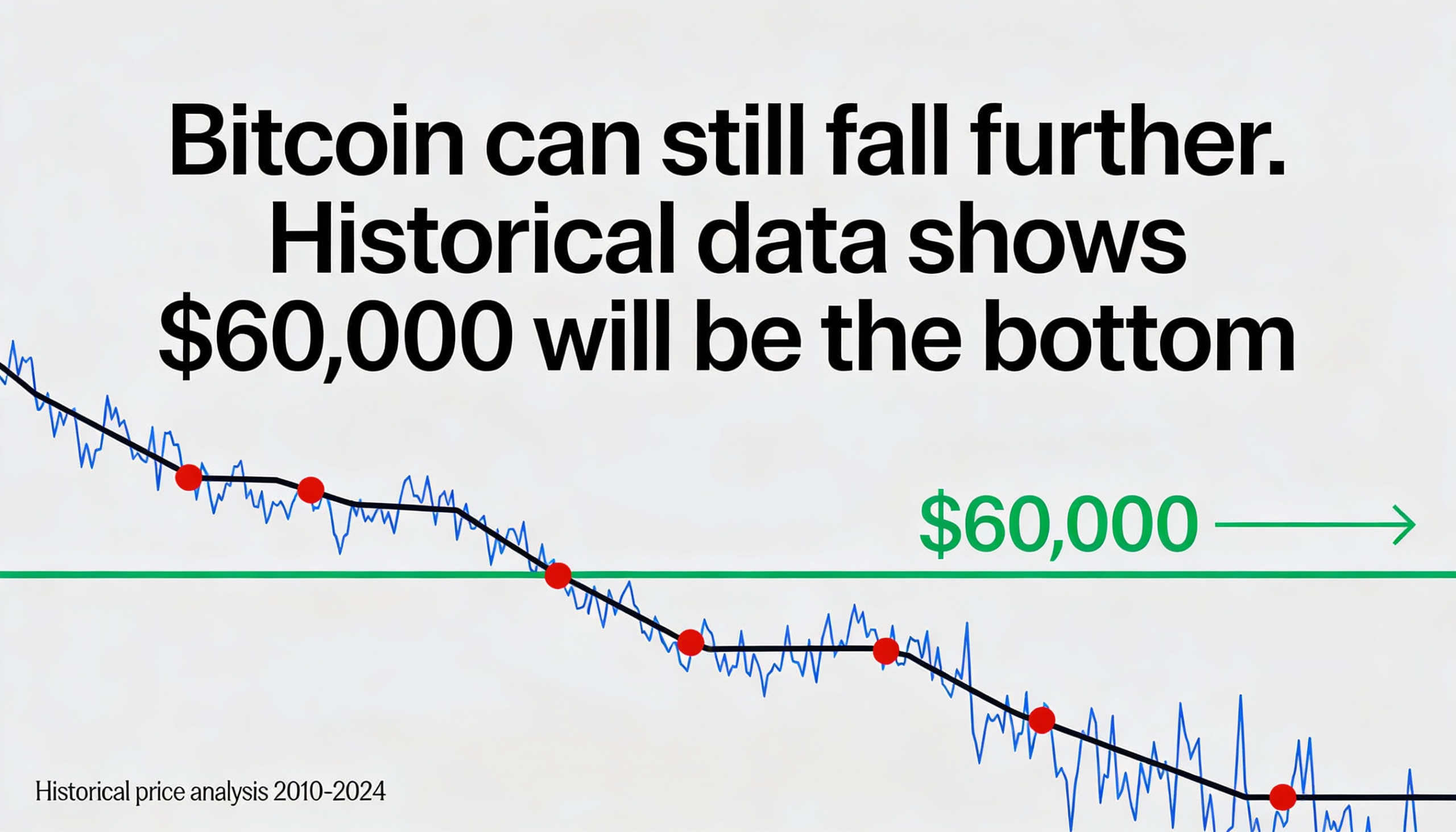

Historical data suggest that bitcoin has consistently found support during bear markets at its 200-week moving average, a level that may once again come into focus following the cryptocurrency’s latest selloff.

Bitcoin slid 11% last week to around $74,800, marking its steepest weekly decline since March 2025. But for investors worried about a renewed crypto winter, the bigger concern may lie further down the chart. A move toward $58,000—roughly 25% below current levels—would align with the long-term support zone defined by the 200-week moving average (WMA).

The recent selloff, coupled with weak dip-buying interest, has raised fears that bitcoin’s correction is far from over. While the drop has already erased a significant portion of gains from the latest bull cycle, history suggests the path to a durable bottom can be prolonged and painful.

The 200-week moving average, which tracks bitcoin’s mean closing price over nearly four years, is widely viewed as a long-term momentum gauge and a cornerstone of the asset’s four-year market cycle. In every prior cycle, it has marked or closely coincided with major market bottoms. That level currently sits near $57,926.

Bitcoin typically peaks in the fourth quarter of the fourth year of its cycle. In this cycle, it reached a record high of $126,000 in October and has since fallen about 40%. The recent decline also pushed bitcoin below the Ichimoku Cloud on the weekly chart, a technical indicator used to assess trend strength, momentum, and support.

When prices trade above the Ichimoku Cloud, it generally signals a healthy bullish trend. A sustained move below it, however, points to weakening momentum and heightened vulnerability to extended downside. Bitcoin’s recent weekly close beneath the cloud represents a bearish shift that has historically preceded the most severe phases of past bear markets.

The price action also appears broadly consistent with the four-year cycle theory, which is tied to bitcoin’s halving schedule—an event that cuts new supply roughly every four years and has historically driven alternating bull and bear markets.

During the 2015 bear market, bitcoin hovered just above $200 and repeatedly used the 200-week moving average as support. In the 2018–2019 downturn, the same level, then near $3,000, again served as a floor, aside from a brief breakdown during the Covid-driven market shock in March 2020.

In the most recent cycle, bitcoin fell below the 200-week moving average in June 2022, dropping under $22,000 and remaining below the line for more than a year. The price did not reclaim the level until October 2023, reinforcing its role as a critical long-term trend indicator.

While there are no guarantees that history will repeat, bitcoin’s break below the Ichimoku Cloud suggests that another prolonged bear-market phase may be unfolding. Still, the proximity of the 200-week moving average offers a familiar—and time-tested—support level for investors searching for a potential floor.