Bitcoin is on pace to record an unprecedented streak of back-to-back declines in January and February, marking a historically weak start to 2026.

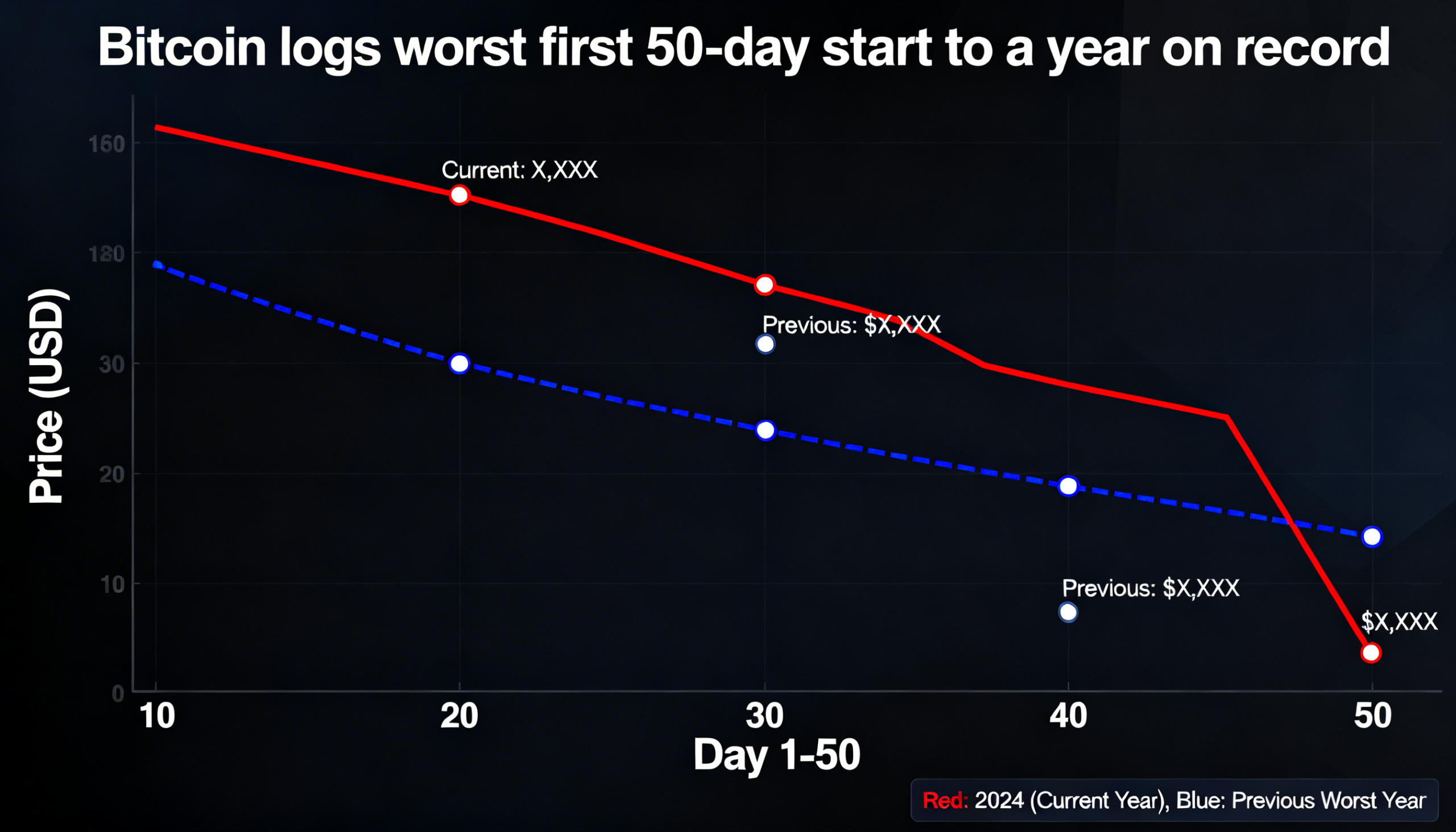

Fifty days into the year, bitcoin is down 23% year to date, making it the poorest opening stretch of any financial year on record, according to Checkonchain data. The cryptocurrency fell 10% in January and has dropped another 15% in February so far.

Data from Coinglass shows bitcoin has never before posted consecutive losses in the first two months of the year. While January has seen double-digit declines in years such as 2015, 2016, and 2018, each of those downturns was followed by a rebound in February. If the current losses persist, bitcoin will also be on track for its weakest back-to-back monthly performance since 2022.

Checkonchain’s index data further highlights the severity of the drawdown. In a typical down year, the average index reading sits around 0.84 at the 50-day mark — a level traders often use to measure cyclical weakness. Bitcoin currently stands at 0.77, underscoring the depth of the current pullback.

The sluggish start follows a 17% decline in 2025, a post-election year. Historically, post-election years have tended to outperform election years and, on aggregate, have also outpaced other up years. Against that backdrop, the continued underperformance in early 2026 stands out even more sharply.