Bitcoin retreated during U.S. trading on Tuesday, surrendering part of its rebound from the weekend selloff as investors piled into precious metals and trimmed risk exposure across markets.

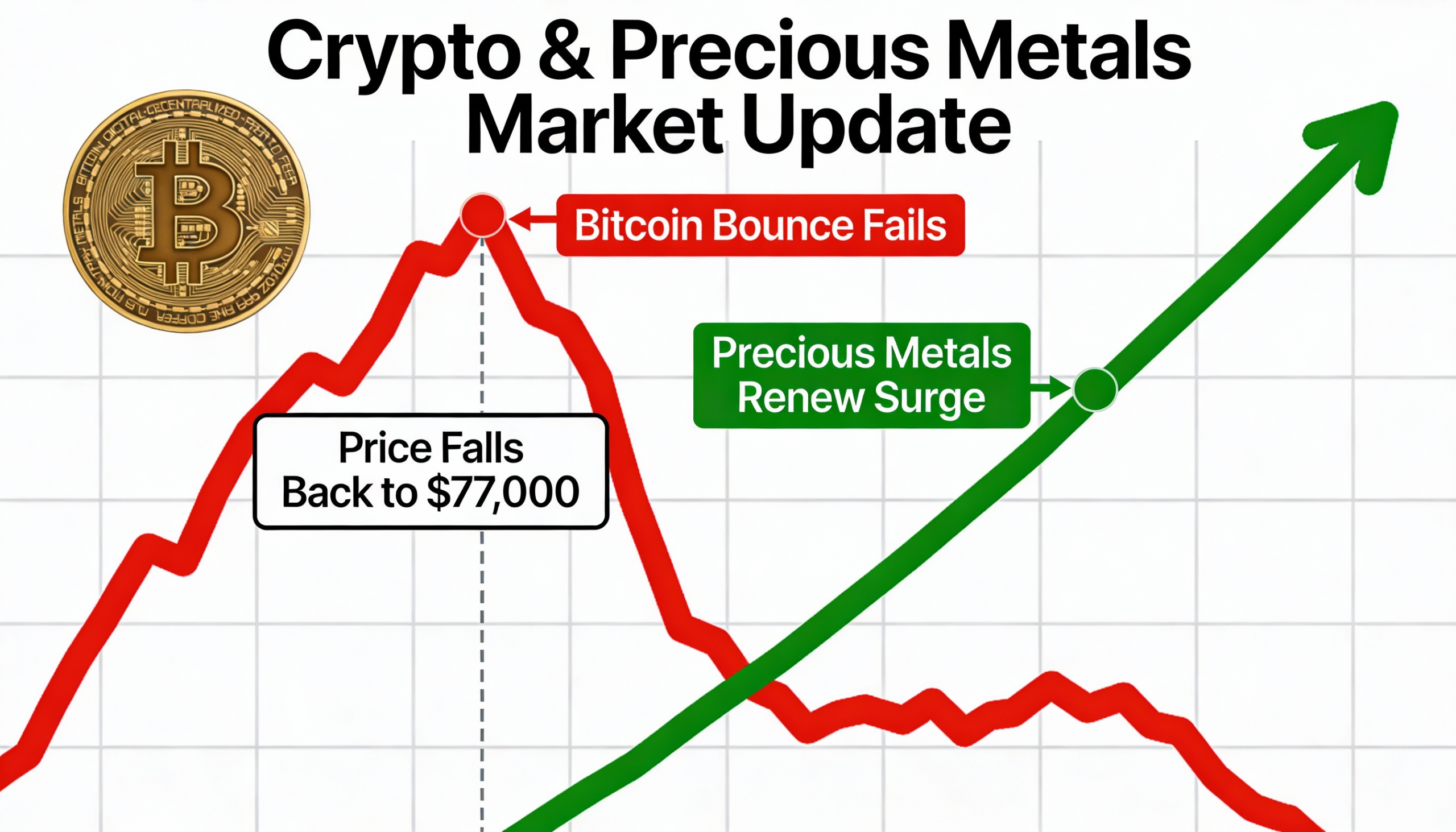

After rallying about 7% from panic lows near $74,000 to trade above $79,000, bitcoin reversed lower and was last trading around $77,100, down roughly 2% over the past 24 hours. Ether fell more steeply, sliding 4.7% to about $2,260.

The pullback in crypto came as gold and silver surged, marking a strong rebound from their own sharp declines late last week. Silver jumped nearly 15% on the day, while gold extended gains toward the $5,000-per-ounce level following a 6.5% advance.

Risk assets broadly weakened alongside the crypto selloff. U.S. equities, particularly large-cap technology and artificial intelligence-related names, moved lower. Nvidia, Oracle, Broadcom, Micron and Microsoft were each down between 3% and 5%, dragging the Nasdaq lower by about 1%.

Crypto-linked stocks largely mirrored the risk-off tone. Strategy, the largest publicly traded holder of bitcoin, fell more than 2% to fresh lows, while Coinbase and Bullish declined by similar amounts. Galaxy Digital plunged over 12% after reporting disappointing fourth-quarter results, and stablecoin issuer Circle slipped another 3.5%.

A pocket of strength emerged among bitcoin miners that have pivoted toward AI infrastructure. TeraWulf jumped 12% after announcing the acquisition of two U.S. industrial sites that could more than double its power capacity to 2.8 gigawatts. Cipher Mining rose 4% after outlining plans to raise $2 billion in high-yield debt to fund its Black Pearl data center in Texas, which is expected to deliver 300 megawatts under a long-term lease with Amazon Web Services.

Dead-cat bounce

Derivatives positioning suggests traders expect any recovery from the weekend lows below $75,000 to be short-lived, according to Jake Ostrovskis, head of OTC at crypto trading firm Wintermute.

Ostrovskis said demand for upside exposure remains limited, echoing conditions seen in April 2025. At the same time, heavy buying of near-term downside protection has pushed short-dated implied volatility above longer-dated contracts, creating a backwardated options curve.

He added that a normalization of the curve back into contango — alongside cooling volatility — would be an early signal that markets may be forming a more durable bottom.