Bitcoin advanced following January’s U.S. jobs release, which delivered a strong headline gain but pointed to uneven hiring beneath the surface.

The largest cryptocurrency was trading around $67,800, up on the day, as digital asset markets absorbed the hotter-than-expected payrolls number without a sharp selloff. The steady price action is being read by some traders as a sign of waning downside pressure and a tentative revival in risk appetite, even as macro conditions remain restrictive.

The CoinDesk 20 Index rose 1.5% since midnight UTC, with nearly all constituents in positive territory.

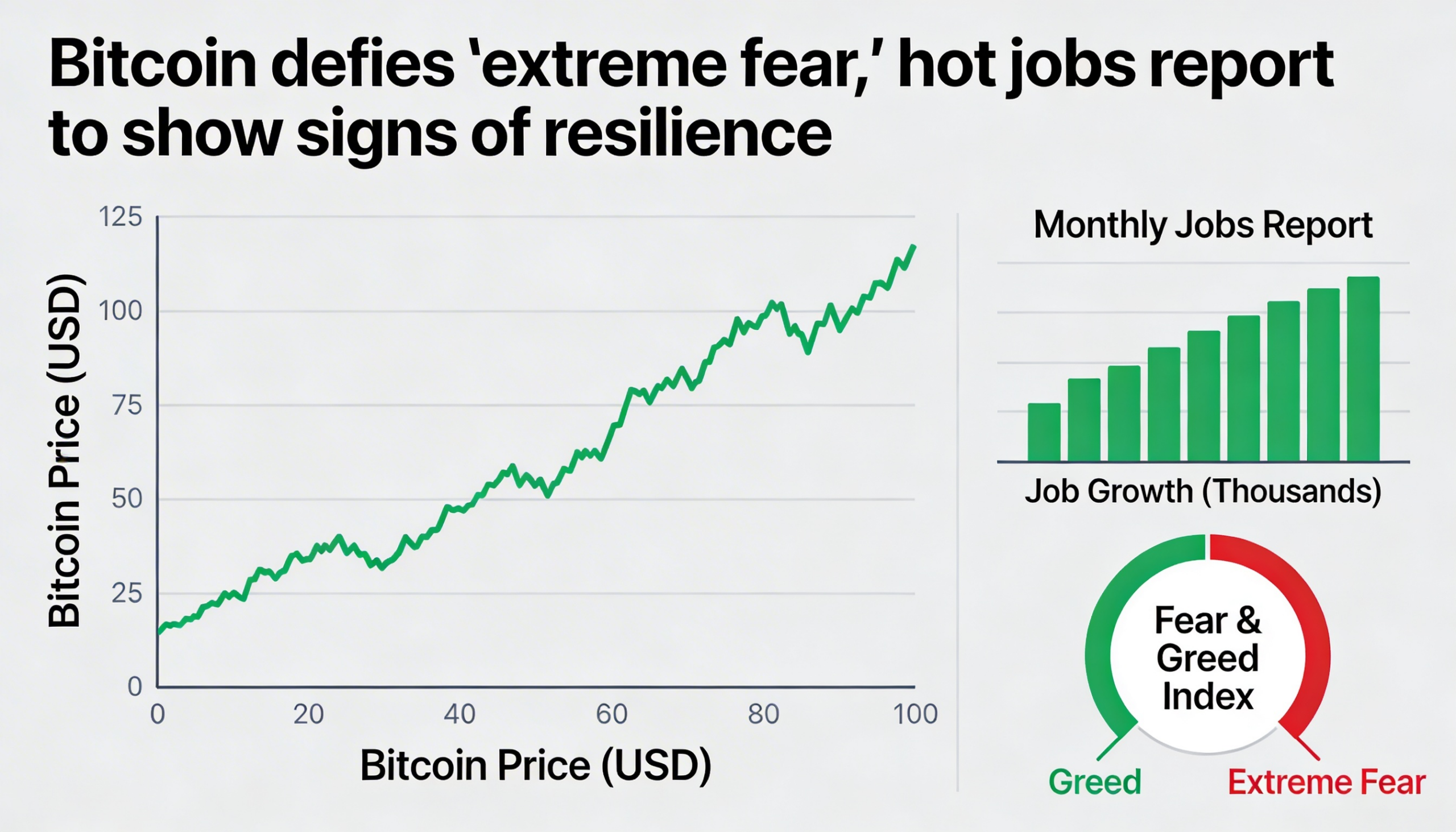

The U.S. economy added 130,000 jobs in January, comfortably ahead of forecasts for 70,000. The surprise dampened expectations for an imminent rate cut from the Federal Reserve, with markets now pushing potential easing out to July.

Under normal circumstances, reduced odds of near-term rate cuts would pressure risk-sensitive assets such as cryptocurrencies. However, the report showed that job gains were largely concentrated in health care and related fields, while most other sectors saw little change. That breakdown suggests the robust headline figure may be masking broader cooling trends across the economy.

Bitcoin’s relative stability comes even as sentiment remains deeply pessimistic. The Crypto Fear & Greed Index has fallen to 5, its lowest level since the 2022 collapse of FTX, highlighting the contrast between fragile investor mood and resilient price performance.

Derivatives landscape

Bearish momentum appears to be leveling off. Open interest is steady near $15.8 billion, and perpetual futures funding rates have rotated back to neutral or slightly positive levels.

Funding is particularly constructive on Bybit (+9.5%) and Binance (+3.4%), while Hyperliquid remains a bearish outlier at -4.5%. At the same time, the three-month futures basis is hovering around 2%, indicating that institutional participation has yet to meaningfully accelerate alongside the retail-led shift in funding dynamics.

In the options market, traders are leaning defensive. The one-week 25-delta skew slipped to 19%, with put options representing 54% of 24-hour volume. Implied volatility has moved into short-term backwardation, signaling a premium for immediate downside protection.

Data from Coinglass shows $342 million in liquidations over the past 24 hours, split roughly evenly between long and short positions. Bitcoin accounted for $145 million of that total, followed by ether at $84 million and other tokens at $18 million. Binance’s liquidation heatmap flags $68,800 as a key level to monitor if prices extend higher.

Institutional moves in DeFi

BlackRock is deepening its involvement in decentralized finance by listing its $2.2 billion tokenized U.S. Treasury fund, BUIDL, on Uniswap. The integration allows DeFi participants to access Treasury yields through the decentralized exchange.

The move represents the first time the asset management giant has introduced a tokenized product on a decentralized platform. BlackRock also disclosed a strategic investment in Uniswap and acquired an undisclosed amount of UNI, the protocol’s governance token.

UNI initially surged 25% to $4.11 following the announcement before pulling back to $3.35. The development appears to mark the first direct governance-token investment in a DeFi project by a major traditional financial institution.

To execute the rollout, BlackRock collaborated with Uniswap Labs and compliance firm Securitize. BUIDL transactions will be routed through UniswapX, an offchain quote system that aggregates pricing from approved market makers before settling trades onchain.

Access to the product is limited to qualified investors vetted by Securitize to ensure adherence to U.S. securities regulations.