Bitcoin and altcoin prices have climbed in early 2026, but underlying market liquidity remains fragile, according to on-chain analytics firm Glassnode. The divergence between rising prices and shrinking trading activity echoes concerns first highlighted in a CoinDesk analysis last November following October’s crypto crash.

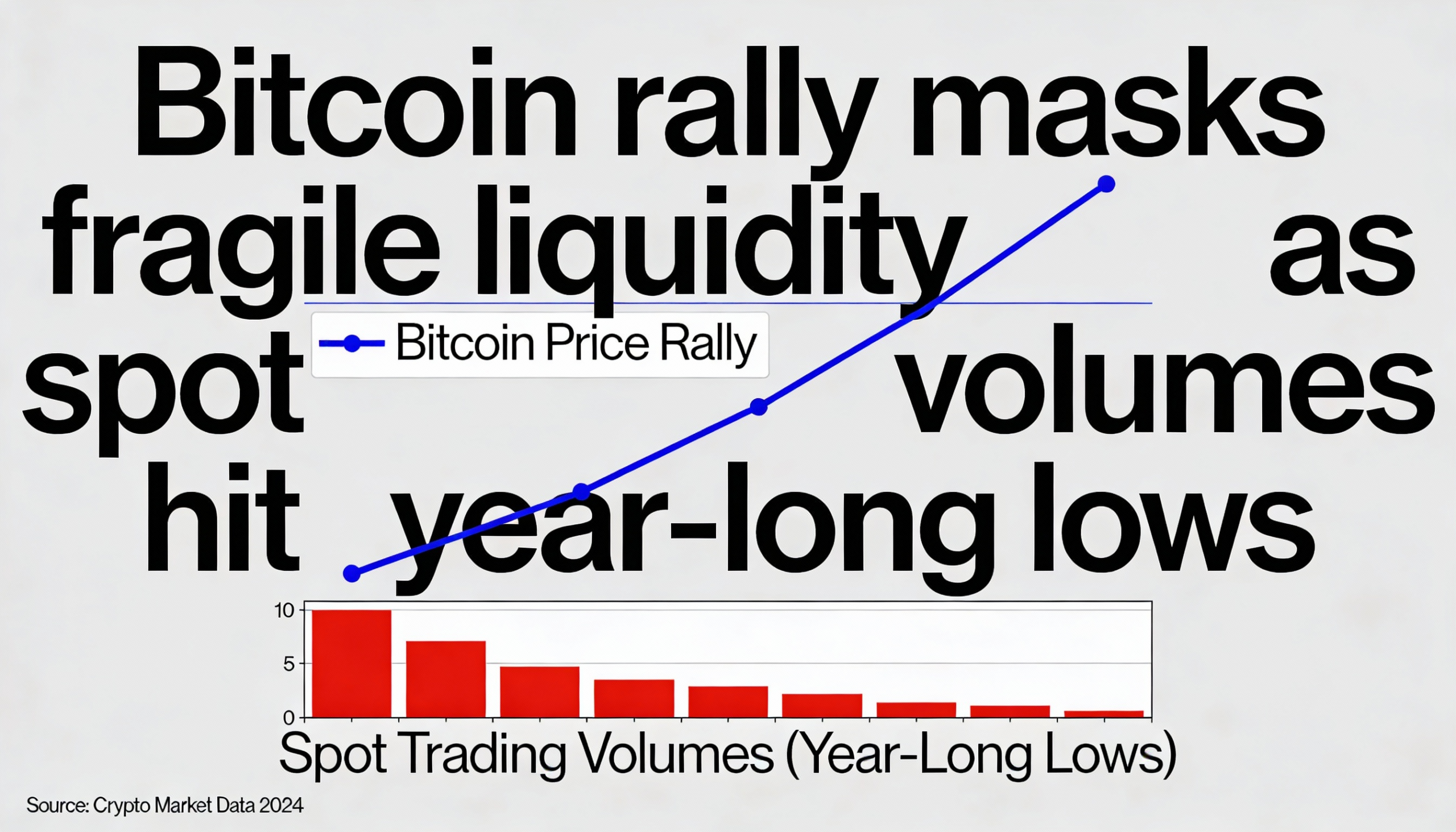

Glassnode data shows that both bitcoin spot trading volume and total altcoin spot volume have dropped to their lowest levels since November 2023, even as prices have advanced. Spot volume, which measures actual buy and sell activity on exchanges, is widely regarded as a barometer of real market participation and demand.

Typically, strong price moves are supported by rising volumes as new buyers enter the market. In this case, however, spot volumes have fallen to year-long lows, indicating that the recent price strength may be underpinned by limited participation.

The trend echoes findings from CoinDesk research, which noted that liquidity across centralized exchanges — including bitcoin and ether order-book depth — failed to fully recover after the October liquidation cascade that wiped out $19 billion in leveraged positions within hours. Post-crash, order-book depth has remained structurally lower, leaving markets more vulnerable to sharp price swings.

Bitcoin is currently trading around $93,500, up roughly 7.5% since Jan. 1, but the rally on minimal volume highlights potential warning signs for traders, with thin liquidity making the market more susceptible to exaggerated moves.