XRP continues to trade within a narrow range, with sellers firmly defending resistance near $1.90 and buyers stepping in around $1.86, setting up conditions for a potentially decisive move.

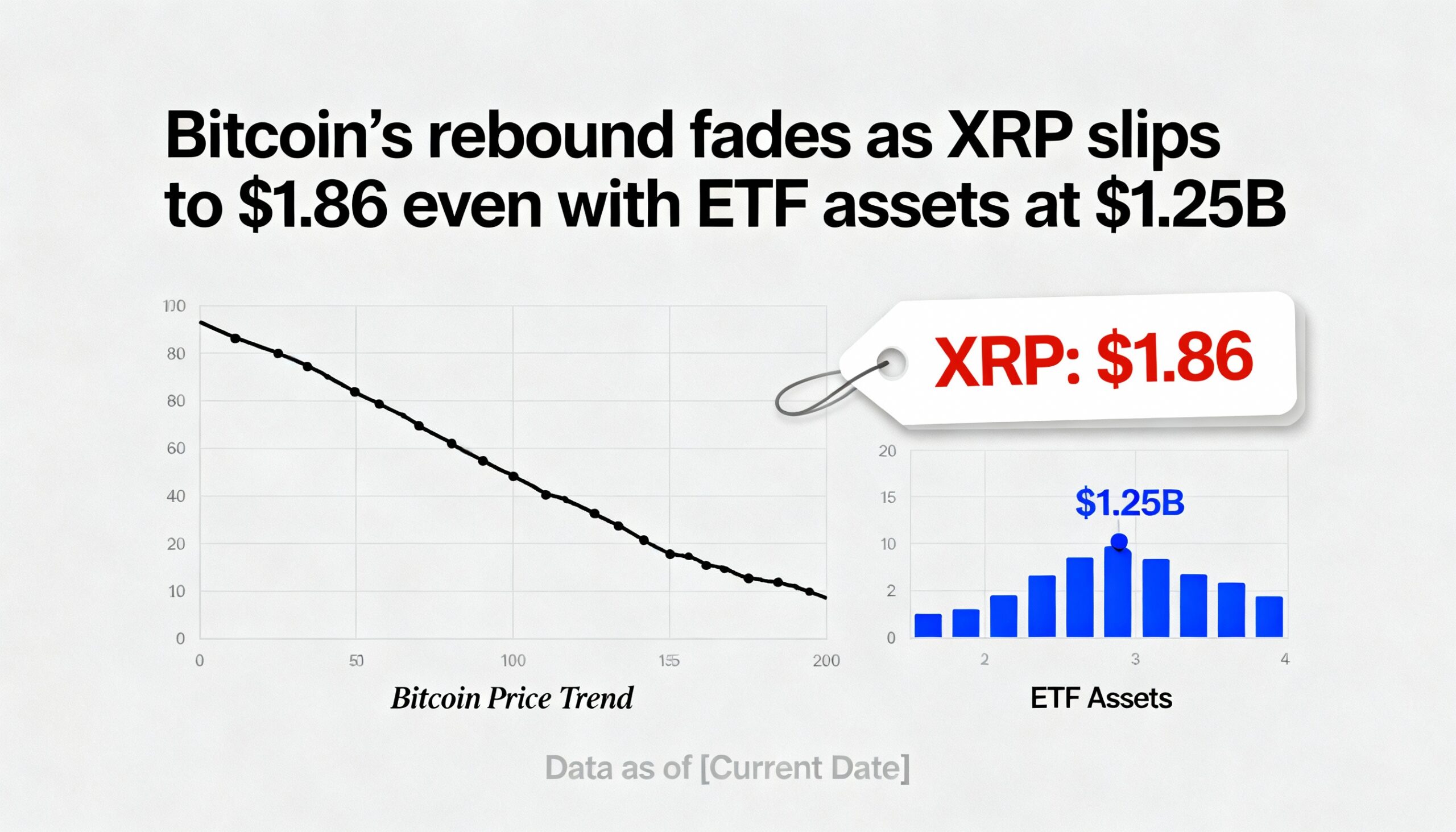

The token slipped back to $1.86 as traders continued to sell into short-term rallies, even as demand for spot XRP exchange-traded funds remained steady. Total ETF-held assets rose to $1.25 billion, highlighting a disconnect between improving institutional positioning and subdued spot price action as the market absorbs supply at key technical levels.

Market backdrop

Institutional appetite for XRP exposure continued to build through regulated products, with investors adding $8.19 million to XRP ETFs in recent sessions. That pushed total net assets to $1.25 billion, reinforcing the view that professional investors are accumulating exposure via structured vehicles rather than chasing momentum in the spot market.

The trend mirrors broader institutional behavior across crypto markets, where portfolio managers increasingly favor products that reduce custody, compliance and operational complexity. XRP’s deep liquidity across venues and consistent ETF inflows have helped anchor longer-term demand, even as short-term trading remains choppy.

Across the wider market, bitcoin’s attempted rebound failed to gain traction during U.S. hours, leaving major tokens locked in a risk-off, range-bound environment where technical levels continue to dictate near-term price action.

Technical analysis

XRP slipped from $1.88 to $1.86, remaining confined within a broader $1.85–$1.91 range. Sellers repeatedly capped advances in the $1.9060–$1.9100 zone, with elevated volume confirming active supply rather than a low-liquidity drift. Roughly 75.3 million tokens changed hands during the session’s most active period, about 76% above average.

Price briefly broke out of a tight $1.854–$1.858 consolidation area, pushing to $1.862 on a surge in activity that ran roughly eight to nine times typical intraday volume. The move, however, lacked follow-through, and XRP rotated back toward $1.86 as sellers reasserted control.

The repeated rejection above $1.90 suggests that zone remains a preferred area for distribution. At the same time, consistent bids near $1.86–$1.87 have so far prevented a deeper pullback. Together, the tightening range points to a coiled market structure, where a sustained break in either direction is likely to drive the next meaningful move.