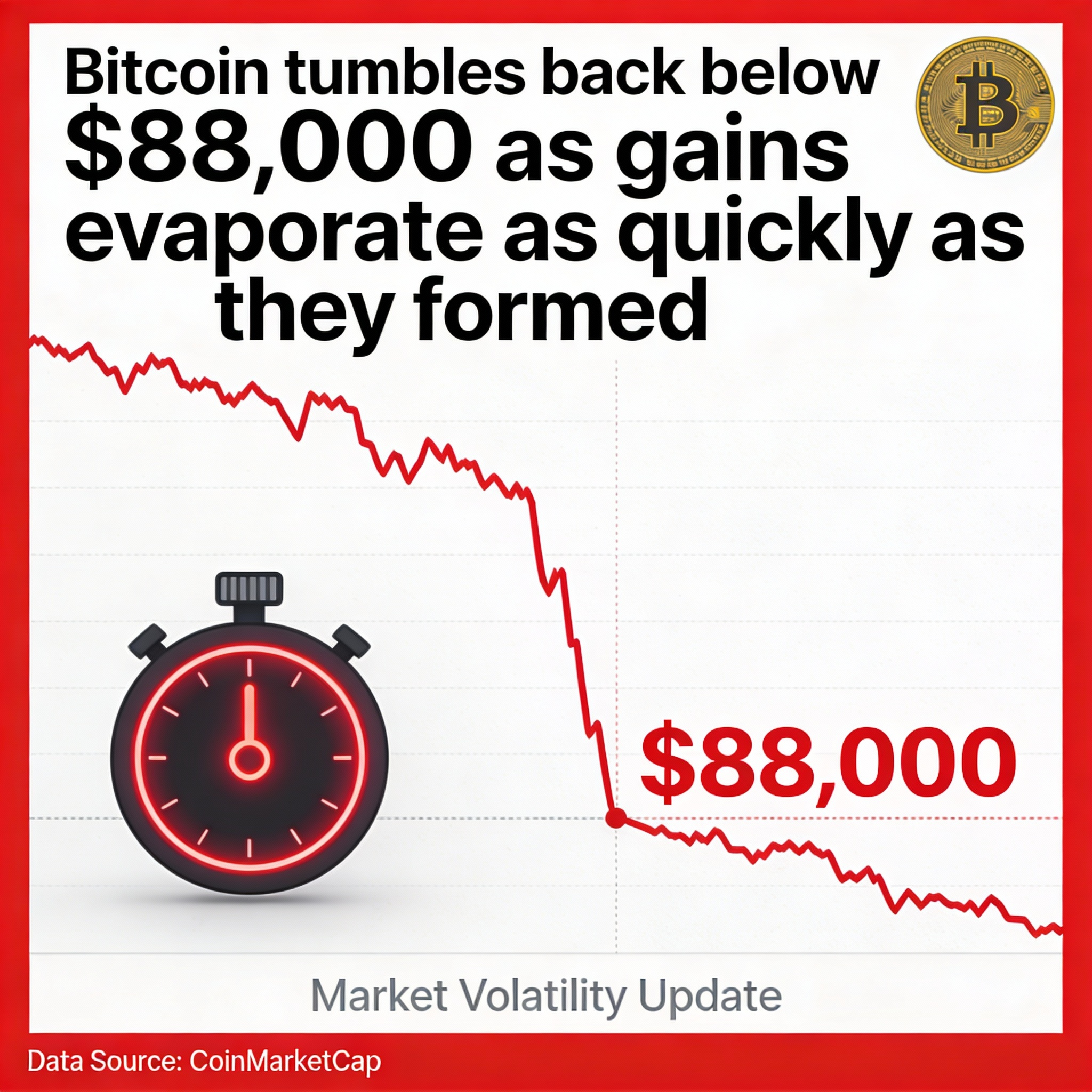

Crypto markets experienced violent swings in early U.S. trading, with bitcoin (BTC) staging a rapid rally from roughly $87,000 to above $90,000 before abruptly reversing and falling back toward the $87,000 level within minutes.

Bitcoin was last trading near $87,300, down about 0.5% over the past 24 hours, after having been up more than 3% earlier in the session.

The sharp reversal coincided with heavy selling in artificial intelligence-linked equities. Shares of Nvidia, Broadcom and Oracle dropped between 3% and 6%, while the tech-heavy Nasdaq slid more than 1%.

Pressure on AI-related stocks intensified after reports that Blue Owl Capital had withdrawn from financing a planned $10 billion Oracle data center in Michigan.

The sudden volatility sparked more than $190 million in liquidations across crypto derivatives markets over the past four hours, according to CoinGlass. Around $72 million of the total came from long positions, while roughly $121 million in short bets were also wiped out.

Thin liquidity remains a key driver of bitcoin’s choppy, indecisive price action, leaving the market vulnerable to external shocks, said Hunter Rogers, co-founder of bitcoin yield protocol TeraHash.

“We’re clearly seeing signs of market exhaustion,” Rogers said. “In that environment, even relatively small amounts of selling can push prices sharply lower.”

He added that bitcoin’s ability to hold the $80,000–$85,000 support zone will be crucial in determining whether the market faces another leg down or can stabilize and recover.