AI infrastructure stocks, including HUT 8, IREN, and Cipher Mining, tumbled as AMD plunged 14% following disappointing fourth-quarter results.

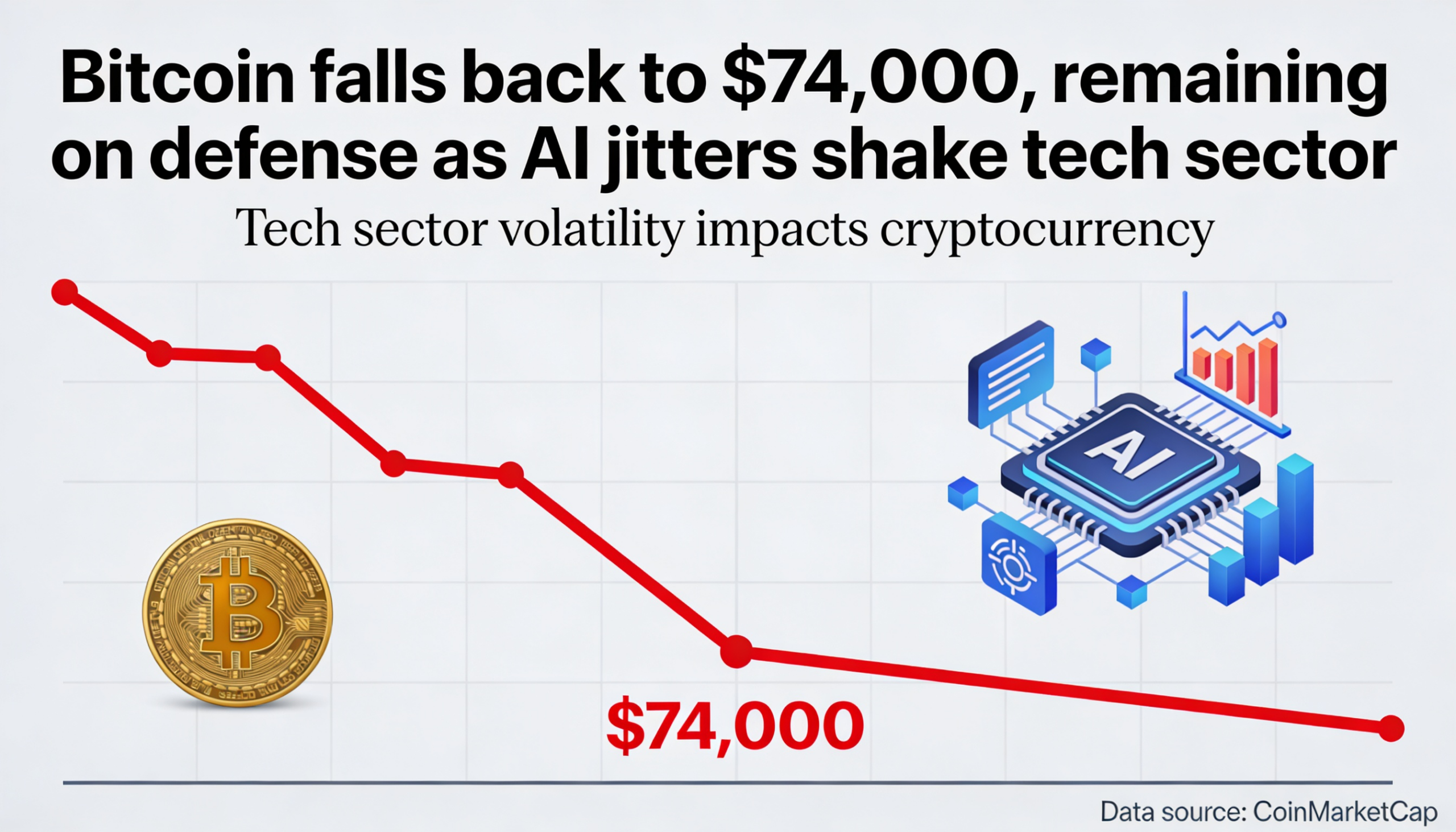

Bitcoin (BTC $68,561.87) fell back below $74,000 early in the U.S. session, erasing gains from Tuesday as weakness in tech shares weighed on the broader crypto market.

The Nasdaq 100 dropped 1% after a 1.5% decline the previous day, while the software sector continued its selloff. The iShares Expanded Tech-Software ETF (IGV) fell another 4%, down 17% in just over a week amid growing concerns that AI could be highly disruptive.

Crypto miners, increasingly tied to AI infrastructure, mirrored the slide. Cipher Mining (CIFR), IREN, and Hut 8 (HUT) all fell more than 10%, reflecting the ripple effect from AMD’s underwhelming outlook.

Gold also reversed course, giving back an overnight gain that briefly lifted it to $5,113 per ounce and sliding back below $5,000.

Mixed U.S. economic signals

The ISM Services PMI for January held steady at 53.8, matching December’s revised reading and slightly exceeding expectations, signaling ongoing expansion in the services sector.

However, private job growth slowed sharply, with ADP reporting just 22,000 new positions—well below forecasts of 48,000 and December’s already weak 37,000. The official January jobs report, normally scheduled for Friday, was delayed until next week due to the short government shutdown.

“Manufacturing has lost jobs every month since March 2024’s Main Street recession, and now professional services and large employers are showing weakness,” said Lekker Capital CIO Quinn Thompson, who also noted that markets may be underestimating the Fed’s potential stimulus in 2026.