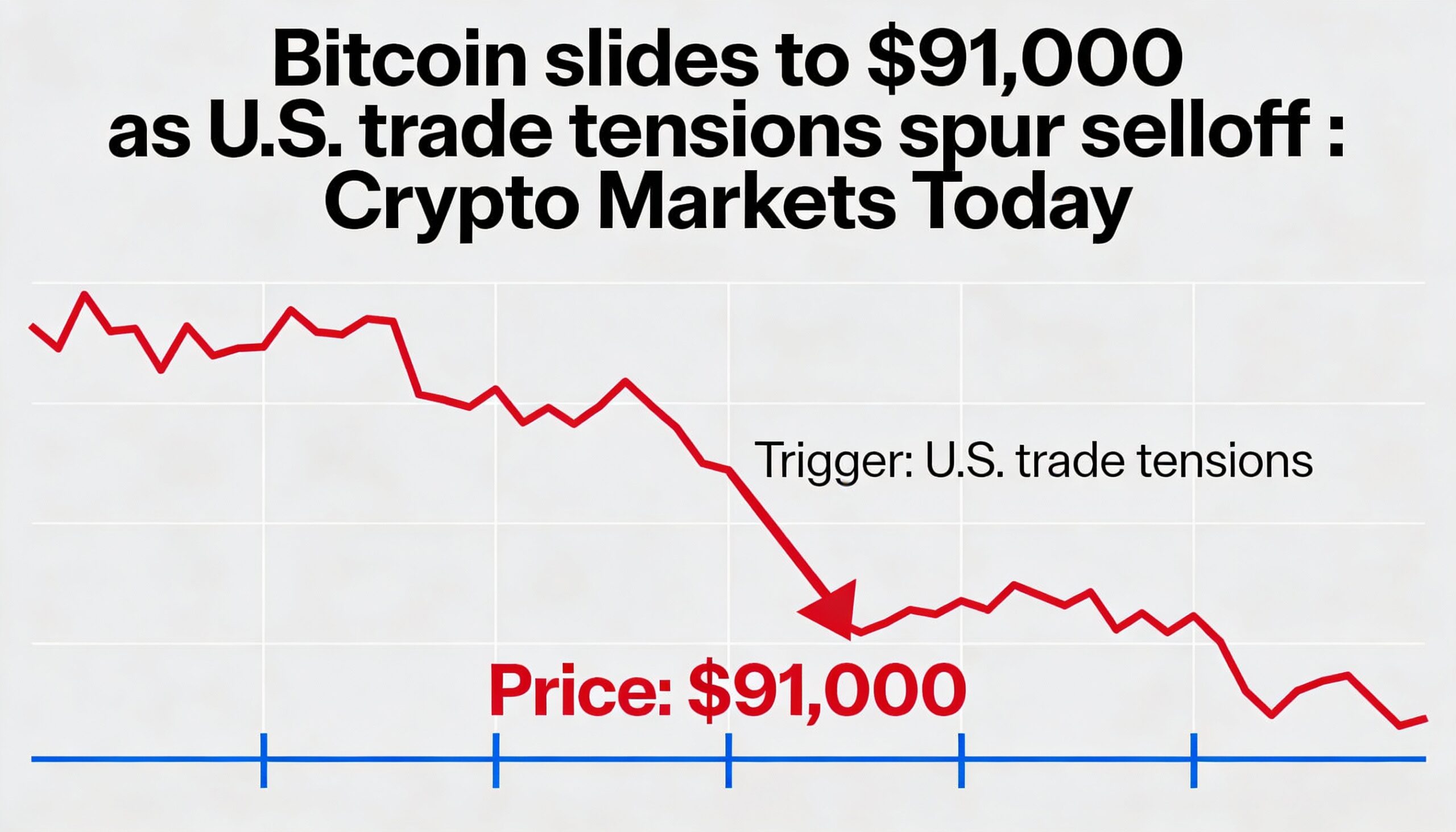

Bitcoin Retreats Below $91K as Asia-Led Selling Hits Crypto Markets

Bitcoin erased last week’s rally, dropping to $90,258 as Asia-driven selling swept through the crypto market alongside falling U.S. equity futures. The retreat reversed BTC’s climb from $98,000, highlighting ongoing volatility.

Selling intensified during the Asia session, starting around 01:15 UTC and easing by 07:00 UTC. Privacy-focused coins were among the hardest hit: Monero (XMR) fell 9% to $515, and Dash (DASH) dropped 3% to $69.44, reflecting waning trader interest after a strong start to the year.

The downturn in crypto mirrored moves in U.S. equities. Nasdaq 100 futures slid more than 1.9% since Sunday evening, and S&P 500 futures fell 1.6%, as investors reacted to ongoing U.S.-EU trade tensions over Greenland.

Safe-haven assets extended their gains, with gold and silver climbing to record highs.

Derivatives Activity Highlights

- Over $360 million in crypto futures were liquidated over 24 hours, mostly long positions.

- Bitcoin’s 30-day implied volatility (BVIV) rose to 42% from 39.7%, reflecting renewed demand for options.

- DOGE, ZEC, and ADA led declines in futures open interest, while BTC futures remained steady.

- Funding rates for most major tokens stay positive, though ZEC and TRX funding are deeply negative, signaling dominant bearish positioning.

- On Deribit, BTC and Ether (ETH $3,000.50) put options are priced above calls, and on Derive, traders assign a 30% chance of BTC dropping below $80,000.

Altcoins Under Pressure

Lower-liquidity altcoins underperformed Bitcoin. Ethereum and Solana (SOL $130.22) lost over 3%, while DeFi tokens AERO and SKY fell more than 5.5%. The CoinDesk Memecoin Index (CDMEME) slipped 3.91%, underperforming broader benchmarks.

Market watchers say Bitcoin’s next move will determine altcoin stability. Consolidation between $85,000 and $95,000 could stabilize markets, but a sustained drop below $85,000 could trigger widespread losses, as liquidity remains fragile following October’s $19 billion liquidation cascade.