Bitcoin’s downturn is deepening as persistent sell pressure, a hawkish shift in macro expectations, and increasingly defensive positioning weigh on the market, according to insights from several major trading desks.

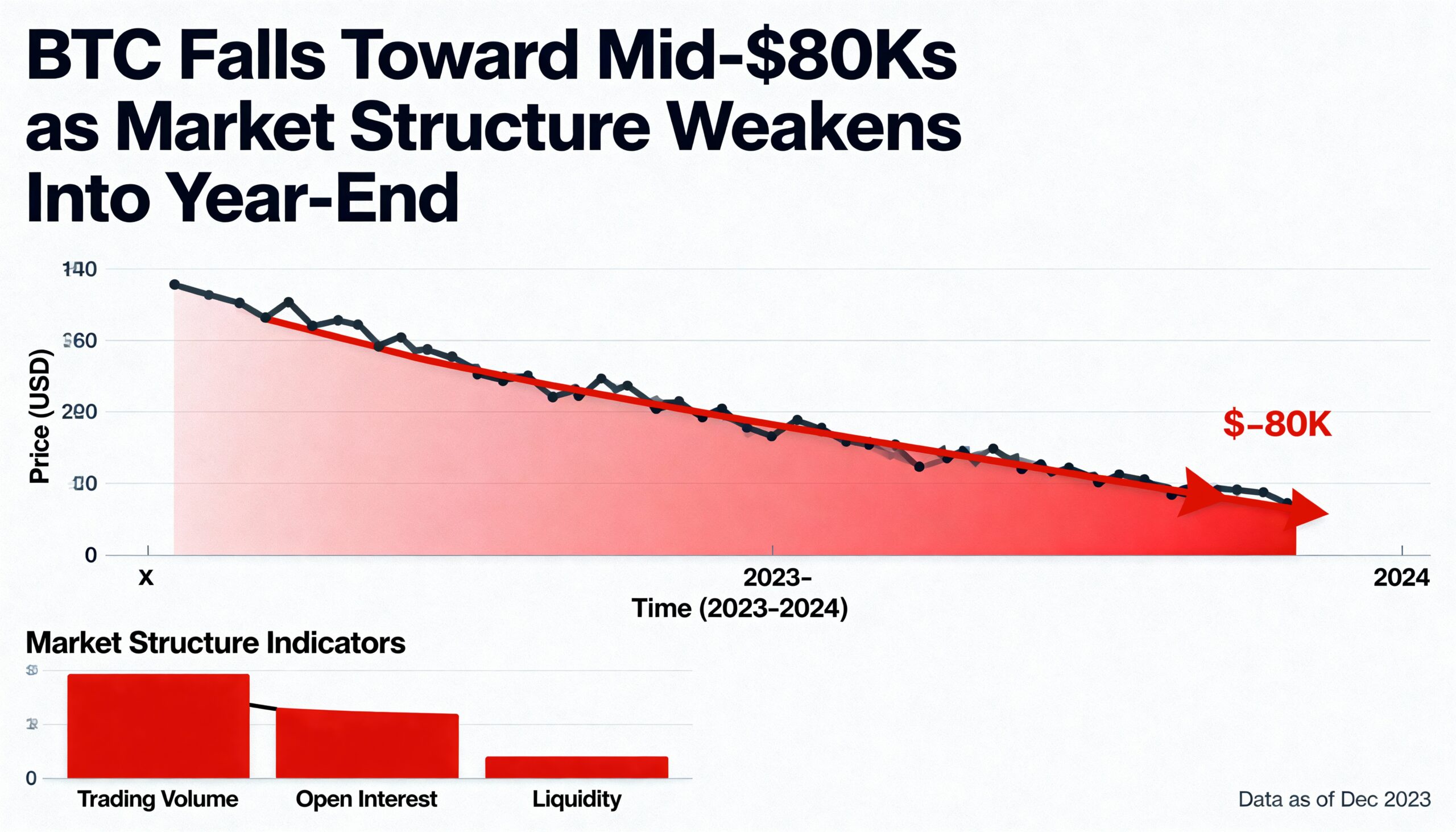

BTC has now fallen more than 7% over the past 24 hours and more than 20% during the past month—significantly underperforming equities, which have held up thanks to Nvidia’s strong results that helped ease concerns of an AI-driven pullback.

FlowDesk, in a market update shared on Telegram, said that a steady stream of coins from long-inactive bitcoin wallets is hitting centralized exchanges, with tens of thousands of BTC being moved after years of dormancy. These inflows have eroded bid depth and left spot markets firmly skewed toward sellers. The firm added that many managers are shifting into a capital-protection mindset as the year draws to a close, reducing risk rather than chasing upside—a dynamic that further thins liquidity at major support levels.

The weakness is echoed across derivatives. FlowDesk noted strong demand for downside hedges in BTC and ETH, with traders rolling put exposures lower as the volatility surface remains heavily weighted toward bearish bets.

Data from Deribit supports the shift in sentiment. As CoinDesk has previously reported, the options market has undergone a sharp repositioning: the once-dominant $140,000 call is no longer the largest strike by open interest, having been overtaken by the $85,000 put. That strike now represents the single biggest concentration of BTC options positioning, signaling expectations for further declines.

Market attention is increasingly turning to MicroStrategy as bitcoin’s slide brings it closer to the firm’s average purchase price of $74,430. JPMorgan recently warned that MicroStrategy’s weak stock performance reflects growing fears of a potential removal from the MSCI index in January—a move that could force billions in passive selling and add yet another stress point to an already fragile crypto backdrop.