Bitcoin Long-Term Holder Supply Hits Cyclical Low, Signaling Easing Sell Pressure

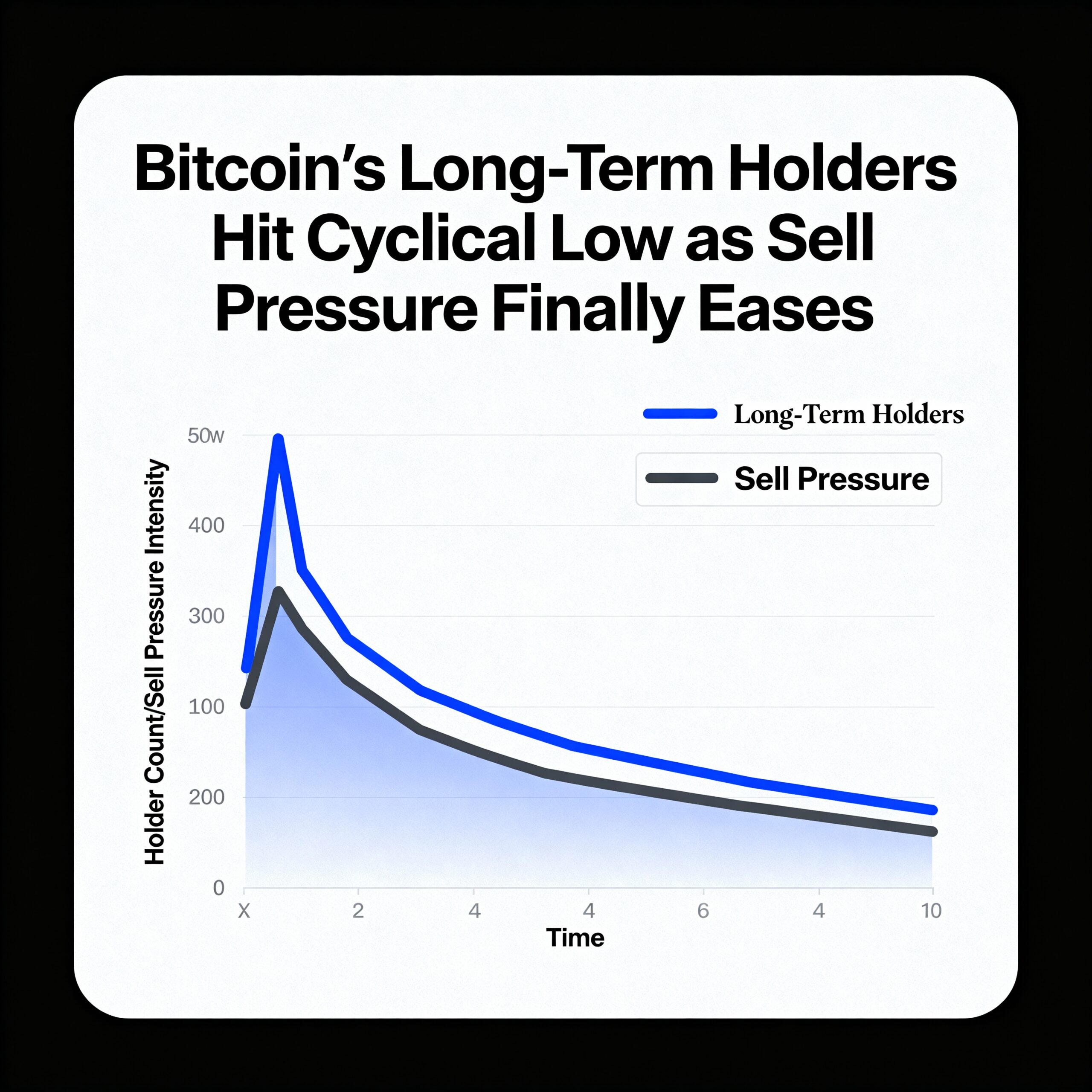

Bitcoin’s long-term holder (LTH) supply hit a cyclical low when the price dropped to $80,000, indicating that the bulk of spot-driven selling may be coming to an end. Since then, Bitcoin has rebounded to $90,000, roughly 15% above the recent low, suggesting that selling pressure from the recent 36% correction has largely subsided.

Long-term holders—those who have held coins for at least 155 days—saw their supply reach a trough on Nov. 21, the same day Bitcoin bottomed. The subsequent stabilization and early uptick in supply point to reduced distribution from seasoned holders, easing structural selling pressure in the market.

From July to November, long-term holders decreased their holdings from 14,769,512 BTC to 14,330,128 BTC. Previous LTH supply lows occurred in April 2024 and March 2025. The April 2024 decline followed Bitcoin’s all-time high of $73,000, reflecting holders distributing into strength. The March 2025 low coincided with a correction driven by tariff concerns, with Bitcoin bottoming around $76,000.

In prior cycles, LTH supply typically dropped sharply during retail-driven mania phases, most notably in 2017 and 2021. This cycle, however, has been more measured, with steadier inflows and outflows rather than a dramatic sell-off. Analysts note this evolution suggests a shift in market structure and holder behavior, challenging traditional four-year cycle patterns.

With long-term holders stabilizing, the easing of selling pressure may provide a stronger foundation for Bitcoin’s next leg up.