Glassnode’s latest weekly analysis suggests that bitcoin’s current market structure is beginning to resemble the early stages of the 2022 downturn, with more coins slipping into loss, softening demand across spot venues, and a noticeable shift toward defensive positioning in derivatives.

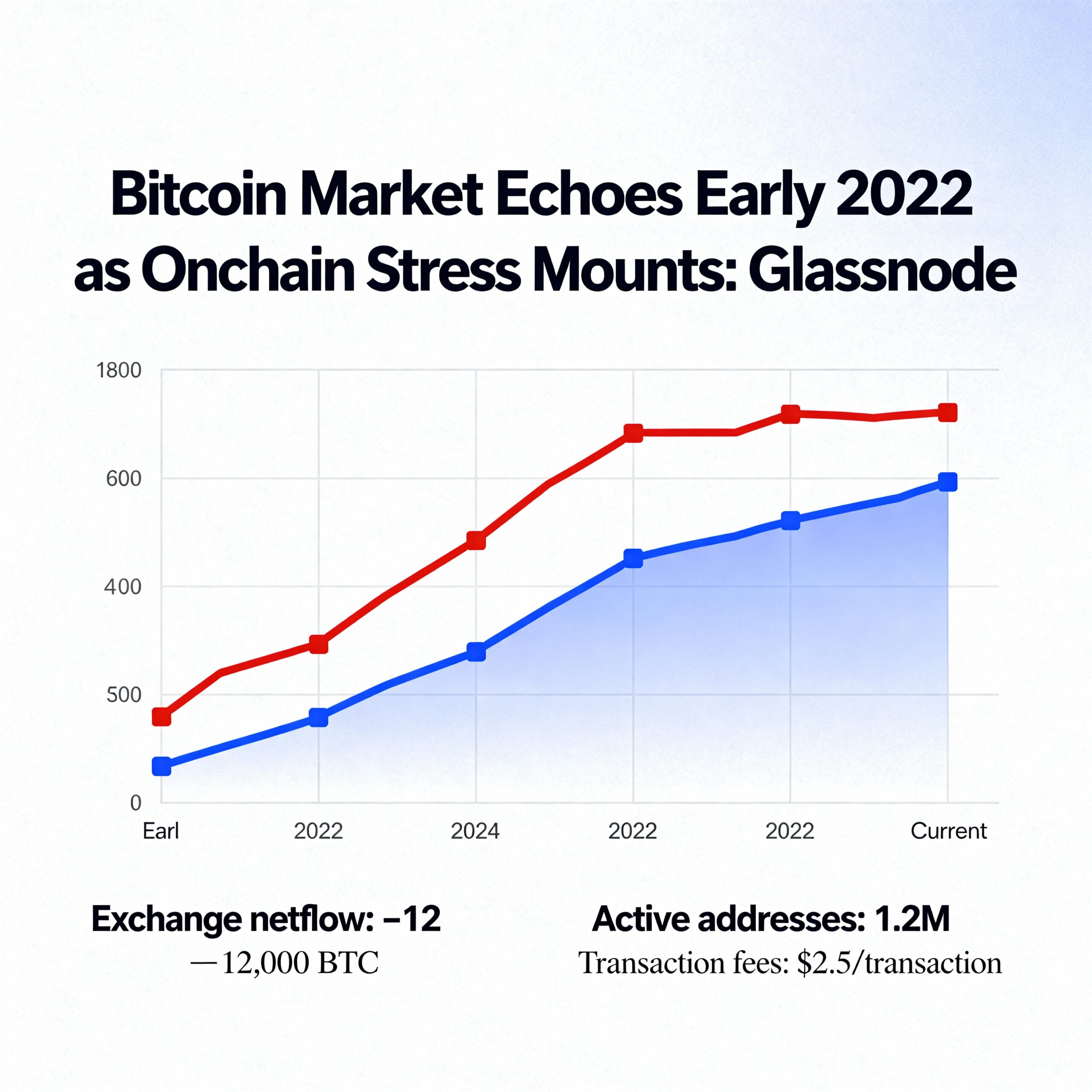

The report flags rising capitulation risk among recent and price-sensitive buyers. Glassnode’s supply quantiles cost-basis model shows that since mid-November, bitcoin has traded below the 0.75 quantile, hovering around $96,100. As a result, more than a quarter of the circulating supply now sits at an unrealized loss—a pattern that also marked the beginning of the 2022 bear market.

Supply in loss has continued to expand. On a seven-day moving average, this figure has reached 7.1 million BTC, nearing the top of the 5–7 million range that defined stress conditions in early 2022.

Despite these pressures, realized capital inflows remain positive. The realized cap net position change is running at roughly $8.69 billion per month, though it remains far below the summer peak of $64.3 billion.

Off-chain indicators highlight a further cooling in investor appetite. ETF flows have turned decisively negative, with BlackRock’s IBIT fund posting its sixth straight week of outflows—its longest losing streak since its January 2024 debut. Over the last five weeks, redemptions have surpassed $2.7 billion.

Spot liquidity signals are weakening as well. Glassnode notes that cumulative volume delta has begun to roll over, led by persistently negative readings on Binance. The Coinbase premium, which had briefly returned to positive territory, also appears on track to fall back into discount.

Derivatives markets reflect the same caution. Open interest has trended downward since November, indicating a pullback from leveraged positioning, particularly after the sharp liquidation event on Oct. 10. Funding rates are largely neutral with the occasional negative print, while a cooling funding premium points to a more balanced and less speculative backdrop.

Options activity ahead of next week’s FOMC meeting reinforces the defensive mood. Traders are refraining from positioning for a strong upside break. Earlier in the week, put demand dominated as bitcoin approached $80,000. After prices stabilized, flows shifted toward calls, reflecting a modest easing of fear rather than renewed bullish conviction.